Colombo, Oct 31 (LankaBIZ) -The reduction in impairment charges by such a huge amount seems to be somewhat questionable. This move by the bank could be viewed as an attempt to offset the decline in interest income, possibly using impairment adjustments to present an improved financial picture.

Financial Highlights

- Profit Before Tax Growth: Profit before tax rose by 47.07% to LKR 10.71 billion from LKR 7.28 billion in the same period of 2023, illustrating significant improvements in operational performance and effective cost management, despite challenges in net interest income.

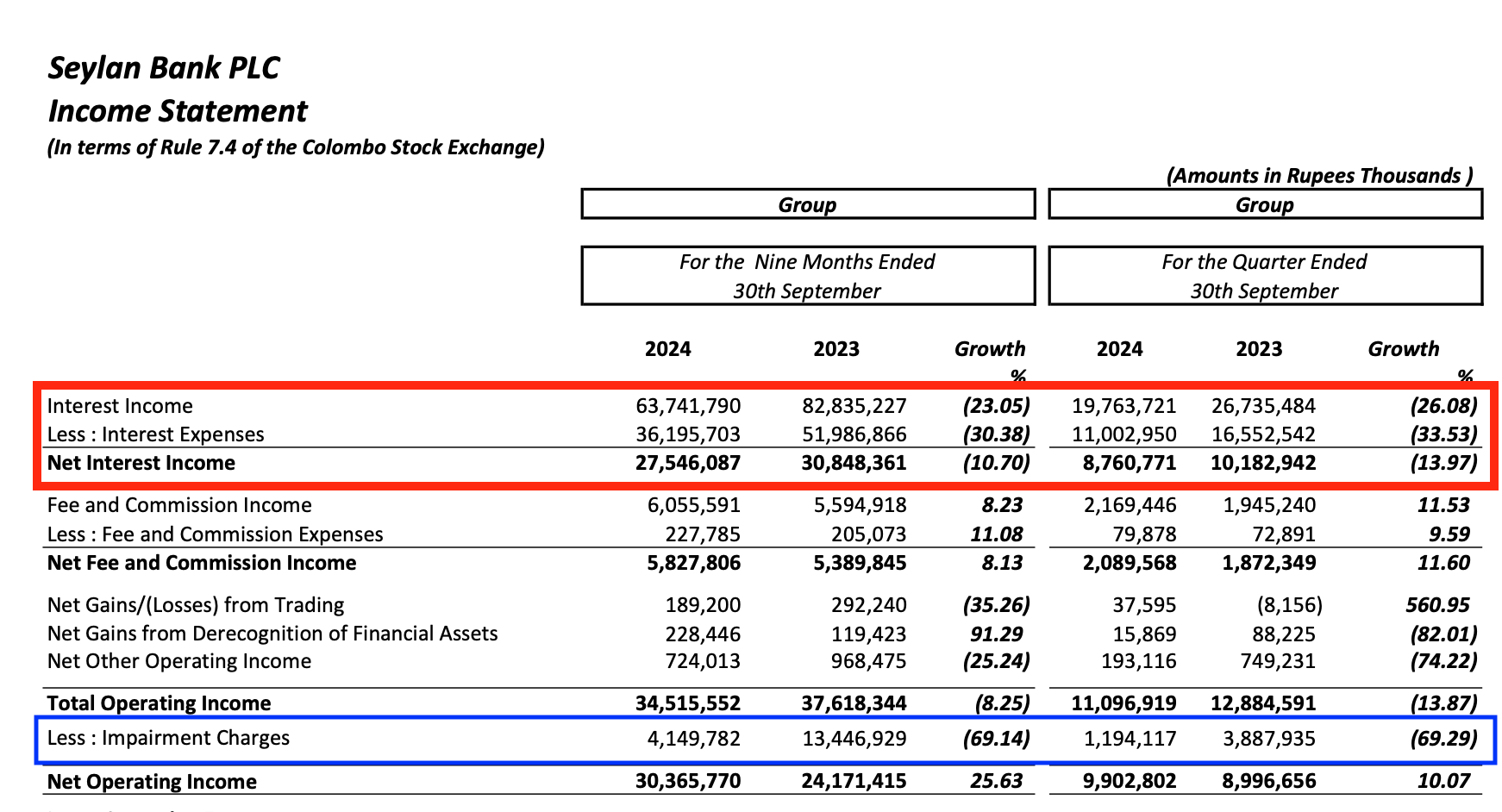

- Net Interest Income: A notable reduction in net interest income, decreasing by 10.70% to LKR 27.55 billion, was driven by a drop in the net interest margin from 5.76% in 2023 to 5.03% in 2024. The decrease resulted from heightened competition in the lending space and tighter margins on key products.

- Fee and Commission Income: Fee-based income grew by 8.13%, totaling LKR 5.83 billion compared to LKR 5.39 billion in 2023. Growth in card transactions and remittances played a significant role in this increase, reinforcing Seylan’s diversified income base beyond traditional lending.

- Operating Income: Total operating income experienced a contraction of 8.25%, reducing from LKR 37.62 billion to LKR 34.52 billion, primarily due to the compression of net interest margins. This indicates the need for continued expansion of fee-generating activities.

- Operating Expenses: The Bank’s total operating expenses rose by 13.10% to LKR 15.82 billion. The increase is attributed to higher personnel expenses and the cost of consumables, aligned with inflationary trends and collective agreements for staff benefits.

- Impairment Charges: Impairment charges fell sharply by 69.14%, amounting to LKR 4.15 billion from LKR 13.45 billion in 2023. This significant decrease reflects the Bank’s improved credit quality and successful recovery efforts across its loan portfolio.

- Taxation Impact: Income tax expenses increased by 47.69% to LKR 4.09 billion due to higher profitability, while VAT on financial services rose 32.28%, highlighting the combined impact of regulatory obligations on Seylan’s cost structure.

Download Full Research Report