Analysis and determination of best-performing company for investment among the top conglomerates based on diversification, revenue growth, profitability, net assets, and valuation (Price-to-Earnings Ratio (PER) and Price-to-Book Value (PBV)) during quarter ended 30th June 2024

Companies Analyzed

- Hayleys PLC (HAYL)

- LOLC Holdings PLC (LOLC)

- John Keells Holdings PLC (JKH)

- Richard Pieris and Company PLC (RICH)

- Vallibel One PLC (VONE)

- Melstacorp PLC (MELS)

- CIC Holdings PLC (CIC)

- Cargills Ceylon PLC (CARG)

- Softlogic Holdings PLC (SHL)

- Hemas Holdings PLC (HHL)

1. Diversification

Overview: Diversification is a critical metric for reducing risk and ensuring stable returns across different economic cycles. Companies with operations across multiple sectors are better positioned to withstand sector-specific downturns.

- Hayleys PLC: This company is highly diversified across multiple sectors, including transportation, consumer retail, textiles, agriculture, construction materials, and purification products. This extensive sectoral presence helps mitigate risks associated with economic downturns in specific industries.

- LOLC Holdings PLC: LOLC Holdings demonstrates significant diversification, operating in financial services, manufacturing, trading, leisure, plantations, insurance, and real estate. This broad portfolio balances risk and provides multiple revenue streams, making it less susceptible to sector-specific risks.

- John Keells Holdings PLC: John Keells is diversified across leisure, property, consumer foods, retail, and financial services. Despite the broad sectoral exposure, it faces challenges in segments such as leisure due to reduced tourism.

- Richard Pieris and Company PLC: This company has a diversified portfolio with operations in retail, plantations, rubber, tyre, plastics, furniture, electronics, and financial services, showing resilience in its retail and plantation sectors.

- Vallibel One PLC: Vallibel One is less diversified, focusing primarily on finance, lifestyle, aluminum, and leisure sectors. While this strategy provides depth in specific areas, it lacks the broad diversification of companies like Hayleys and LOLC.

- Melstacorp PLC: Melstacorp operates in beverages, plantations, telecommunications, financial services, and other diversified sectors. Its primary focus is on beverages and financial services, making it moderately diversified.

- CIC Holdings PLC: CIC is moderately diversified, focusing on agriculture, livestock, plantations, industrial raw materials, and healthcare. This provides a good balance but less diversification compared to larger conglomerates.

- Cargills Ceylon PLC: Cargills is diversified in FMCG, retail, restaurants, real estate, and agriculture, which allows it to withstand economic pressures and maintain steady growth.

- Softlogic Holdings PLC: Softlogic engages in retail, healthcare, financial services, and IT. Despite this diversity, it faces challenges due to high financial costs and a difficult economic environment.

- Hemas Holdings PLC: Hemas operates in consumer brands, healthcare, mobility, and leisure, demonstrating strategic diversification across sectors with high growth potential.

2. Revenue Growth

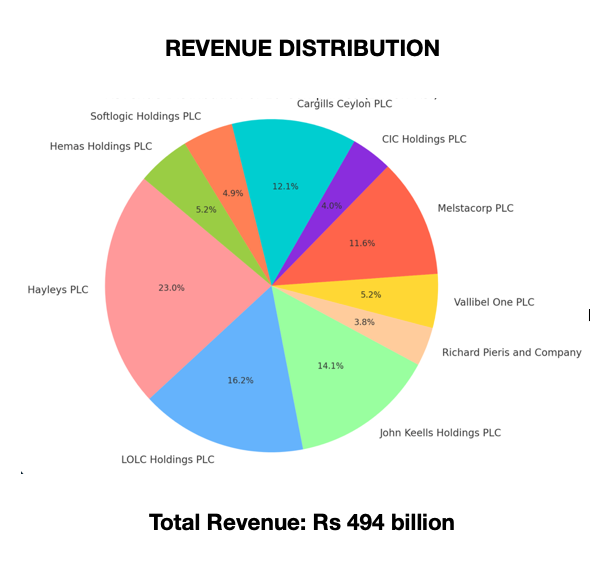

Diversified Conglomerates have achieved an aggregate revenue of Rs. 494 billion for quarter ended 30th June 2024. Here is the revenue distribution.

