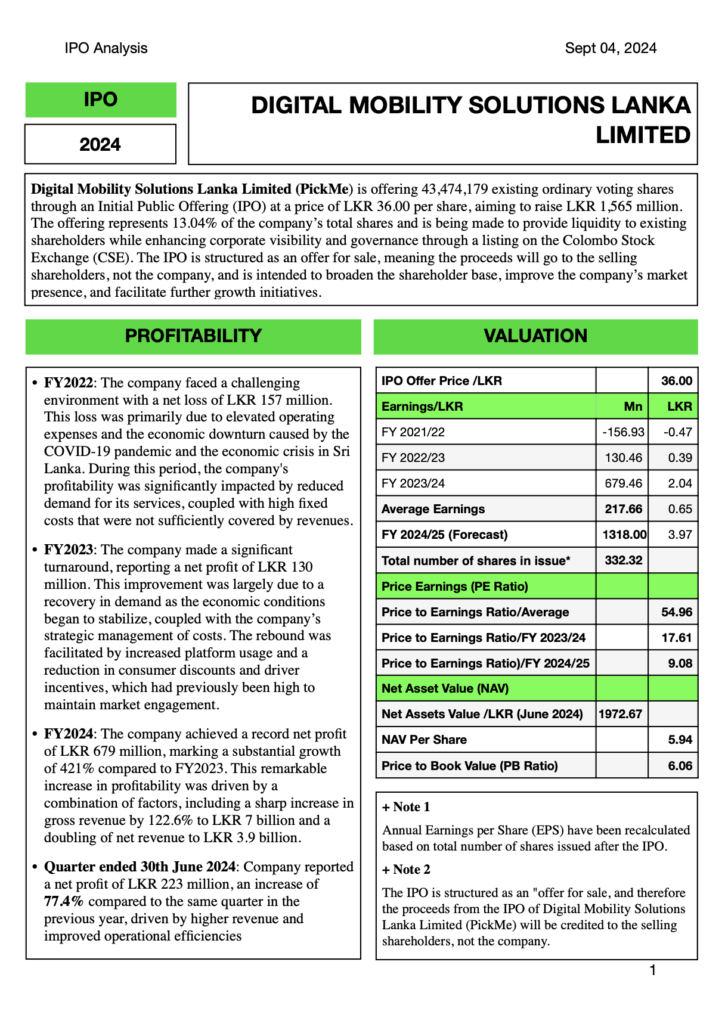

Digital Mobility Solutions Lanka Limited (PickMe) is offering 43,474,179 existing ordinary voting shares through an Initial Public Offering (IPO) at a price of LKR 36.00 per share, aiming to raise LKR 1,565 million. The offering represents 13.04% of the company’s total shares and is being made to provide liquidity to existing shareholders while enhancing corporate visibility and governance through a listing on the Colombo Stock Exchange (CSE). The IPO is structured as an offer for sale, meaning the proceeds will go to the selling shareholders, not the company, and is intended to broaden the shareholder base, improve the company’s market presence, and facilitate further growth initiatives.

Download Prospectus: https://invest.pickme.lk/wp-content/uploads/2024/09/PickMe-Prospectus-IPO-FINAL_LR.pdf

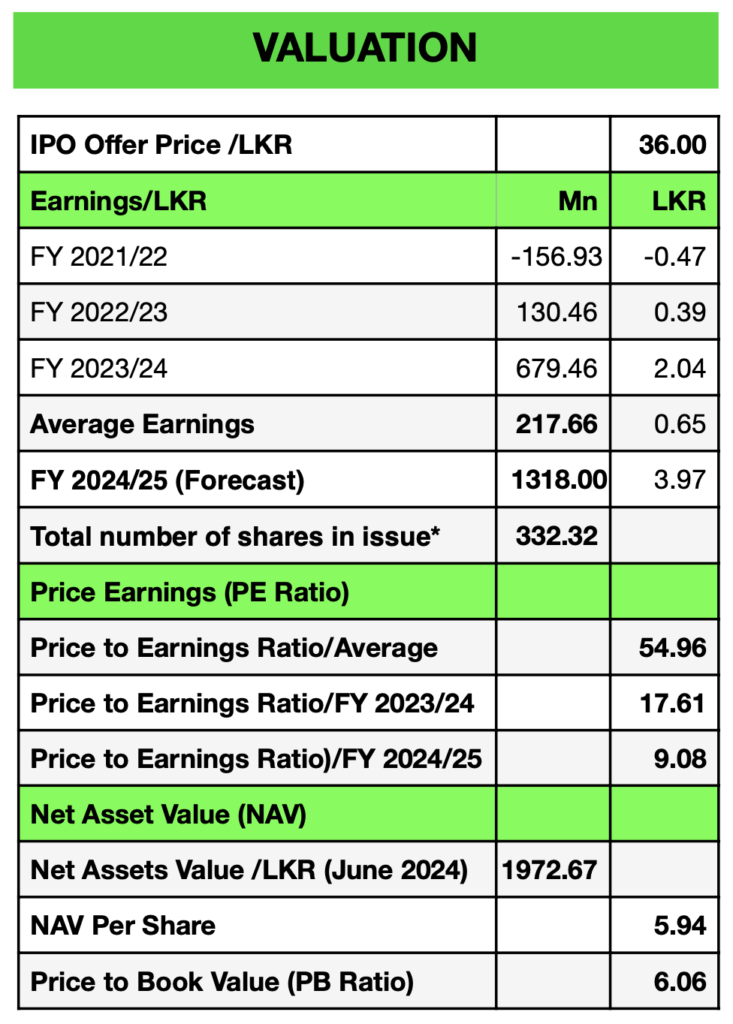

Valuation:

Note 1: Annual Earnings per Share (EPS) have been recalculated based on total number of shares issued after the IPO.

Note 2: The IPO is structured as an “offer for sale, and therefore the proceeds from the IPO of Digital Mobility Solutions Lanka Limited (PickMe) will be credited to the selling shareholders, not the company.

IPO Outlook:

Based on the valuation metrics provided for Digital Mobility Solutions Lanka Limited’s IPO, here is a summary:

- Net Asset Value (NAV) Per Share: The NAV per share is LKR 5.94, while the IPO price is LKR 36.00 per share. This indicates a Price to Book Value (PBV) ratio of 6.06, suggesting that the IPO price is significantly higher than the company’s book value.

- Earnings Per Share (EPS): The company’s forecasted EPS for FY 2024/25 is LKR 3.97, and the EPS for FY 2023/24 was LKR 2.04. At the IPO price of LKR 36.00, the Price to Earnings (PE) ratios are 9.08 and 17.61 for the forecasted and past year’s EPS, respectively. The PE ratio based on average historical earnings is quite high at 54.96, reflecting an overvaluation relative to historical performance. As of the latest updates, the Market P/E ratio for the CSE was reported to be around 8.8x as of late August 2024

Given the high PBV and PE ratios, the IPO is priced at a premium that may not be justified by the company’s current financial performance and book value.

Analytical Report:

Digital Mobility Solutions Lanka Limited (PickMe) IPO

Download Full Report: https://lankabizz.net/product/digital-mobility-solutions-lanka-limited-pickme-ipo/