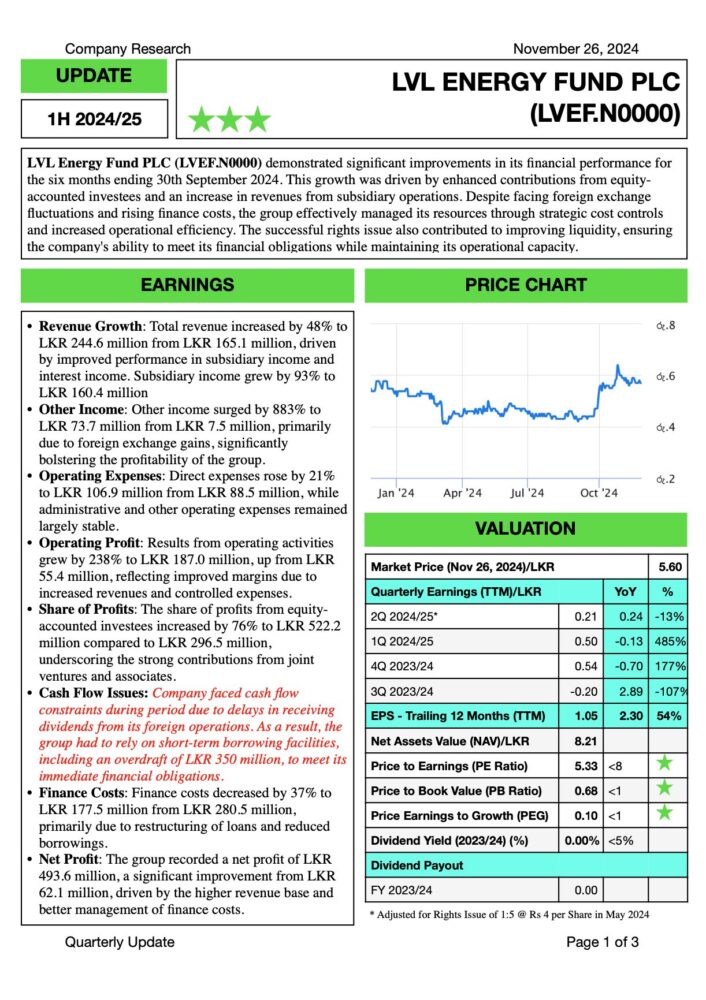

Colombo, Sri Lanka (LankaBIZ), Nov 27, 2024 – LVL Energy Fund PLC faced cash flow constraints during the six months ended 30th September 2024 due to delays in receiving dividend from its foreign Investments. These delays stemmed from prolonged dividend payments by key foreign investee companies, exacerbated by currency conversion challenges and regulatory restrictions in the operating countries. As a result, the group had to rely on short-term borrowing facilities, including an overdraft of LKR 350 million, to meet its immediate financial obligations. This issue highlights the group’s dependency on timely remittances from foreign investments and the need for strategic liquidity management to mitigate such risks in the future.

LVL Energy Fund acquires equity stakes in project companies, often as a co-investor with strategic or financial partners. As at 30th September 2024 companies Investment in equity accounted Investees amounted to LKR 7.4 billion.

Steps taken by LVL Energy Fund PLC

- Debt Restructuring: The company has restructured loans with financial institutions, such as DFCC Bank and NDB Bank, to extend repayment periods and align obligations with anticipated cash inflows. This reduces immediate debt-servicing pressures.

- Rights Issues: LVL Energy Fund raised LKR 465.8 million through a rights issue during the period, providing additional liquidity to settle outstanding debt and fund operations without over-reliance on external borrowings.

- Short-Term Borrowings: To manage cash flow mismatches caused by delays in dividend remittances from foreign investees, the company utilized overdraft facilities, such as a LKR 350 million facility from Hatton National Bank, to meet immediate financial obligations.

