Colombo, Sri Lanka (LankaBIZ) Nov 19, 2024 -According to latest comparative analysis of all banking sector companies, Nations Trust Bank PLC has become the top-performing bank for the 9 months ended 30th September 2024 based on its strong profitability, low Price-to-Earnings Ratio, high Return on Equity, excellent Net Interest Margin, and superior credit quality. These metrics highlight its efficient operations, undervaluation, and robust financial health, making it the best investment choice among the analyzed banks.

Download the Report

Overview

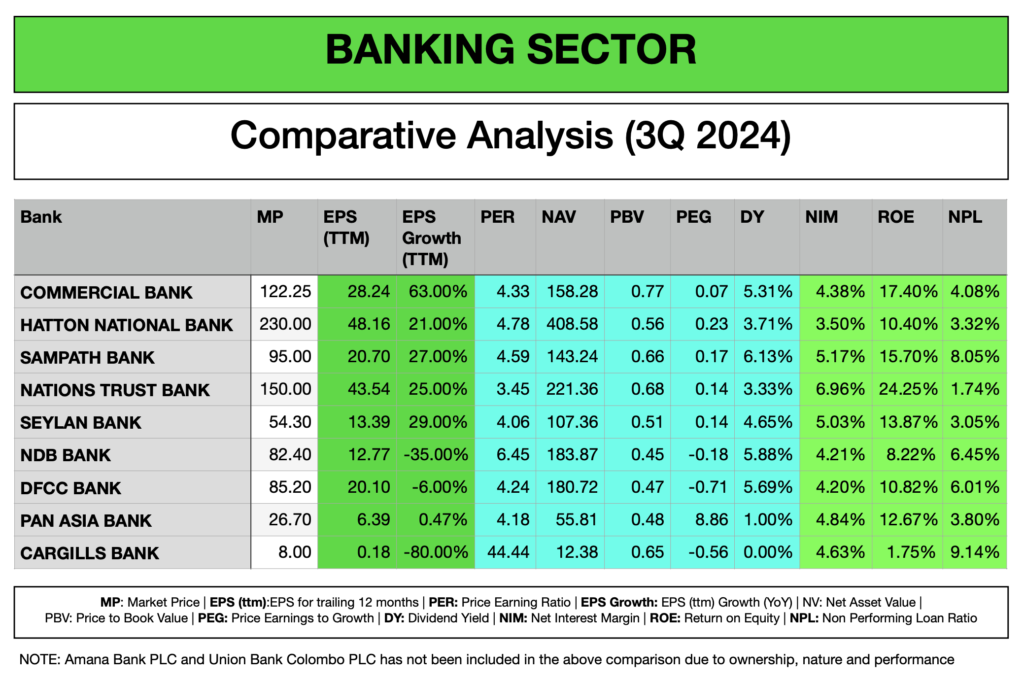

This report evaluates the performance and valuation of key banks in the sector using metrics such as Market Price (MP), Earnings Per Share (EPS), Price to Earnings Ratio (PER), Net Asset Value (NAV), and other profitability indicators. Recommendations are made based on comparative performance and valuation metrics.

Key Findings

Hatton National Bank demonstrates the highest Market Price (Rs. 230.00) and Earnings Per Share (Rs. 48.16), indicating strong investor confidence and profitability. Nations Trust Bank shows the lowest Price-to-Earnings Ratio (3.45), suggesting undervaluation, while Cargills Bank has the highest ratio (44.44), reflecting overvaluation. EPS growth is highest for Commercial Bank at 63%, signifying robust earnings expansion, while Cargills Bank exhibits the poorest growth at -80%.

Net Asset Value is led by Hatton National Bank (Rs. 408.58), reflecting its high intrinsic worth, while Cargills Bank records the lowest NAV (Rs. 12.38). Dividend Yield is strongest for Sampath Bank (6.13%), and Nations Trust Bank shows the highest Net Interest Margin (6.96%) and Return on Equity (24.25%), making it highly profitable. Non-Performing Loan Ratios indicate the best asset quality for Nations Trust Bank (1.74%) and the highest credit risk for Cargills Bank (9.14%).

Top Performing Bank (3Q2024)

Nations Trust Bank PLC is considered as the top-performing bank for the 9 months ended 30th September 2024 based on its strong profitability, low Price-to-Earnings Ratio, high Return on Equity, excellent Net Interest Margin, and superior credit quality. These metrics highlight its efficient operations, undervaluation, and robust financial health, making it the best investment choice among the analyzed banks.

For individual performance and research update of all banks are available at: https://lankabizz.net/product-tag/banks/