Colombo, Sri Lanka, Jan 5, 2024 (LANKABIZ) – The Colombo Stock Exchange (CSE) is poised for potential long-term growth, driven by macroeconomic reforms, structural adjustments, and improved investor sentiment. Despite current challenges, the All Share Price Index (ASPI) is likely to exhibit upward momentum, with a potential to reach 22,000 points in the medium term according to research analysts. This prediction is supported by several key factors:

Macroeconomic Stabilization: Efforts by the government to implement structural reforms, reduce fiscal deficits, and stabilize the Sri Lankan Rupee (LKR) are likely to create a conducive environment for market growth. The stabilization of the exchange rate and reduced inflationary pressures could improve both local and foreign investor confidence.

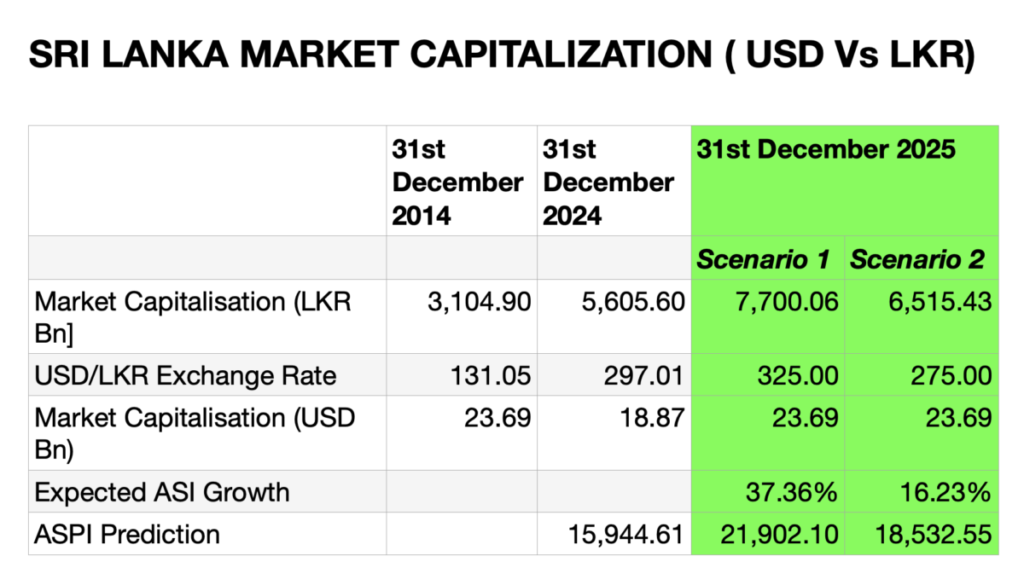

The significant depreciation of the Sri Lankan Rupee (LKR) against the US Dollar (USD) over the last decade, with the exchange rate rising from LKR 131.05 per USD in 2014 to LKR 297.01 per USD in 2024. Despite a nominal increase in market capitalization in local currency terms from LKR 3,104.9 billion to LKR 5,695.6 billion, the market capitalization in USD terms has declined by 19%, from USD 23.7 billion to USD 19.2 billion. This depreciation of the LKR has eroded the dollar-denominated value of the Colombo Stock Exchange (CSE), making it less attractive to foreign investors. It underscores the critical impact of exchange rate volatility on the stock market’s performance and its ability to sustain dollar-based growth, emphasizing the need for macroeconomic stability and currency management to enhance investor confidence.

Colombo Stock Market: The Colombo Stock Exchange (CSE) presents a significant opportunity for USD-based investments when considering Sri Lanka’s potential GDP growth and the favorable conversion rate of the Sri Lankan Rupee (LKR). While the LKR has depreciated substantially against the USD, this creates an entry point for foreign investors to acquire equities at relatively lower dollar costs. With Sri Lanka’s GDP expected to grow due to ongoing structural reforms, export-driven industries, and recovery in key sectors such as tourism and agriculture, the earnings potential of listed companies is likely to improve.