- Hedging Practices: The company employs hedging mechanisms for its USD-denominated revenues and loans in foreign operations, protecting against exchange rate volatility and ensuring stable cash flows.

- Cost Management: Strict cost controls are in place to manage operational expenses and reduce the impact of higher finance costs on profitability, ensuring resources are directed toward critical needs.

- Dividend Adjustments: LVL Energy Fund optimizes cash reserves by adjusting dividend payments to shareholders, prioritizing internal capital requirements over distributions during tight financial periods.

- Strategic Focus on High-Yield Projects: By investing in projects with stable and high returns under long-term Power Purchase Agreements (PPAs), the company ensures predictable income streams to support financial obligations.

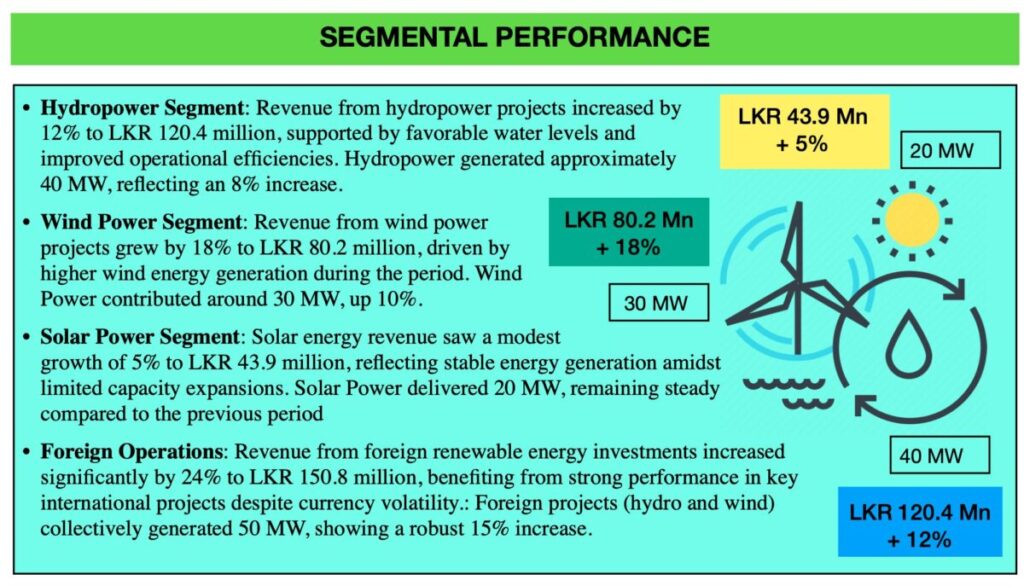

- Revenue Diversification: The company’s broad portfolio across hydropower, wind, solar, and international markets mitigates reliance on any single revenue source, reducing vulnerability to localized financial issues.

LVL Energy Fund PLC Investments

LVL Energy Fund PLC has strategically diversified its portfolio with foreign investments primarily in renewable energy projects across South Asia. The key countries where the company holds foreign investments include:

- Bangladesh: Investments in large-scale thermal and renewable energy projects. Includes equity stakes in Lakdhanavi Bangla Power Limited and Feni Lanka Power Limited, which operate under Power Purchase Agreements (PPAs) with the Bangladesh Power Development Board. These projects generate stable USD-denominated revenues.

- Nepal: Focus on hydropower projects that capitalize on Nepal’s abundant water resources and favorable conditions for renewable energy development.

- Myanmar (previous investments): Historically, LVL Energy Fund has shown interest in renewable energy projects in Myanmar, particularly hydropower, though the current operational status may be influenced by geopolitical and economic conditions.

These investments contribute significantly to the company’s profitability, particularly through equity-accounted income, despite challenges such as currency volatility and delays in dividend remittances. The foreign ventures align with the company’s strategy to expand its renewable energy footprint in high-growth emerging markets.

Download Research Report