Colombo, Nov 04 (LankaBIZ) – The external sector of Sri Lanka demonstrated mixed performance as of September 2024, reflecting resilience amid global economic pressures.

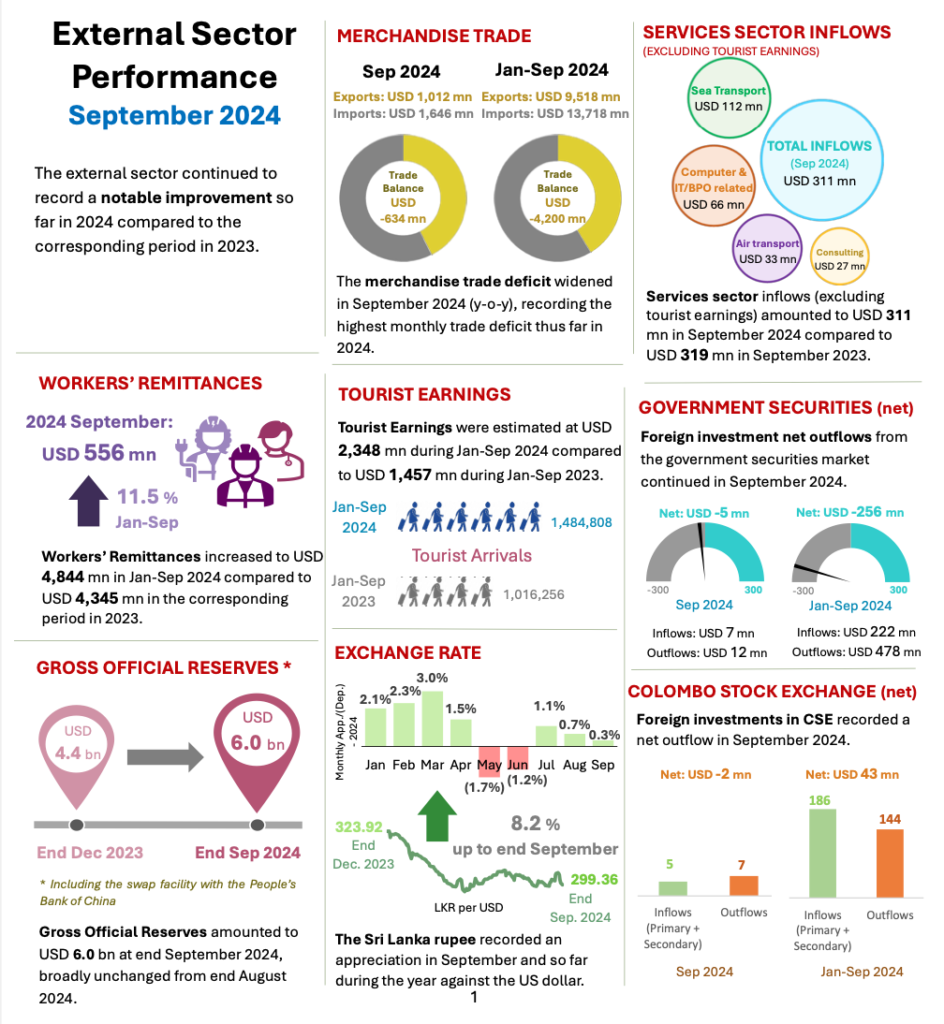

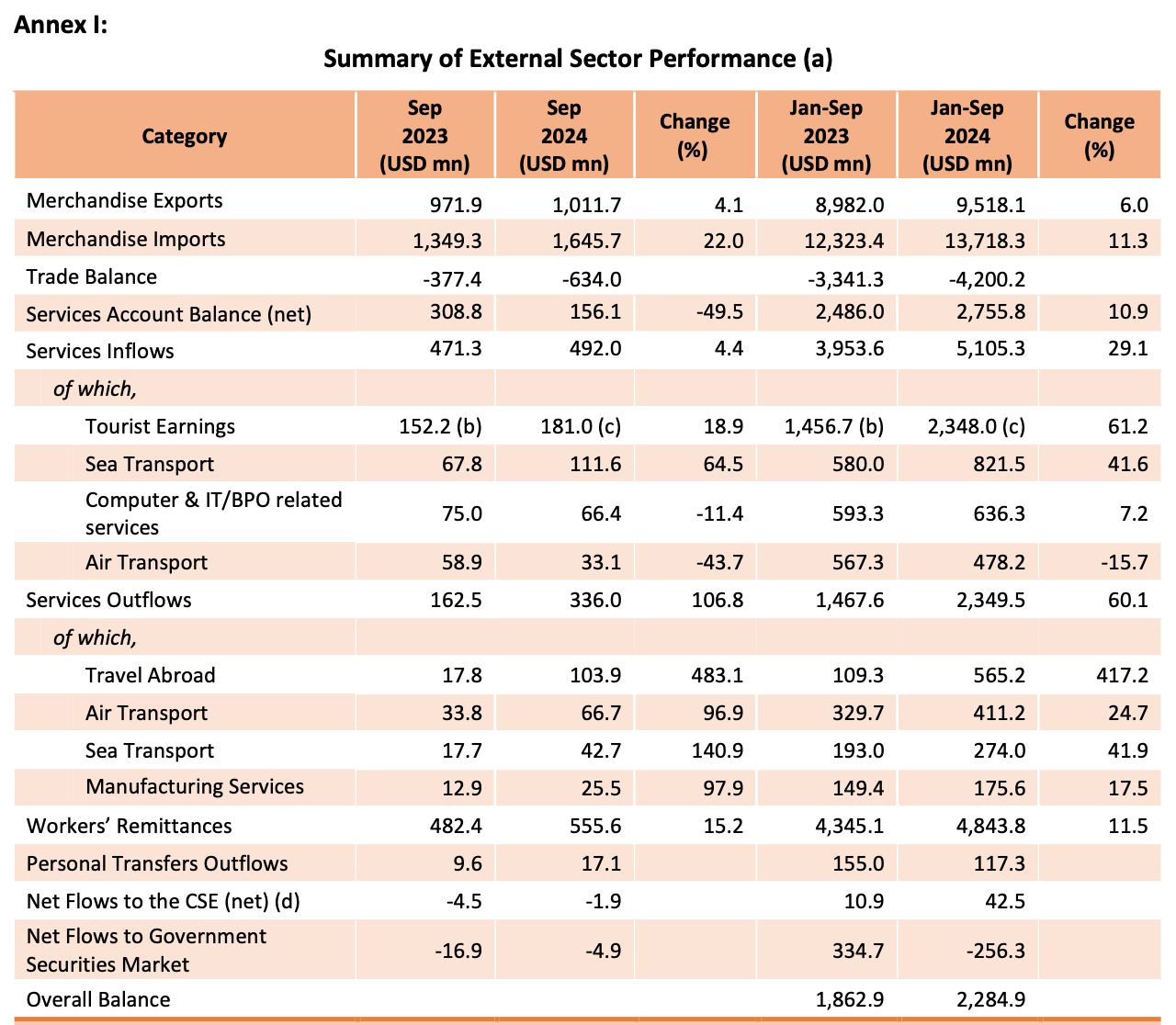

Trade Balance

Sri Lanka’s trade deficit expanded significantly in September 2024, rising to USD 634 million compared to USD 377 million in September 2023. This increase reflects a 22% year-over-year (y-o-y) growth in import expenditure, which reached USD 1,646 million due to higher demand for intermediate and investment goods. In contrast, exports grew at a slower pace, up 4.1% y-o-y to USD 1,012 million. The cumulative trade deficit for January-September 2024 widened to USD 4.2 billion, up from USD 3.3 billion in the corresponding period of 2023, underscoring challenges in balancing external trade. Industrial exports, particularly textiles and garments, provided some support, though agriculture and mineral exports declined, further impacting the trade gap.

Tourism Earnings

Tourism continued to recover strongly, contributing significantly to Sri Lanka’s external sector. In September 2024, tourism earnings rose by 18.9% y-o-y, reaching USD 181 million. The cumulative earnings from tourism for January-September 2024 were USD 2.35 billion, a 61.2% increase over the same period in 2023. This growth was driven by steady increases in tourist arrivals, which totaled approximately 1.48 million for the year to date, up from 1.02 million in the prior year. The tourism sector’s robust performance has provided a much-needed boost to the services sector, helping to partially offset weaknesses in merchandise trade.

Workers’ Remittances

Workers’ remittances continued to show resilience, contributing USD 556 million in September 2024, marking a 15.2% increase compared to September 2023. For the period from January to September 2024, total remittances reached USD 4.84 billion, an 11.5% increase year-over-year. Monthly remittance inflows have consistently exceeded USD 500 million since March 2024, highlighting the stable support from the Sri Lankan diaspora. Remittances remain a critical source of foreign exchange, offering significant support to the country’s external sector amid fluctuating trade balances.

