Sri Lanka’s Fuel Price Formula was introduced in May 2018 as part of a government initiative to reduce the fiscal burden on the economy caused by fuel subsidies. The idea was to adopt a market-based fuel pricing mechanism that would adjust retail fuel prices in line with international oil prices. The formula aimed to depoliticize fuel pricing and ensure fiscal responsibility. Below are the main details of the fuel price formula and its shortcomings:

Key Details of the Fuel Price Formula

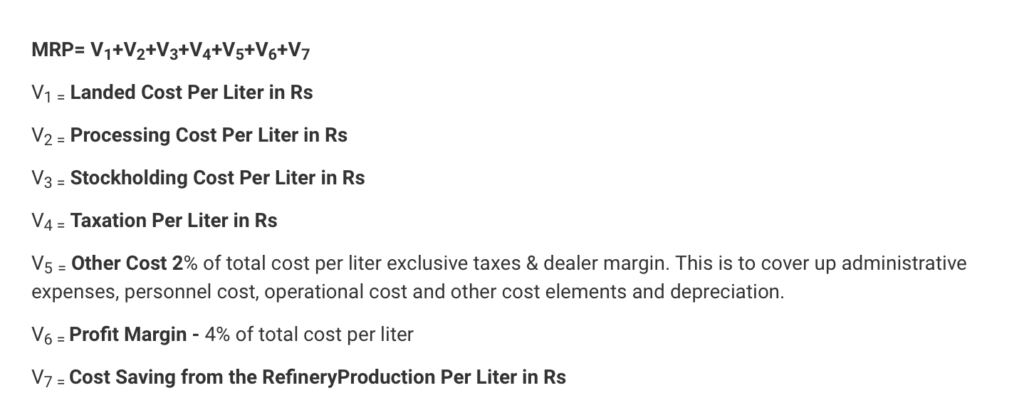

- Price Components:

- Cost of Importing Crude Oil: The core component was the import cost, which fluctuated based on international oil market prices.

- Taxes and Levies: Various taxes, including excise duty, VAT, and other levies, were added to the base price.

- Operational Costs: This included costs incurred by the Ceylon Petroleum Corporation (CPC) and Lanka IOC (the main suppliers), such as refining, distribution, and administration costs.

- Exchange Rate: Given Sri Lanka’s need to import fuel, the value of the Sri Lankan Rupee against the U.S. dollar played a significant role.

- Margins: Margins for fuel stations and suppliers were factored in.

- Price Review Frequency: The formula allowed for periodic price adjustments (monthly) to reflect changes in international oil prices and domestic factors, especially the exchange rate.

- Tax Revenues: The government retained flexibility in imposing taxes and levies, which provided them with the ability to influence prices to some extent.

- Depoliticizing Fuel Prices: By aligning prices with international market rates, the formula aimed to reduce political pressure for maintaining artificially low fuel prices.

