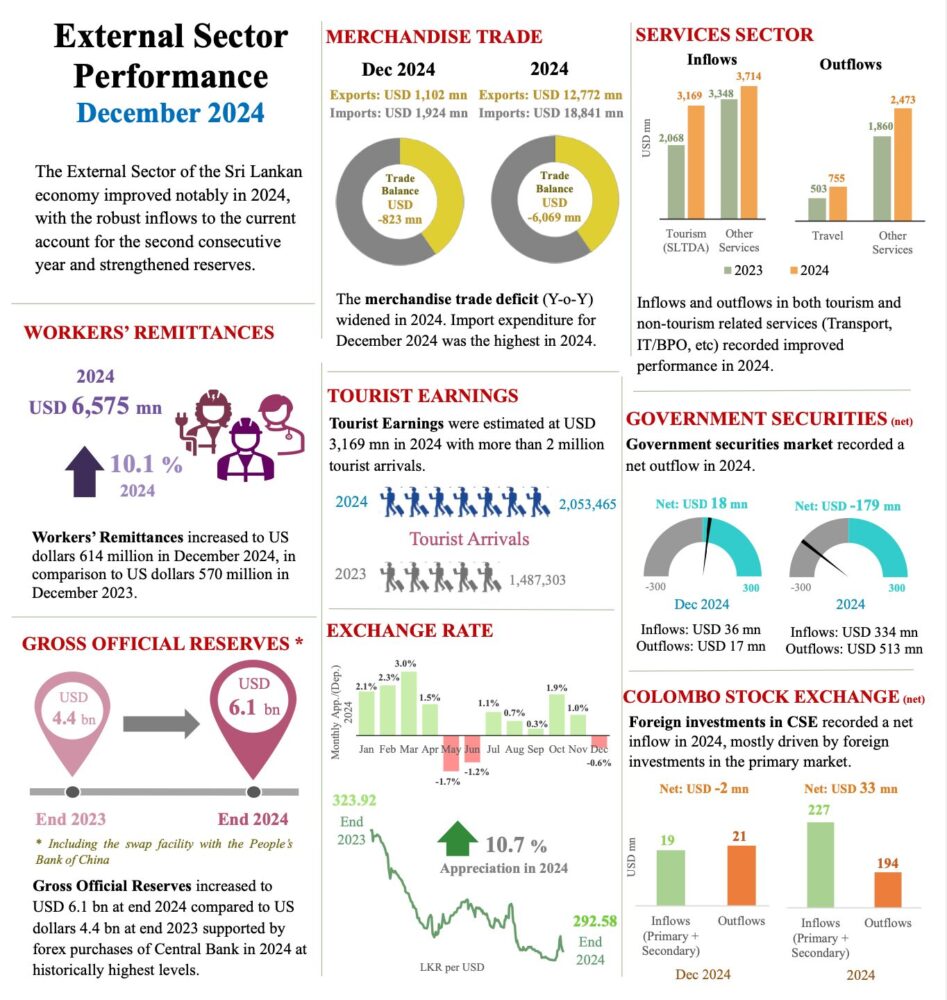

The Sri Lankan economy experienced a notable improvement in its external sector performance in 2024, bolstered by robust inflows into the current account for the second consecutive year. Despite challenges in merchandise trade, substantial growth in tourism earnings, workers’ remittances, and a strengthened foreign reserves position underscored the nation’s economic resilience.