Gross Official Reserves (GOR)

Sri Lanka’s Gross Official Reserves (GOR) stood steady at USD 6.0 billion as of end-September 2024, largely unchanged from the previous month. This reserve level includes a swap facility from the People’s Bank of China and provides an import cover of approximately 3.9 months. The stability in reserves, despite increased import costs, signals effective reserve management, likely buoyed by remittance inflows and tourism earnings. Nevertheless, the reserve composition includes conditional components, suggesting that sustainable growth in other foreign exchange sources remains vital to maintaining reserves at stable levels.

Exchange Rate Movements

The Sri Lankan rupee appreciated significantly against the US dollar, showing a 10.3% gain over the year through September 2024. This appreciation trend extended to other major currencies, including the euro, pound sterling, and Indian rupee. Reflecting the rupee’s nominal appreciation, the Real Effective Exchange Rate (REER) index also rose from 70.2 in December 2023 to 72.6 by the end of September 2024. However, while this appreciation signals stronger external positioning, it may impact export competitiveness, as a stronger rupee makes Sri Lankan exports relatively more expensive in international markets.

Foreign Investment Flows

Foreign investment outflows have continued to weigh on Sri Lanka’s financial account. In September 2024, net outflows from government securities amounted to USD 5 million, contributing to a cumulative outflow of USD 256 million for the January-September period. Foreign flows to the Colombo Stock Exchange (CSE) also recorded a net outflow of USD 2 million in September 2024, though cumulative figures for the year show a small net inflow of USD 43 million. Persistent outflows reflect investor caution and underscore the need for structural improvements to attract and retain foreign capital.

Each of these indicators illustrates the complex dynamics of Sri Lanka’s external sector. While tourism and remittances have provided resilience, challenges remain in the trade deficit and foreign investment flows, calling for balanced economic policies to strengthen the external sector.

Read Full Report by Central Bank of Sri Lanka