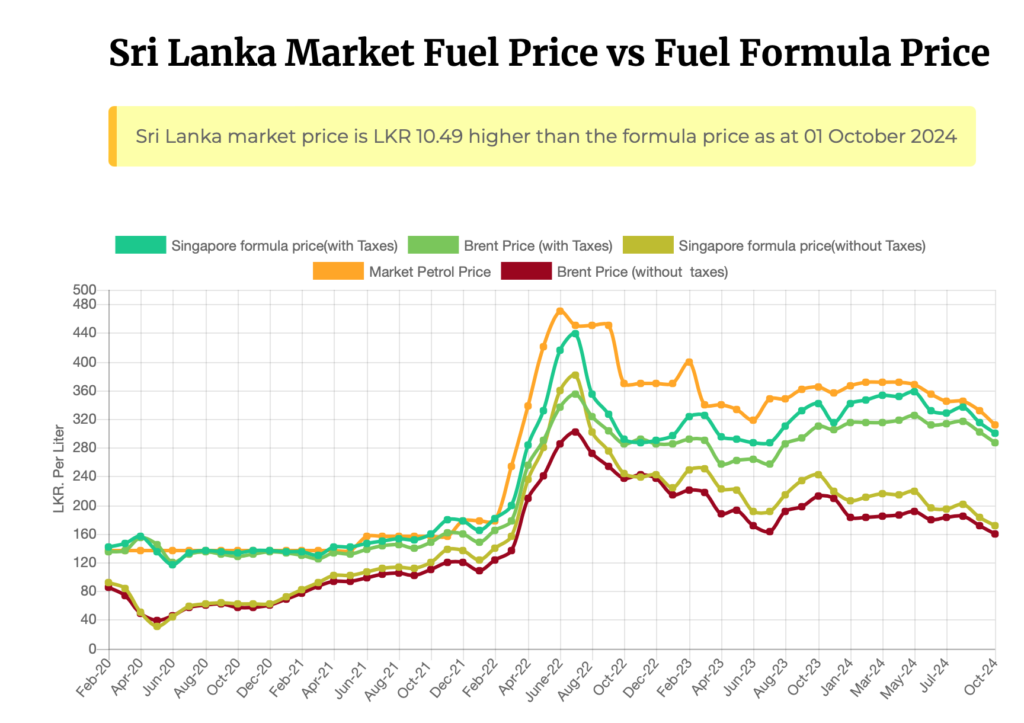

Sri Lanka Market Fuel Price Vs Fuel Formula Price

*Brent Price (with Taxes/without Taxes) is the Fuel Formula price (with Taxes/without Taxes) using the Brent Price *Singapore formula Price (with Taxes/without taxes) is the Fuel Formula price (with Taxes/without Taxes) using the Singapore Platts Price. Source: Central Bank of Sri Lanka | Formula Price Calculation | CEYPTCO

Fuel Price Formula

Shortcomings of the Fuel Price Formula

- Lack of Transparency:

- The fuel pricing mechanism lacked detailed transparency. The formula itself was not fully disclosed to the public, creating suspicion about the actual calculation process. Many stakeholders, including the public, were unaware of the specific weightings or parameters of the formula, which led to mistrust.

- No clear, publicized explanation was provided on how taxes and operational costs were being applied or adjusted. This opacity led to claims that the formula was subject to manipulation.

- Volatility and Price Shocks:

- While the formula aimed to align with international market prices, it failed to smooth out volatility. Rapid increases in global oil prices, or depreciation of the Sri Lankan Rupee, resulted in significant price hikes at the retail level, affecting consumers.

- This volatility caused public dissatisfaction, as the formula did not include any stabilization mechanism, like a price cap or gradual phasing-in of price hikes. Sudden fuel price hikes had knock-on effects on transportation and basic goods.

- Fiscal Strain and Political Sensitivity:

- Despite the introduction of the formula, the government sometimes delayed price adjustments due to political reasons, especially before elections, undermining the credibility of the system. For instance, there were instances when price increases were not implemented in a timely manner, leading to revenue losses for CPC and Lanka IOC.

- The government retained control over taxes and could still influence retail prices through tax cuts or increases, which partially defeated the purpose of depoliticizing fuel prices.

- Impact on the Economy:

- The rapid adjustments in fuel prices negatively impacted inflation and cost of living. Increased transport costs contributed to a rise in the price of essential goods, hitting low-income households particularly hard.

- The absence of social protection measures or a fuel subsidy scheme for vulnerable groups worsened the situation, especially during periods of high global oil prices. The formula did not adequately address the social impact of frequent price changes on the population.

- Exchange Rate Vulnerabilities:

- Given Sri Lanka’s reliance on fuel imports, the formula was highly sensitive to fluctuations in the exchange rate. As the Sri Lankan Rupee depreciated, the cost of fuel rose sharply, regardless of stable or even declining international oil prices. The formula did not adequately buffer against such currency risks.

- Inadequate Consideration of Supply Chain Costs:

- The formula primarily focused on crude oil prices and taxation, but it did not fully account for domestic supply chain issues, such as inefficiencies in fuel distribution or refining. These operational inefficiencies meant that the end-user paid more than just the international market price adjustments.

- Public Discontent and Protests:

- There were multiple instances of public protests and discontent over the frequent price hikes. Many people felt that the government was passing on the entirety of global price increases to the public without offering any buffer or relief, which led to unrest and strikes, especially among transportation providers.

Conclusion

While the fuel price formula was intended to bring about fiscal discipline and ensure alignment with global prices, it suffered from several shortcomings. The lack of transparency, exposure to global volatility, and failure to cushion the social and economic impacts led to widespread dissatisfaction. The formula, as implemented, was not robust enough to handle fluctuations in international prices or domestic macroeconomic challenges like currency depreciation. These factors, coupled with political interference, undermined its effectiveness, leading to calls for a more transparent and flexible approach.