Colombo, April 6, 2025 (LankaBIZ) — The ripple effects of the United States’ sweeping reciprocal tariffs are beginning to reach Sri Lanka, as export-reliant industries feel the pressure from global trade realignments. Although Sri Lanka was not directly targeted by the policy, analysts warn that the island nation’s key sectors — especially apparel and manufacturing — face rising costs, weakening competitiveness, and long-term sustainability concerns.

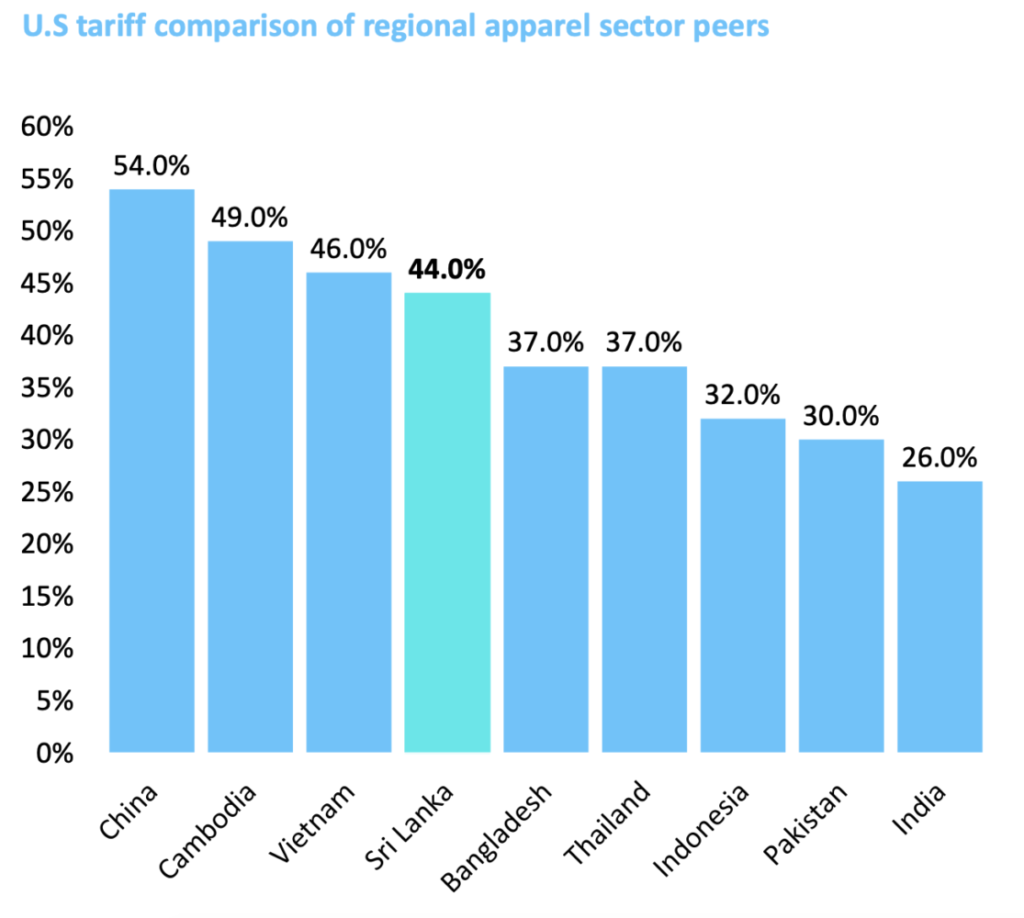

US President Donald Trump has issued an executive order imposing a 44 percent tariff on Sri Lankan goods, citing it as a reciprocal measure to what he described as the 88 percent in taxes and trade barriers imposed by Sri Lanka on the United States.

“The U.S. is Sri Lanka’s single largest export market. Any disruption in that corridor affects thousands of jobs and millions in revenue,” said an official at the Export Development Board.