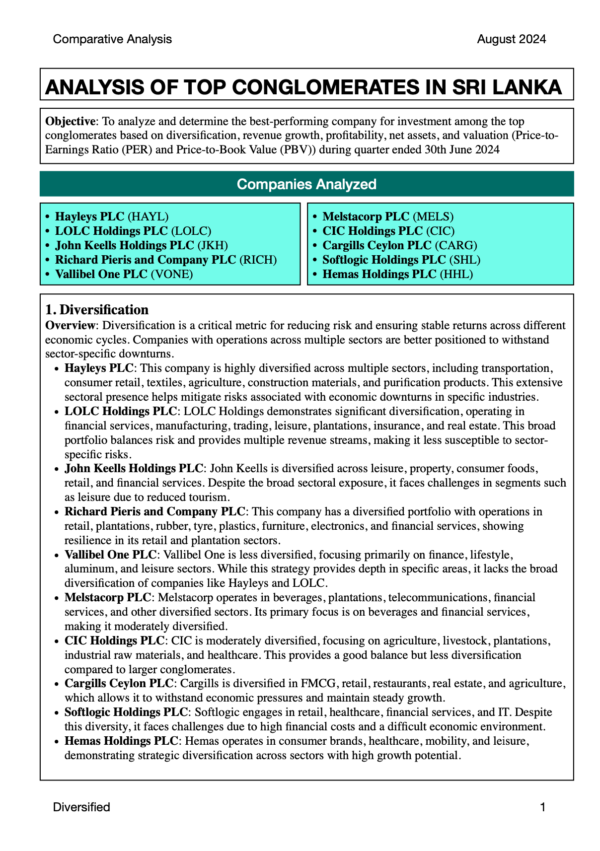

Overview: Revenue growth is a key indicator of a company’s market position and its ability to expand its customer base and product offerings. Companies with consistent revenue growth are generally better positioned for long-term success.

- Hayleys PLC: Hayleys reported a 17% increase in revenue, reaching Rs. 113.6 billion. This growth was primarily driven by strong performances in the transportation and consumer retail sectors.

- LOLC Holdings PLC: LOLC’s gross income increased by 7% to LKR 79.8 billion, driven largely by financial services and plantations. However, revenue from operations decreased by 6%, reflecting some challenges in certain segments.

- John Keells Holdings PLC: John Keells revenue for the quarter ended June 30, 2024, was Rs. 69.66 billion, representing a 9% increase from Rs. 63.78 billion in the same period of the previous year. This growth was primarily driven by higher sales across various segments, including Consumer Foods, Retail, and Financial Services

- Richard Pieris and Company PLC: Richard Pieris achieved a 5.5% increase in revenue to Rs. 18.69 billion, supported by strong performances in the retail and plantation sectors.

- Vallibel One PLC: Vallibel One experienced a 7% decline in revenue to Rs. 25.79 billion, primarily due to economic challenges affecting customer contracts.

- Melstacorp PLC: Melstacorp reported a 6.52% increase in revenue to Rs. 57.1 billion, with significant contributions from the beverages sector.

- CIC Holdings PLC: CIC achieved a 16% increase in revenue to Rs. 19.8 billion, driven by strong performance in crop solutions and health & personal care.

- Cargills Ceylon PLC: Cargills recorded a 5.6% increase in revenue to Rs. 59.93 billion, primarily from FMCG and retail sectors, showing resilience in a challenging market.

- Softlogic Holdings PLC: Softlogic reported a marginal 1% increase in revenue to LKR 24.13 billion, reflecting subdued growth in a challenging economic environment.

- Hemas Holdings PLC: Hemas experienced a 12.5% decline in revenue to LKR 25.5 billion due to price adjustments and subdued consumer spending.

