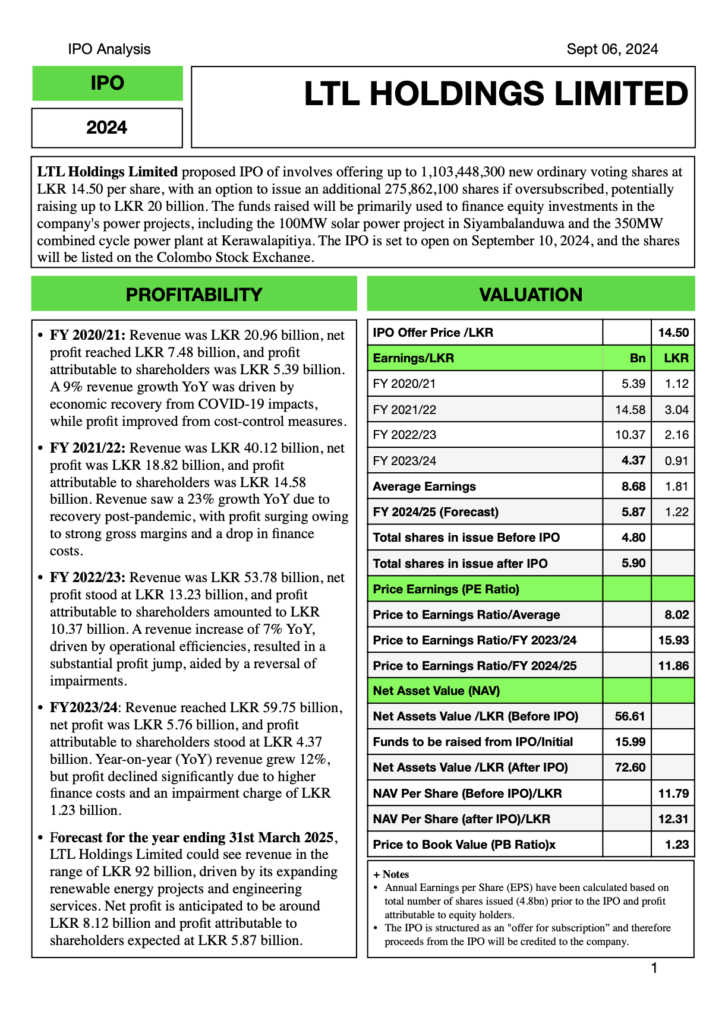

LTL Holdings Limited proposed IPO of involves offering up to 1,103,448,300 new ordinary voting shares at LKR 14.50 per share, with an option to issue an additional 275,862,100 shares if oversubscribed, potentially raising up to LKR 20 billion. The funds raised will be primarily used to finance equity investments in the company’s power projects, including the 100MW solar power project in Siyambalanduwa and the 350MW combined cycle power plant at Kerawalapitiya. The IPO is set to open on September 10, 2024, and the shares will be listed on the Colombo Stock Exchange.

Profitability

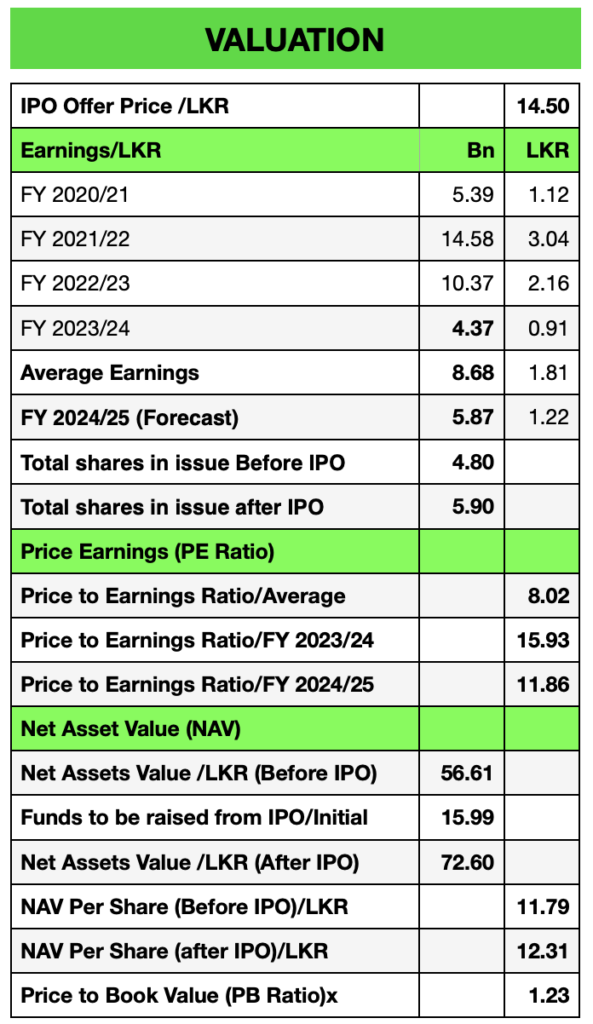

- FY 2020/21: Revenue was LKR 20.96 billion, net profit reached LKR 7.48 billion, and profit attributable to shareholders was LKR 5.39 billion. A 9% revenue growth YoY was driven by economic recovery from COVID-19 impacts, while profit improved from cost-control measures.

