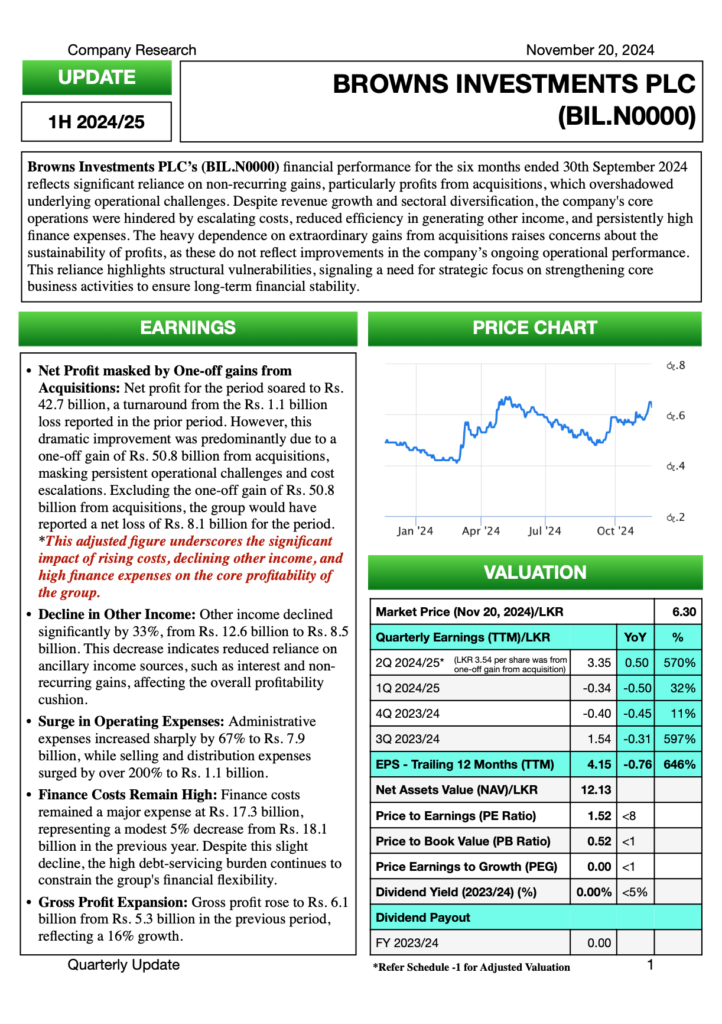

Colombo, Sri Lanka (LankaBIZ) Nov 20, 2024 – According to official Financial Statement for quarter ended 30th September 2024, released by the Browns Investments PLC (BIL), Net profit for the period soared to Rs. 42.7 billion, a turnaround from the Rs. 1.1 billion loss reported in the prior period. However, this dramatic improvement was predominantly due to a one-off gain of Rs. 50.8 billion from acquisitions, masking persistent operational challenges and cost escalations and ultimate profitability of the group. Excluding the one-off gain of Rs. 50.8 billion from acquisitions, the group would have reported a net loss of Rs. 8.1 billion for the period. This adjusted figure underscores the significant impact of rising costs, declining other income, and high finance expenses on the core profitability of the group.

Details of One-Off Gains

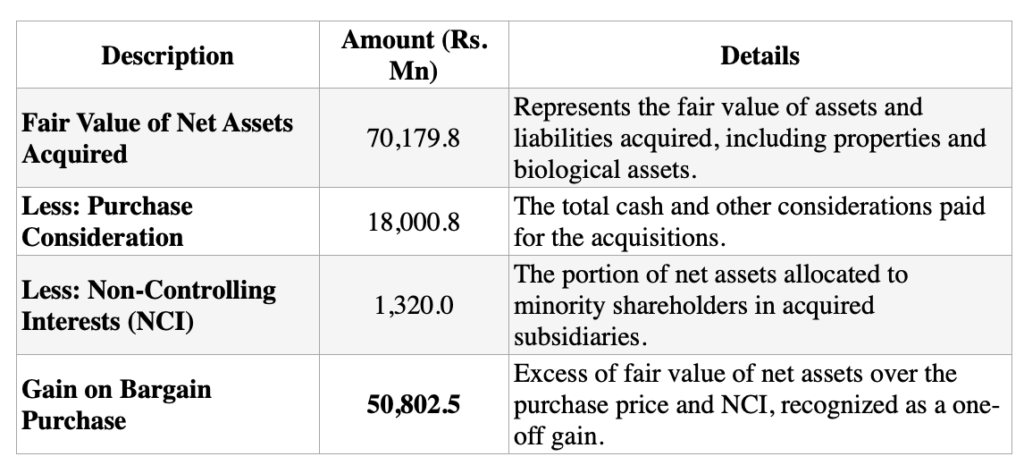

During the six months ended 30th September 2024, Browns Investments PLC reported a one-off gain of Rs. 50.8 billion arising from the acquisition of subsidiaries, including Lipton Teas and Infusions in Kenya, Rwanda, and China. This gain represents a “bargain purchase” (negative goodwill), which occurs when the fair value of the identifiable net assets acquired exceeds the purchase consideration. Such gains are non-recurring and unrelated to the group’s core operational performance.

Applicable Accounting Rules

Under Sri Lanka Accounting Standard SLFRS 3 (Business Combinations), the fair value of the net assets acquired is assessed at the acquisition date. Any excess of net assets over the purchase price is recognized as a gain in the statement of profit or loss. The standard mandates this treatment to reflect the economic benefit derived from acquiring assets at below-market value or due to unique circumstances, such as distress sales by the seller.

Potential Distortion of Investor Perception

The inclusion of one-off gains from acquisitions in the profit and loss statement can significantly distort investor perception. While such gains inflate net profits, they do not reflect the company’s operational efficiency or recurring income-generating capacity. Investors may be misled into overestimating the company’s profitability and long-term growth prospects if these extraordinary items are not adequately disclosed and contextualized. As these gains are unlikely to recur, they create an artificial enhancement of performance metrics, potentially leading to inflated share prices and unrealistic expectations. Transparency in financial reporting and clear communication about the nature and sustainability of profits are essential to mitigate such distortions.

Download Full Report: