Colombo, Sri Lanka (LankaBIZ) Nov 21, 2024 -Colombo Dockyard PLC, a subsidiary of Onomichi Dockyard Company Limited of Japan, continues to face substantial financial challenges, with the group reporting a gross loss of Rs. 421.5 million for the nine months ended 30th September 2024. This alarming performance marks a significant deterioration from the gross loss of Rs. 2.18 billion in the prior period. Despite reductions in operational losses, the group remains unprofitable at a gross level, raising critical concerns for minority shareholders and the wider financial ecosystem in Sri Lanka.

A primary concern is the suspected use of transfer pricing mechanisms, which appear to favor the Japanese parent company at the expense of Colombo Dockyard PLC’s profitability. By manipulating the pricing of goods and services transacted within the group, the parent company potentially siphons value out of the Sri Lankan entity, creating persistent staging losses for the group. This practice not only erodes shareholder value for local minority investors but also denies fair tax revenues to the Sri Lankan government, exacerbating fiscal challenges for the country.

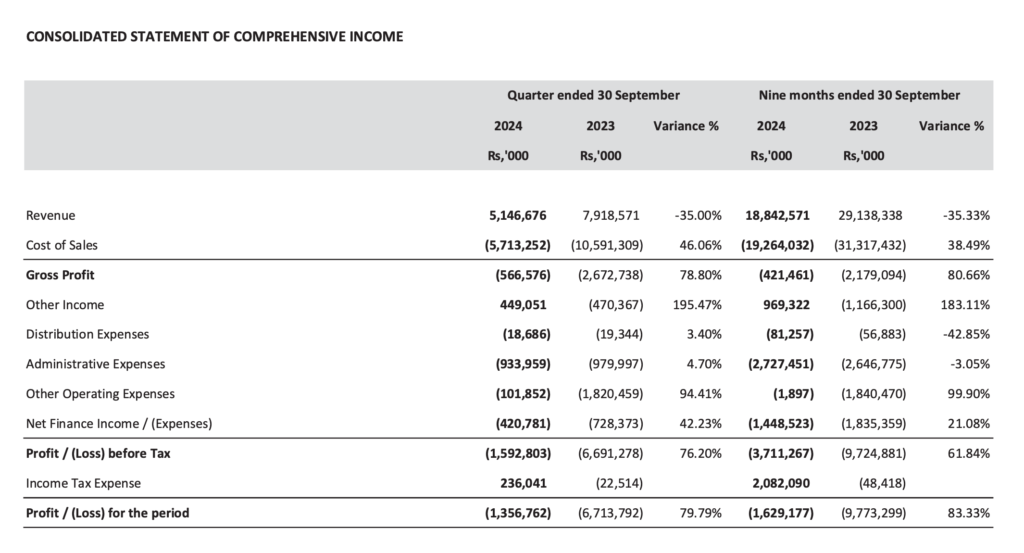

Despite generating Rs. 18.84 billion in revenue for the period, a 35.3% decline from Rs. 29.14 billion in 2023, the company remains heavily burdened by its cost structure, with cost of sales exceeding revenue at Rs. 19.26 billion. Shipbuilding, a critical revenue segment, reported a massive loss of Rs. 3.38 billion, undermining the overall profitability of the group. Furthermore, administrative expenses, which totaled Rs. 2.73 billion, continued to strain the company’s financial resources without yielding proportional returns.

Income Statement

Impact to Shipping Industry and Sri Lanka Economy

Dry docks are critical to the shipping industry, serving as essential facilities for the repair, maintenance, and construction of vessels. In Sri Lanka, with its strategic location along major international shipping routes, dry docks play a pivotal role in supporting maritime trade and logistics. They enable shipowners to ensure the operational efficiency and safety of their fleets, reducing downtime and enhancing reliability. Additionally, the presence of well-managed dry docks positions Sri Lanka as a competitive maritime hub, attracting international business and contributing significantly to foreign exchange earnings, employment generation, and infrastructure development. The maintenance and development of these facilities are crucial for sustaining the nation’s maritime reputation and economic integration into global trade networks.

