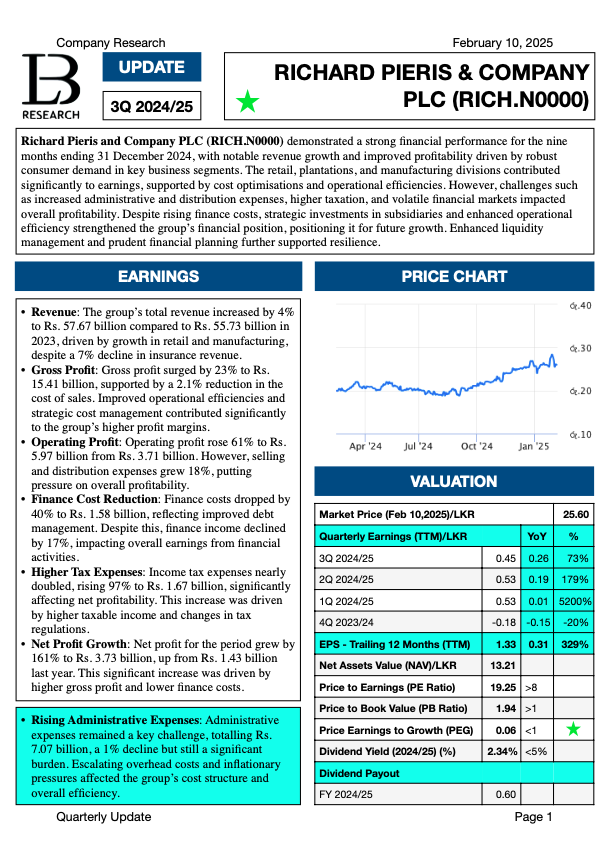

Colombo, February 15, 2025 – Richard Pieris and Company PLC (RICH.N0000) has posted an impressive financial performance for the nine months ending December 31, 2024, with a 161% increase in net profit, reaching Rs. 3.73 billion, compared to Rs. 1.43 billion in the previous year.

Revenue and Profitability on the Rise

The group’s total revenue rose by 4% to Rs. 57.67 billion, primarily driven by strong retail and manufacturing sector performance, despite a 7% decline in insurance revenue. The company also recorded a 23% surge in gross profit to Rs. 15.41 billion, aided by a 2.1% reduction in the cost of sales.

Operating profit saw a significant jump of 61% to Rs. 5.97 billion, with improved operational efficiencies and strategic cost management playing a key role. However, selling and distribution expenses increased by 18%, exerting some pressure on overall margins.

Finance Costs Decline, but Taxation Nearly Doubles

A 40% reduction in finance costs to Rs. 1.58 billion helped strengthen the group’s financial standing. However, income tax expenses surged by 97%, reaching Rs. 1.67 billion due to higher taxable income and regulatory changes.

Sectoral Performance Highlights

- Retail revenue remained stable at Rs. 26.96 billion, though inflationary pressures impacted overall sales growth.

- Plantations grew by 3%, reaching Rs. 12.05 billion, driven by higher yields and improved commodity prices.

- Plastic, Furniture & Electronics saw strong growth of 34%, reaching Rs. 8.85 billion.

- Tyres and Rubber segments showed stability, with revenue at Rs. 4.47 billion and Rs. 5.99 billion, respectively.

- Financial Services saw a 2% decline in revenue to Rs. 3.34 billion, mainly due to lower investment income.

Future Outlook and Challenges

Despite economic uncertainties, the company remains optimistic about growth, focusing on digital transformation, supply chain efficiency, and cost optimization. However, challenges such as rising taxation, inflation, and high short-term borrowings continue to pose financial risks.

Richard Pieris & Company’s stock price has risen to Rs. 25.60, reflecting strong investor confidence. With continued expansion in key business areas and a focus on strategic investments, the company is well-positioned for sustainable long-term growth

Download Research Report