Colombo, February 15, 2025 (LankaBIZ)– Hayleys PLC, one of Sri Lanka’s largest diversified conglomerates, has reported an impressive financial performance for the nine months ended December 31, 2024, driven by strong revenue growth, operational efficiencies, and strategic cost management.

Robust Revenue Growth and Profitability

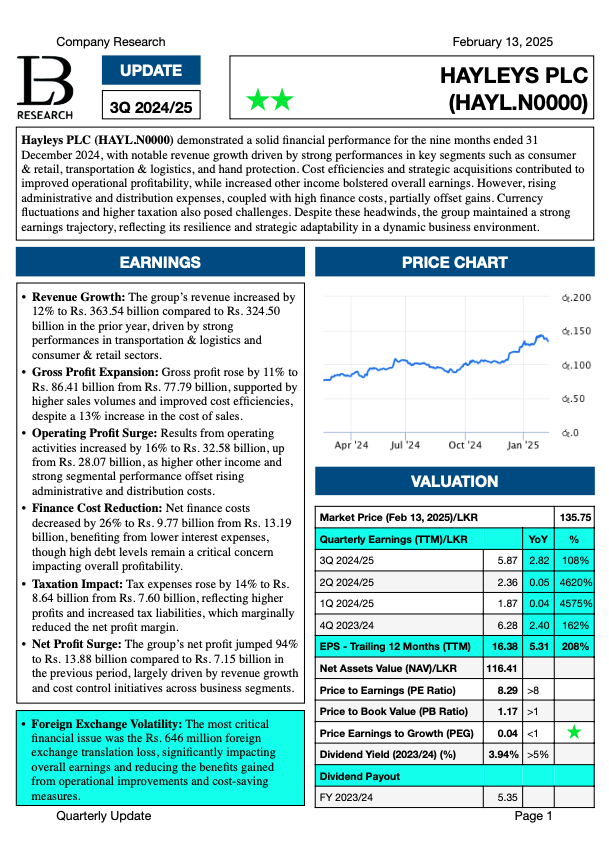

The group’s revenue increased by 12% to Rs. 363.54 billion, compared to Rs. 324.50 billion in the prior year. This growth was largely fueled by strong performances in the transportation & logistics and consumer & retail segments.

Gross profit saw an 11% increase to Rs. 86.41 billion, supported by higher sales volumes and improved cost efficiencies, despite a 13% rise in cost of sales. Operating profit surged 16% to Rs. 32.58 billion, as increased income and segmental performance offset rising administrative and distribution expenses.

Additionally, the sharp rise in other income, particularly the 423% increase in the third quarter of FY 2024/25, raises concerns about the sustainability of future earnings. The surge in other income to Rs. 3,888.1 million for the nine months and Rs. 2,678.7 million for the quarter appears to be driven by one-off gains, which are non-recurring in nature. This raises the risk that Hayleys PLC’s profitability could decline in subsequent periods if core operating performance does not improve or if similar non-operating gains are not realized.

The company’s dependence on this other income to support operating profit is notable, with it contributing 12% of operating profit for the nine months and 20% for the quarter. Without this, the operating profit growth of 16% (nine months) and 20% (quarter) would have been considerably lower, especially given rising distribution (+18% YoY) and administrative (+7% YoY) expenses. Therefore, future earnings growth may be difficult to sustain unless Hayleys PLC can drive improvements in core business segments or reduce operating costs. Investors should closely monitor recurring revenue streams and core segment performance in upcoming quarters to assess earnings quality and sustainability.

One of the standout achievements was a 94% rise in net profit, reaching Rs. 13.88 billion, compared to Rs. 7.15 billion in the previous period. This was primarily due to revenue growth, stringent cost-control measures, and the surge in Other Income.

Financial Position and Market Performance

Hayleys PLC also benefited from a 26% reduction in net finance costs, bringing it down to Rs. 9.77 billion. This was mainly due to lower interest expenses, although high debt levels continue to pose challenges.

However, the company reported a Rs. 646 million foreign exchange translation loss, affecting its overall net earnings. Additionally, tax expenses rose by 14% to Rs. 8.64 billion, reflecting increased profitability and higher tax liabilities.

Hayleys’ share price demonstrated strong momentum, closing at Rs. 135.75 per share as of February 13, 2025. The company’s valuation projections suggest a potential share price increase to Rs. 157.28 in a bullish scenario, while a bearish outlook estimates a possible decline to Rs. 98.28 per share.

Segmental Highlights

- Transportation & Logistics: Revenue surged 23% to Rs. 80.78 billion, driven by increased trade volumes and regional logistics expansion.

- Consumer & Retail: Revenue grew 28% to Rs. 78.85 billion, fueled by strong consumer demand and a diversified product portfolio.

- Hand Protection: Revenue rose 7% to Rs. 35.29 billion, supported by stable global demand for gloves.

- Textiles: Revenue declined 12% to Rs. 35.31 billion, impacted by reduced export orders.

- Projects & Engineering: Revenue skyrocketed 87% to Rs. 18.15 billion, backed by new infrastructure contracts.

- Leisure: Revenue climbed 13% to Rs. 7.40 billion, as the tourism industry continued its recovery.

Future Outlook

Despite market challenges such as currency volatility, inflationary pressures, and high debt levels, Hayleys remains optimistic about future growth. The company is focusing on cost efficiency, strategic expansions, and digital transformation initiatives to strengthen its market position.

With a debt-to-equity ratio of 2.77x, managing financial leverage will be crucial in maintaining liquidity. However, positive investor sentiment and a strong earnings trajectory suggest Hayleys PLC is well-positioned for sustained growth in 2025.