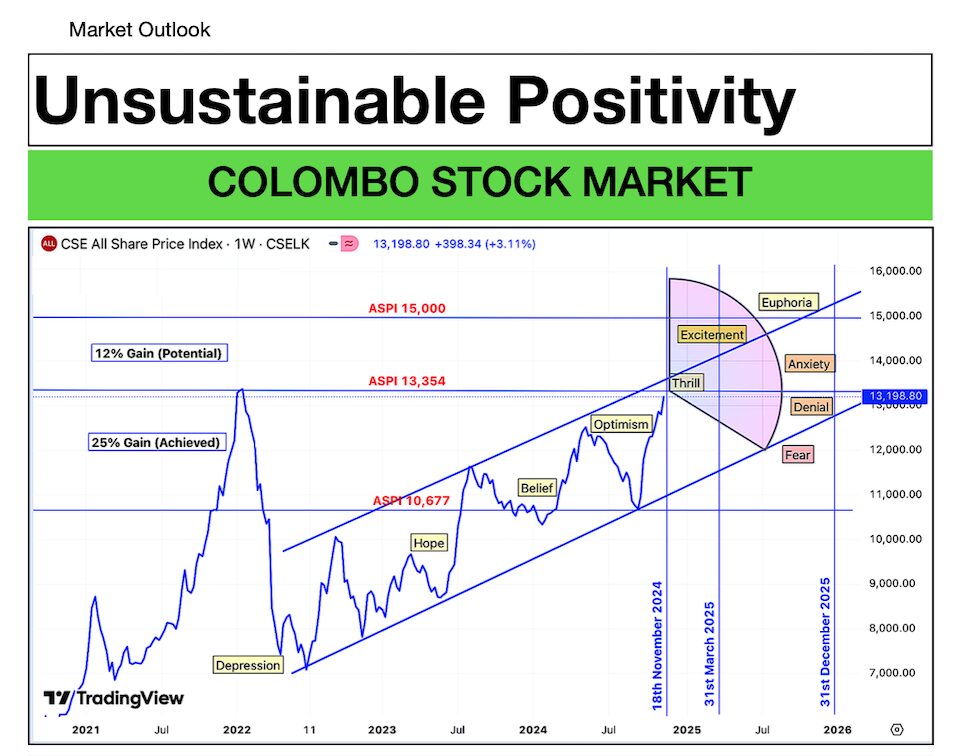

In the wake of President Anura Kumara Dissanayake’s election, the Colombo Stock Exchange (CSE) experienced a notable surge, with the All Share Price Index (ASPI) reaching unprecedented highs. This upward momentum was largely driven by investor optimism surrounding anticipated political reforms and economic recovery.

The recent rally was predominantly sentiment-driven, lacking substantial economic improvements to support such growth. Technical analyses indicate that the ASPI has approached critical resistance levels, historically preceding market corrections. Moreover, despite the political stability achieved through a two-thirds parliamentary majority, Sri Lanka continues to grapple with structural economic challenges, including inflation, high debt, and low investor confidence. The piece cautions that unmet public expectations due to a slow economic recovery could further dampen market confidence, suggesting that the current market optimism may be unsustainable without tangible economic progress.

- Market Sentiment Peak: The stock market operates on forward-looking sentiment. The recent rally, pushing the ASPI to its peak, reflects optimism about political change rather than concrete economic improvements. Now that the political event has concluded, there is a high likelihood that the hype will fade, as investors reassess the prolonged timeline for economic recovery.

- Technical Analysis – All-Time High and Resistance: From a technical standpoint, the ASPI is at a critical resistance level. Historically, such peaks are followed by corrections, as the market consolidates after rapid gains. The current overbought conditions increase the risk of a downturn.

- Political Transition and Speculation: When Anura Kumara Dissanayake became president, his promises of reducing the cost of living, eliminating corruption, and driving economic recovery created optimism in the stock market. This sentiment-driven rally was fueled by rumors and speculations, despite his limited initial ability to enact change due to the lack of parliamentary power.

- Reality of Parliamentary Elections: The stock market further rallied on speculation about the parliamentary election outcome on November 14, 2024, as the anticipation of a strong government stirred hope for policy stability and reform. However, even after securing a two-thirds supermajority (159 seats), the economic challenges remain daunting, and any tangible turnaround will take significant time.

- Economic Reality and Limited Immediate Impact: While the political environment has stabilized, the structural issues plaguing the economy—such as inflation, high debt, and low investor confidence— cannot be resolved in the short term. The 50 days since Dissanayake’s presidency began have shown little progress, highlighting that immediate economic benefits are unrealistic.

- Risk of Public Agitation: If the public becomes disillusioned due to the slow pace of economic recovery and unmet expectations, it could erode market confidence further. Political stability might remain intact, but economic frustration may create headwinds for investor sentiment.