Hunas Holdings PLC (HUNA.N0000) is emerging as one of Sri Lanka’s most strategically diversified conglomerates, establishing a robust presence in hospitality, real estate, renewable energy, and agriculture. The company has garnered significant attention from foreign investors, particularly from Japan, due to its high-growth business model and undervalued market position.

While the company presents significant upside potential, investors should remain cautious, as its strategic share sale to Japanese investors has been delayed due to Sri Lanka’s ongoing debt default situation. Moreover, some Japanese shareholders involved have previously been linked to unethical business practices in Sri Lanka, adding an element of risk.

Valuation and Strategic Share Sale to Japanese Investors

The valuation of Hunas Holdings PLC was conducted by KPMG on behalf of the TAD Group, which previously transferred assets to the company. The valuation estimated the enterprise value at LKR 124.5 billion (USD 341.2 million), with a fair value per share of LKR 147.56—significantly higher than its market price of LKR 25.00 as of February 6, 2025.

Proposed Strategic Share Sale

- Hunas Holdings is expected to settle the asset transfer value through the proposed sale of a strategic shareholding to Japanese investors via a Special Purpose Vehicle (SPV) formed in Japan.

- However, due to Sri Lanka’s debt default crisis, the transaction has been delayed, affecting cash flows and investor sentiment.

- It is likely that Japanese investors will soon execute a trade on the Colombo Stock Exchange (CSE), purchasing shares directly from TAD Group at a price closer to the KPMG valuation.

- Despite optimism, some Japanese shareholders involved have previously been linked to unethical business dealings in Sri Lanka, raising corporate governance concerns.

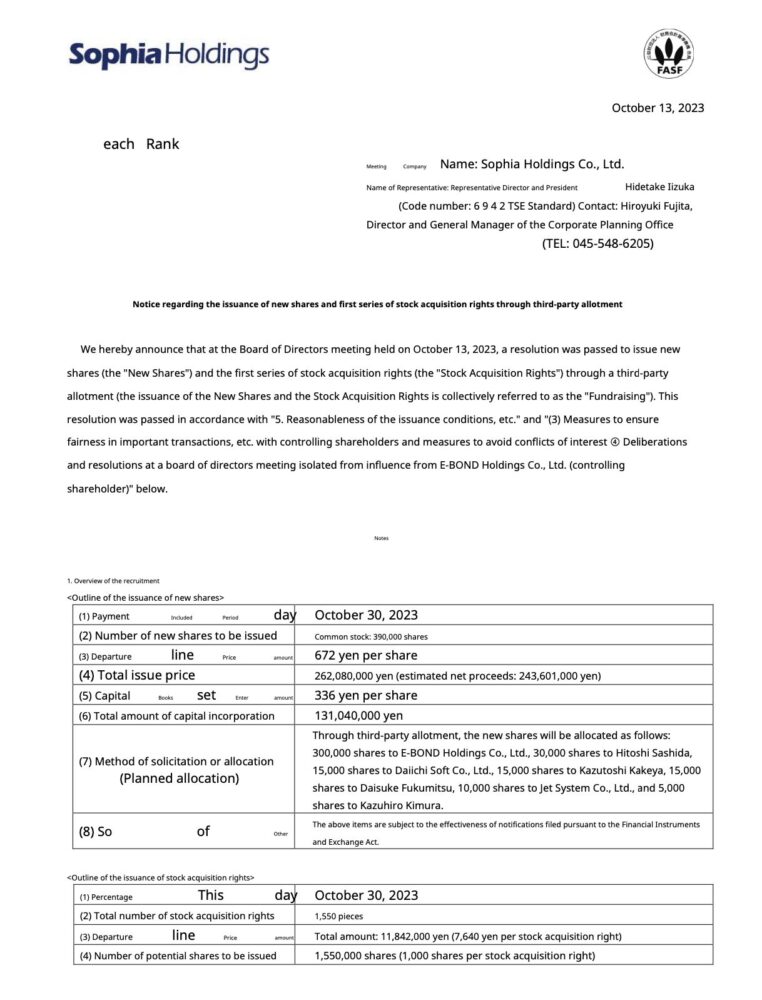

New Japanese Investments and Fundraising

Latest information reveal that Sophia Holdings Co., Ltd., a Japanese investment group, has been involved in a major stock issuance and stock acquisition rights allotment through third-party placements. The issuance was designed to raise funds for strategic investments, including potential expansions into Sri Lankan resort and real estate developments in collaboration with Hunas Holdings.

The Japanese fundraising strategy outlines:

- New share issuance of 390,000 common shares at 672 yen per share.

- Total raised funds of approximately 1.3 billion yen through stock acquisition rights and share placements.

- The use of funds for expanding into foreign recruitment, resort development, and digital infrastructure projects in Sri Lanka.

This reinforces Hunas Holdings’ attractiveness as a foreign investment target, while also raising questions regarding governance, ethical business practices, and potential risks for local stakeholders.