Mismanagement of dry dock operations, as seen in certain instances, poses a severe threat to the shipping industry and the broader economy of Sri Lanka. Inefficiencies, financial mismanagement, or unfair practices, such as those linked to transfer pricing, can undermine the viability of key players like Colombo Dockyard PLC. Such failures can lead to higher operational costs for shipping companies, delays in vessel turnaround times, and a loss of competitive advantage, driving business away to better-managed ports in the region. Furthermore, the financial instability of dry dock operators jeopardizes tax revenues and foreign investment, weakening the maritime sector’s contribution to the national economy. Addressing mismanagement is essential not only to safeguard the shipping industry but also to protect Sri Lanka’s position as a pivotal player in the global maritime trade.

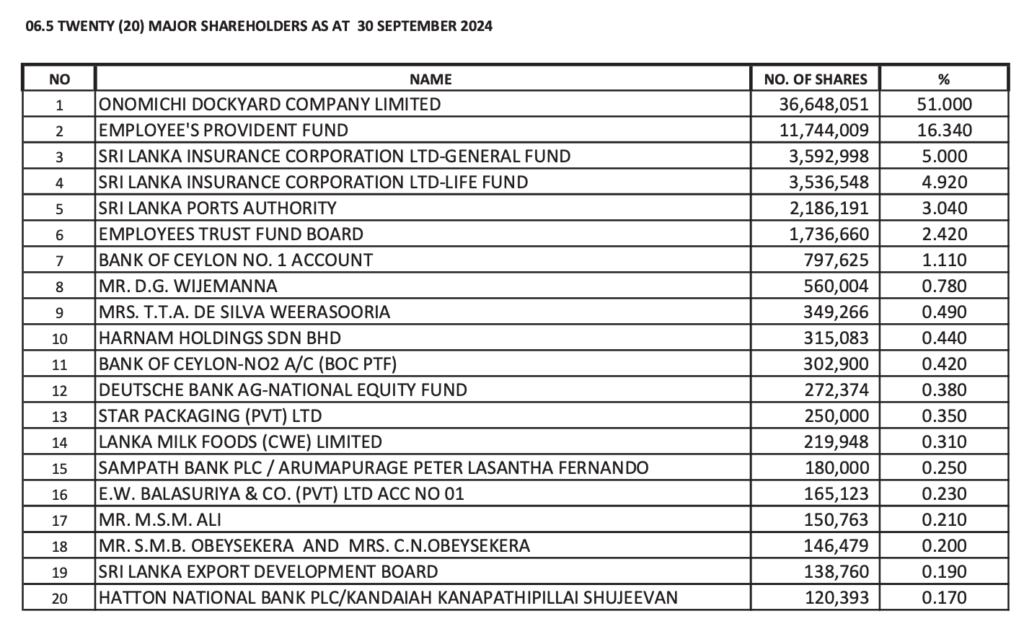

Major Shareholders of Colombo Dockyard PLC

Shareholders Concern

From a shareholder perspective, the sustained losses and gross-level unprofitability have severely impacted earnings, with the company recording a loss of Rs. 1.63 billion for the period. This persistent underperformance has also negatively influenced Colombo Dockyard’s share price, which declined from Rs. 60.00 in September 2023 to Rs. 43.20 in September 2024, a clear reflection of dwindling investor confidence. For minority shareholders, this downward trend not only signifies lost capital but also raises concerns about governance practices and the equitable treatment of all shareholders.

In conclusion, Colombo Dockyard PLC’s reliance on transfer pricing, lack of gross profitability, and operational inefficiencies cast a shadow over its future. Immediate reforms are required to address these issues, ensure fair practices, and restore confidence among minority investors while fulfilling tax obligations to the government of Sri Lanka. Without decisive action, the company risks further financial deterioration and reputational damage.

One response to “Investors concern over Colombo Dockyard suspected transfer pricing scam to favour Japanese”

[…] Investors concern over Colombo Dockyard suspected transfer pricing scam to favour Japanese […]