Trade Balance and Merchandise Trade

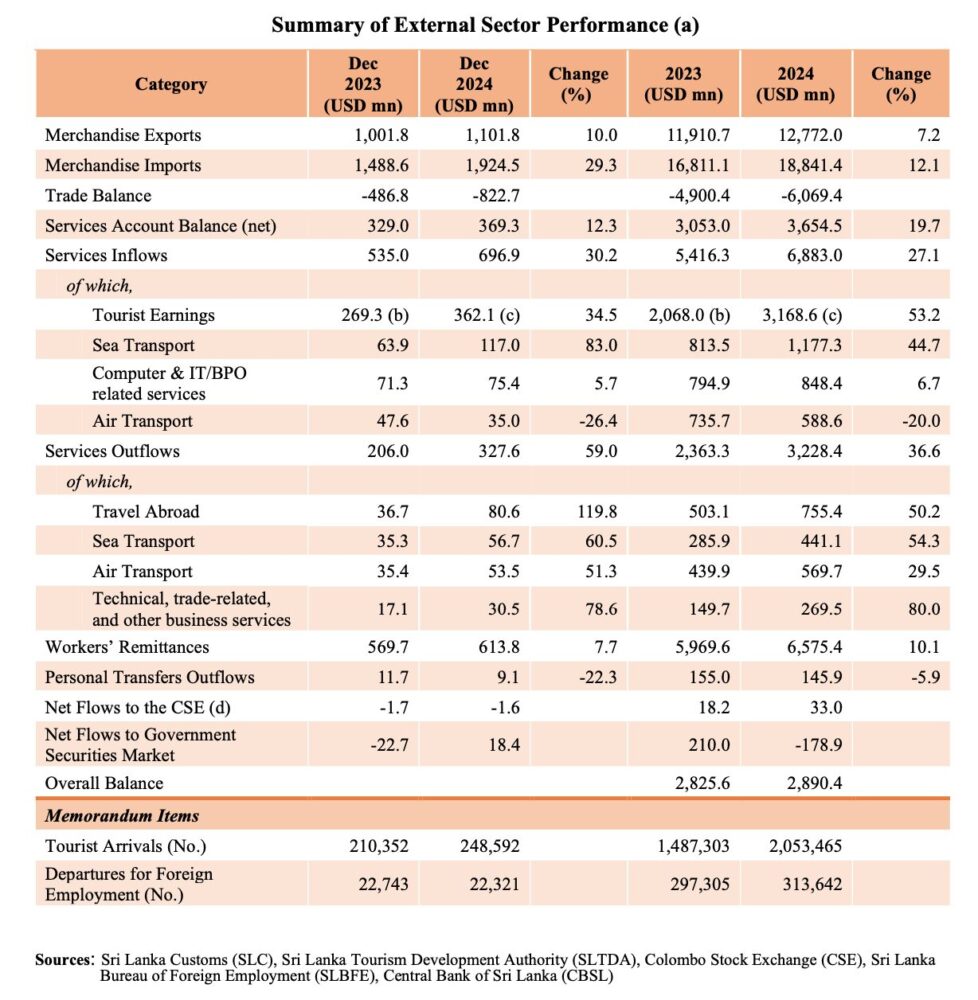

Sri Lanka’s trade deficit widened significantly in 2024, increasing to USD 6.07 billion from USD 4.9 billion in 2023. This was driven by a 12.1% increase in import expenditure to USD 18.84 billion, while merchandise exports grew 7.2% to USD 12.77 billion.

Key Export Growth Areas:

- Petroleum products: Crossed USD 1 billion for the first time due to higher bunkering volumes.

- Textiles and garments: Surpassed the USD 5 billion mark for the first time since 2022.

- Tea, food, beverages, and spices showed robust growth, though gems and machinery exports declined.

Key Import Trends:

- Increased spending on machinery, textiles, chemicals, and consumer goods fueled import growth.

- Fuel imports declined, largely due to lower crude oil and coal imports.

- Consumer goods imports saw an increase, particularly in food and beverages, as well as household and personal items.

Key Highlights:

- Merchandise Trade:

- Exports increased by 7.2%, rising from USD 11,910.7 million in 2023 to USD 12,772.0 million in 2024.

- Imports grew by 12.1%, from USD 16,811.1 million in 2023 to USD 18,841.4 million in 2024.

- The trade deficit widened significantly, from USD -4,900.4 million in 2023 to USD -6,069.4 million in 2024 (a 23.8% increase).

- Services Account:

- Net services balance improved by 19.7%, from USD 3,053.0 million in 2023 to USD 3,654.5 million in 2024.

- Services inflows saw a robust growth of 27.1%, driven by:

- Tourist earnings, which increased sharply by 53.2%.

- Sea transport revenues, up by 44.7%.

- Services outflows rose by 36.6%, with notable increases in travel abroad (50.2%) and technical/trade-related services (80.0%).

- Workers’ Remittances:

- Remittances rose by 10.1%, from USD 5,969.6 million in 2023 to USD 6,575.4 million in 2024, highlighting a positive trend in foreign income inflows.