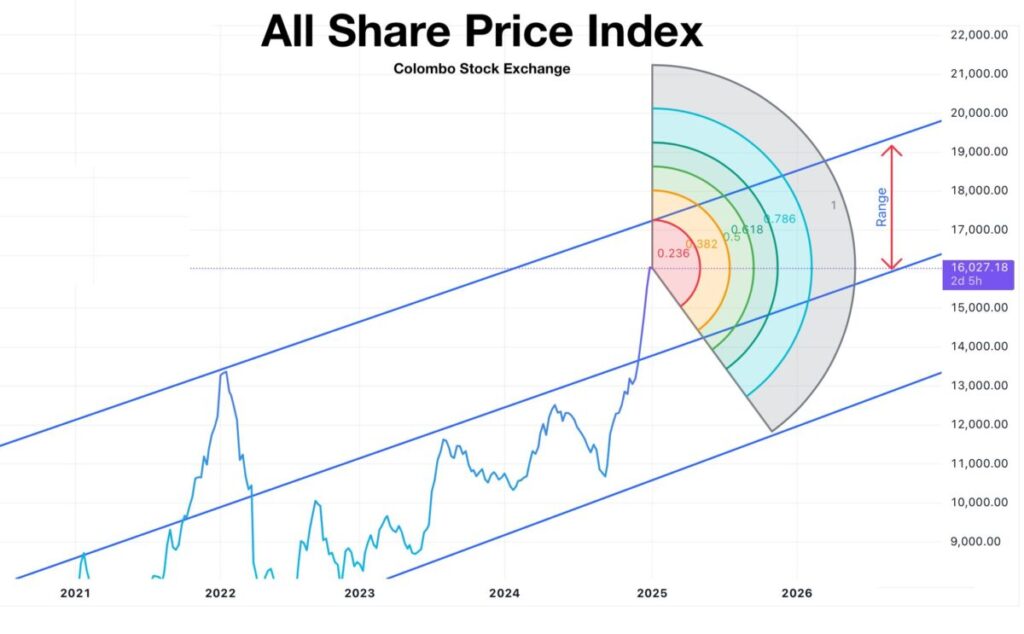

Market to Trade between ASPI 18,500 – 22,000: The predicted ASPI for 2025 varies based on exchange rate scenarios, reflecting its sensitivity to currency fluctuations. Under Scenario 1, with a USD/LKR exchange rate of 325, the ASPI is projected to reach 21,902.10, marking a growth of 37.36%, while Scenario 2, with a stronger exchange rate of 275, forecasts an ASPI of 18,532.55, a growth of 16.23%. Despite a constant market capitalization in USD at $23.69 billion, LKR-based capitalization increases to LKR 7,700.06 billion in Scenario 1 and LKR 6,515.43 billion in Scenario 2, highlighting the impact of exchange rate dynamics on nominal growth and investor returns.

Investment Opportunity: Furthermore, as the GDP grows, the overall economic outlook could stabilize the LKR in the medium term, providing additional value to USD-denominated investments as local market capitalization translates into higher dollar terms. Foreign investors can also benefit from a potential “double gain” — an appreciation in stock prices driven by economic recovery and a more favorable exchange rate if the LKR strengthens in the future. Therefore, despite current challenges, the combination of undervalued equities, anticipated GDP growth, and the current conversion advantage positions the CSE as an attractive opportunity for USD investments.

Strong Earnings Growth: Sectors such as banking, diversified holdings, export-oriented businesses, and tourism are expected to deliver robust earnings growth as the economy recovers. This could act as a catalyst for the ASPI to breach new highs.

Government Divestment: The anticipated privatization of state-owned enterprises and related market-friendly reforms are expected to attract significant foreign and local investments, driving demand for equities and increasing overall market capitalization.

Global Market Trends: With a potential improvement in global economic conditions, emerging markets like Sri Lanka could see increased capital inflows, especially with undervalued equities in the CSE appearing attractive relative to regional peers.

Market Sentiment: The ASPI’s recent rally, which saw it reach an all-time high of 16,473.25 in January 2025, demonstrates strong market momentum. If this trend continues, supported by favorable macroeconomic and sectoral factors, the index could break the 22,000-point mark within the next two to three years.

Challenges to Watch

While the outlook appears optimistic, potential risks include exchange rate volatility, geopolitical uncertainties, and fluctuating global commodity prices. Sustained policy commitment and external stability will be essential for realizing this growth trajectory.

The prediction of the ASPI reaching 22,000 reflects an ambitious yet plausible target, contingent on continued economic and structural improvements coupled with favorable market conditions.