Financial Performance & Valuation Summary

| Business Segment | Valuation (LKR Mn) | Contribution (%) |

|---|---|---|

| Hunas Falls Villa Management (HFVM) | 55,300 | 44.4% |

| Hunas Property Developers (HPD) | 38,500 | 30.9% |

| Hunas Falls Hotel (HFH) | 18,700 | 15.0% |

| Renewable Energy Assets | 7,800 | 6.3% |

| Tea & Agricultural Assets | 4,200 | 3.4% |

| Total Enterprise Value | 124,500 | 100.0% |

The company’s dominance in hospitality and real estate, with HFVM and HPD contributing over 75% of total value, positions it as a key player in Sri Lanka’s luxury tourism and property sector.

Strategic Growth Initiatives

1. Luxury Villa Development (HPD)

- 100 high-end villas on 80 acres of freehold land.

- Expected revenue: LKR 27.3 billion (USD 74.7 million).

- Villas are sold to foreign investors (mostly in USD), reducing currency risk.

- Leaseback model via HFVM ensures consistent revenue.

2. Hospitality Expansion

- Renovation of the 31-room Hunas Falls Hotel (HFH) into a luxury tourism destination.

- Partnership with luxury hotelier Adrian Zecha to rebrand the property.

- Eco-tourism and adventure travel packages to attract premium travelers.

- Expected revenue from hospitality: LKR 18.7 billion (USD 51.9 million).

3. Renewable Energy Investments

- Mini hydro power plants at Eratne, Kuruganaga, Weswin, and Amunumulla.

- A new 3MW hydro plant strengthens the group’s sustainability strategy.

- Expansion into solar and wind energy in alignment with Sri Lanka’s renewable energy goals.

- Revenue from renewable energy: LKR 7.8 billion (USD 21.7 million).

4. Tea Plantation & Agricultural Expansion

- Tea production increased 24% YoY to 720,000 kg.

- Investments in automation and sustainable farming to boost productivity.

- Expected revenue from tea & agriculture: LKR 4.2 billion (USD 11.7 million).

Projected Future Earnings

| Segment | Projected Revenue (LKR Mn) | Projected Profit (LKR Mn) | Profit Margin (%) |

|---|---|---|---|

| Luxury Villa Development (HPD) | 27,300 | 12,285 | 45% |

| Hunas Falls Villa Management (HFVM) | 64,300 | 35,365 | 55% |

| Hunas Falls Hotel (HFH) | 18,700 | 6,545 | 35% |

| Renewable Energy Assets | 7,800 | 4,680 | 60% |

| Tea & Agricultural Assets | 4,200 | 1,260 | 30% |

| Total | 122,300 | 60,135 | ~48% (Weighted Avg.) |

Investment Outlook: A High-Growth Opportunity with Risks

✔ Significant Upside Potential: Fair value of LKR 147.56 per share vs. market price of LKR 25.00.

✔ Foreign Investment Interest: Potential Japanese investor buy-in could boost valuations.

✔ Resilient Business Model: Strong luxury hospitality and renewable energy sectors.

✔ Sustainable Growth Strategy: Expansion in real estate, eco-tourism, and agriculture.

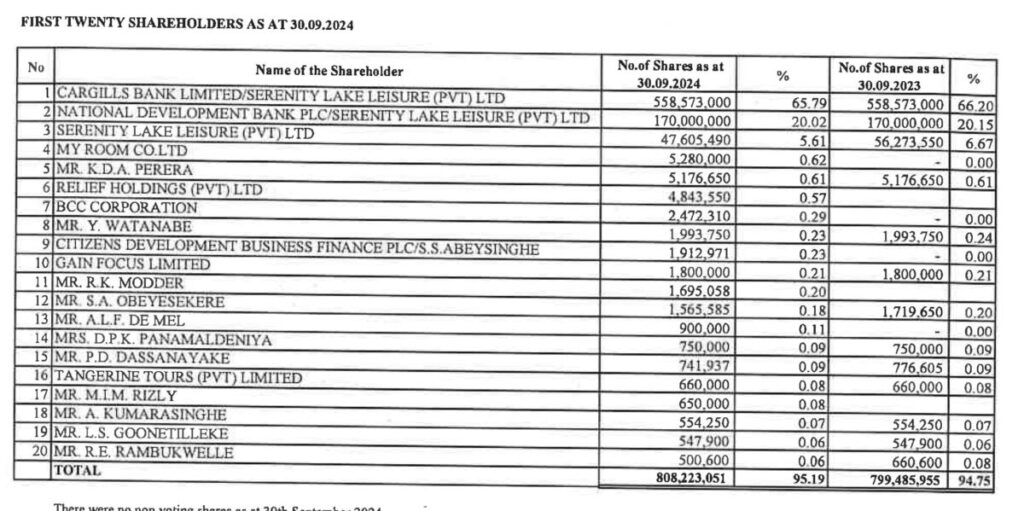

Top 20 Shareholders

Hunas Holdings PLC is undeniably one of Sri Lanka’s rising diversified conglomerates, attracting strong foreign interest while also facing governance risks. If strategic investors execute their trade at fair value, the company’s stock price could surge, benefiting long-term investors. However, the ongoing delays and ethical concerns surrounding certain investors mean that stakeholders should remain vigilant.

The next few months will be crucial in determining whether Hunas Holdings becomes a true market leader—or faces turbulence from delayed investments and governance risks.

Download Report