- Capital Flows:

- Net flows to government securities turned negative in 2024, with a net outflow of USD -178.9 million compared to a net inflow of USD 210.0 million in 2023.

- Net flows to the CSE showed a slight reduction in net outflows.

- Overall Balance:

- Despite the widening trade deficit, the overall balance remained stable, with a slight increase from USD 2,825.6 million in 2023 to USD 2,890.4 million in 2024.

- Tourism and Foreign Employment:

- Tourist arrivals increased significantly by 38.3%, reflecting a recovery in the tourism sector.

- Departures for foreign employment remained stable, showing a marginal 5.3% increase.

Services Sector Performance

The services sector continued to be a bright spot for Sri Lanka’s economy, with inflows excluding tourism earnings reaching USD 3.71 billion in 2024, a 10.9% increase from 2023. Growth was primarily driven by:

- Sea transport services (+44.7%), benefitting from expanded port operations and higher global shipping demand.

- IT/BPO-related services (+6.7%), reflecting increased outsourcing demand and technological advancements.

- Air transport services (-20.0%) declined due to lower earnings from passenger and freight segments, impacted by fluctuating international travel demand.

Tourism Sector Recovery

Sri Lanka’s tourism industry witnessed a remarkable recovery, with earnings soaring 53.2% year-on-year to USD 3.17 billion. Over 2 million tourist arrivals were recorded in 2024, reflecting increased confidence in the country as a travel destination. December alone generated USD 362 million, demonstrating sustained growth.

This surge in tourism earnings was driven by:

- Enhanced marketing campaigns targeting European and Asian markets.

- Improved infrastructure and hospitality services.

- Increased international flight connectivity and relaxation of visa regulations.

Workers’ Remittances: A Strong Contribution

Remittances from overseas workers remained a crucial component of Sri Lanka’s external stability, amounting to USD 6.58 billion in 2024—a 10.1% increase from the previous year. December remittances reached USD 614 million, reinforcing the sector’s steady contribution.

Key factors driving remittance growth:

- Strengthened global labor demand in key markets such as the Middle East and Europe.

- Government incentives to promote formal remittance channels.

- Increased financial literacy among expatriate workers.

Financial Flows and Foreign Investment

- The government securities market recorded a net outflow of USD 179 million in 2024, though the last quarter saw positive net inflows.

- The Colombo Stock Exchange (CSE) registered a net inflow of USD 33 million, largely from primary market investments.

- Increased participation of foreign investors in the equity market due to improved business sentiment and policy stability.

Foreign Reserves and Exchange Rate Movement

Gross official reserves (GOR) improved significantly, reaching USD 6.1 billion by the end of 2024 from USD 4.4 billionin 2023. However, a slight decline from USD 6.5 billion in November 2024 was observed due to external debt restructuring payments.

The Sri Lankan rupee exhibited a strong appreciation of 10.7% against the US dollar in 2024, closing at LKR 292.58 per USD by year-end. However, the currency faced slight depreciation in January 2025, reflecting global currency fluctuations.

Exchange Rate Highlights:

- Real Effective Exchange Rate (REER) index appreciated from 70.2 to 76.7, impacting export competitiveness.

- The rupee’s stability was supported by higher foreign currency inflows and prudent monetary policies.

- Policy measures, including forex market interventions and reserve accumulation, helped manage volatility.

Outlook for 2025

While Sri Lanka’s external sector demonstrated commendable resilience in 2024, challenges persist, particularly in managing trade imbalances and sustaining reserve accumulation. The government’s strategic focus on promoting exports, attracting foreign direct investment, and enhancing service sector earnings will be critical to maintaining stability in 2025.

Key focus areas for 2025:

- Strengthening export diversification to reduce reliance on key industries like textiles and tea.

- Encouraging foreign direct investment (FDI) in manufacturing, technology, and tourism sectors.

- Enhancing trade agreements and regional partnerships to improve market access.

- Implementing macroeconomic policies to sustain rupee stability and manage inflation.

With continued improvements in tourism and remittances, alongside disciplined fiscal and monetary policies, Sri Lanka is poised for a balanced external sector in the coming year. The country’s ability to leverage its strengths in services, exports, and remittances will determine its economic trajectory in 2025 and beyond.

Download Full Report