- FY 2021/22: Revenue was LKR 40.12 billion, net profit was LKR 18.82 billion, and profit attributable to shareholders was LKR 14.58 billion. Revenue saw a 23% growth YoY due to recovery post-pandemic, with profit surging owing to strong gross margins and a drop in finance costs.

- FY 2022/23: Revenue was LKR 53.78 billion, net profit stood at LKR 13.23 billion, and profit attributable to shareholders amounted to LKR 10.37 billion. A revenue increase of 7% YoY, driven by operational efficiencies, resulted in a substantial profit jump, aided by a reversal of impairments.

- FY2023/24: Revenue reached LKR 59.75 billion, net profit was LKR 5.76 billion, and profit attributable to shareholders stood at LKR 4.37 billion. Year-on-year (YoY) revenue grew 12%, but profit declined significantly due to higher finance costs and an impairment charge of LKR 1.23 billion.

- Forecast for the year ending 31st March 2025, LTL Holdings Limited could see revenue in the range of LKR 92 billion, driven by its expanding renewable energy projects and engineering services. Net profit is anticipated to be around LKR 8.12 billion and profit attributable to shareholders expected at LKR 5.87 billion.

Valutaion

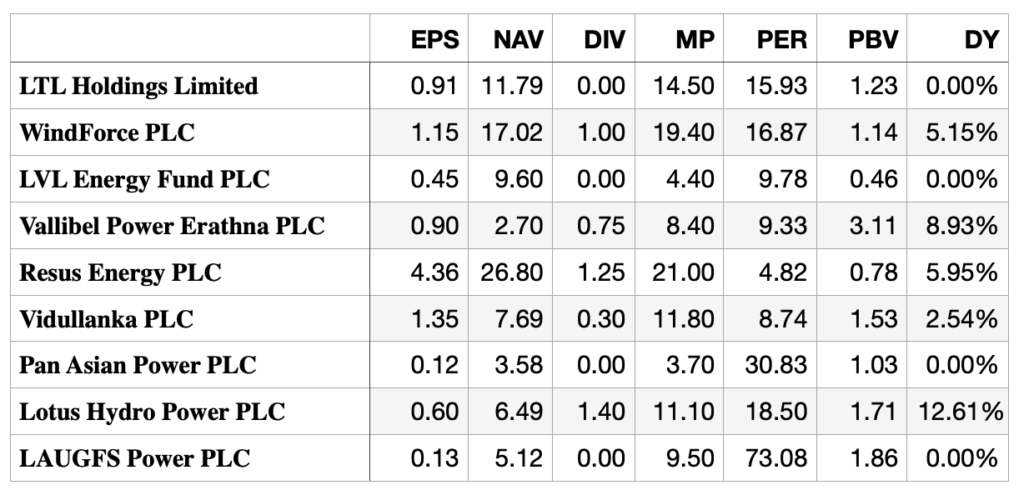

Comparative Analysis

- PER (Price/Earnings) Ratio: LTL Holdings’ PER of 15.93 based on FY 2023/24 earnings is higher than some competitors, reflecting a higher market valuation for its earnings compared to companies like Resus Energy (PER 4.82), LVL Energy Fund (PER 9.78) and Vallibel Power (PER 9.33) but slightly lower than WindForce (PER 16.87). However the LTL Holdings PER based on projected earnings for FY 2024/25 expected to be around 11.86.

- PBV (Price-to-Book Value) Ratio: LTL’s PBV ratio of 1.23 suggests a fair valuation relative to its assets, similar to WindForce (PBV 1.14) but higher than Resus Energy (PBV 0.78) and LVL Energy Fund (0.48), which may be undervalued.

- Earnings Yield: LTL Holdings has an earnings yield of 6.28%, lower than Resus Energy’s 20.75%, indicating LTL is less profitable relative to its share price, and slightly higher than WindForce’s 5.93%, showing moderate profitability.

- Dividend Yield: LTL offers no dividend yield (0.00%), making it less attractive for income-focused investors compared to WindForce (5.15%) and Resus Energy (5.95%), both of which offer higher yields. LTL has decided not to declare any dividends for FY2023 and FY2024, considering the significant investments going into the construction of the Sobadhanavi power plant and to maintain sufficient cash reserves within the LTLH Group amidst the delay in payments by key customers and challenging macro-economic conditions that prevailed in the recent past. Some companies are yet to declare dividend for FY 2023/24

- Total Power Generation: LTL’s large-scale power projects, including the 350MW combined cycle plant and 100MW solar project, indicate strong future capacity, surpassing Resus Energy’s smaller renewable energy projects but trailing WindForce’s substantial 5851.8 GWh output.

Recommendation: LTL Holdings’ IPO is recommended for subscription due to the company’s large size, government involvement, and strong future outlook, particularly in renewable energy. While it lacks dividend yield, its large-scale projects and growth potential make it an attractive long-term investment.

Analytical Report

LTL Holdings Limited – IPO

Analysis and Evaluation of LTL Holdings Limited Initial Public Offering (IPO) based on the information available in the Prospects with further analysis of Impact of Bangladesh Crisis

Download Full Report: https://lankabizz.net/product/ltl-holdings-limited-ipo/