3. Profitability

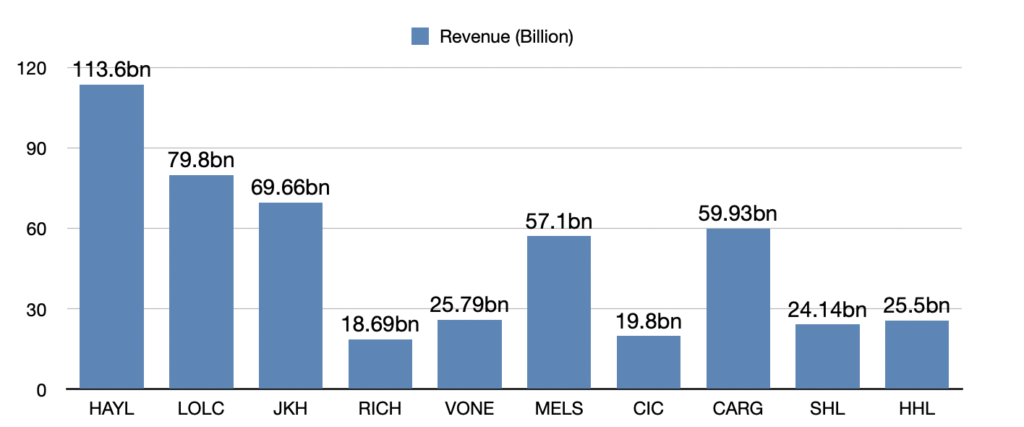

Overview: The net profit is a crucial indicator of a company’s profitability, reflecting its ability to generate earnings after all expenses, taxes, and costs have been deducted. Here is a summary of the net profits for each company for the quarter ended June 30, 2024:

- Hayleys PLC: Reported a net profit before tax increase of 136% to Rs. 3.1 billion, up from Rs. 1.3 billion in the same period last year, driven by reduced finance costs and stable operating profits

- LOLC Holdings PLC: Reported a net profit increase of 74% to LKR 2.15 billion, up from LKR 1.24 billion in the same period last year, driven by strong earnings across key segments and effective cost management.

- John Keells Holdings PLC (JKH): Reported a net loss of Rs. 966.67 million, compared to a net profit of Rs. 1.24 billion in the same period last year. The loss was primarily due to a non-cash exchange loss and increased operating expenses related to the ‘Cinnamon Life’ hotel.

- Richard Pieris and Company PLC: Recorded a net profit of Rs. 1.29 billion, up 859% from Rs. 134.7 million in the same period last year, indicating strong cost management and operational efficiency.

- Vallibel One PLC: Reported a 6% increase in net profit to Rs. 2.56 billion, up from Rs. 2.42 billion in the previous year, driven by effective cost management and reduced finance costs.

- Melstacorp PLC: Achieved a significant surge in net profit, up 730.70% year-over-year to Rs. 3.69 billion from Rs. 444.01 million. This was due to effective cost management and enhanced operational efficiency

- CIC Holdings PLC: Despite an overall increase in revenue, net profit declined by 72.19% to Rs. 321.65 million, down from Rs. 1,156.73 million, due to a significant reduction in other income and increased expenses.

- Cargills Ceylon PLC: Reported a net profit of Rs. 1,537 million, which represents a 17.4% increase from Rs. 1,310 million in the same quarter of the previous year attributed to reduced finance costs and higher operational efficiency.

- Softlogic Holdings PLC: Reported a net loss of LKR 2.62 billion, a 41% reduction from the previous year’s loss of LKR 4.46 billion, reflecting improved cost management

- Hemas Holdings PLC: Reported a net profit of LKR 1.0 billion, down 11.0% from last year, impacted by increased income tax expenses and reduced net profit.

Download Full Report

Diversified Sector (1Q FY2024/25)

Comparative Analysis of Diversified Sector companies for quarter ended 30th June 2024