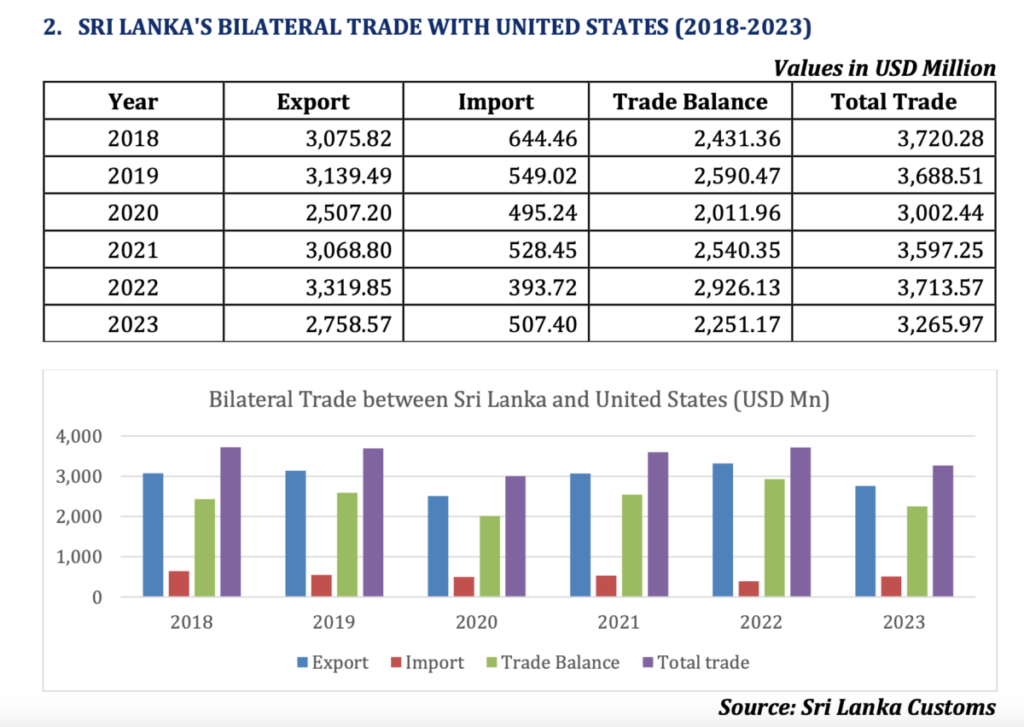

U.S. total goods trade with Sri Lanka were an estimated $3.4 billion in 2024. U.S. goods exports to Sri Lanka in 2024 were $368.2 million, up 4.9 percent ($17.1 million) from 2023. U.S. goods imports from Sri Lanka totaled $3.0 billion in 2024, up 6.1 percent ($173.5 million) from 2023. The U.S. goods trade deficit with Sri Lanka was $2.6 billion in 2024, a 6.3 percent increase

($156.4 million) over 2023.

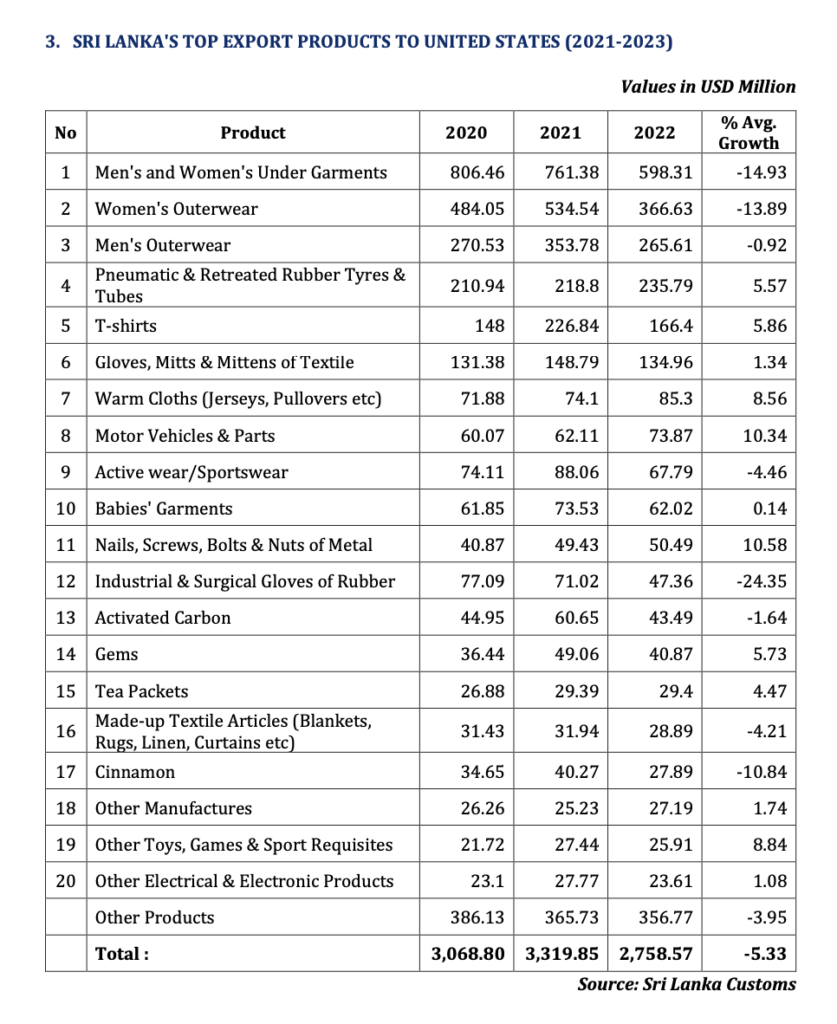

Textiles and Apparel Hit Hardest

The apparel sector, which accounts for over 45% of Sri Lanka’s exports, is already feeling the heat. Many factories rely on imported inputs — often from countries now subject to U.S. tariffs — which has pushed up production costs. With U.S. buyers tightening their margins, Sri Lankan garments are now facing stiff competition from producers in countries with more favorable trade agreements with Washington.

Nearly 40.0% of apparel earnings come from the U.S., and the new tariffs may lead to a decrease in revenue due to reduced orders. The reciprocal tariffs raise the cost of Sri Lankan goods entering the U.S., potentially dampening demand from price-sensitive American buyers and impacting manufacturing volumes. While other Asian countries like India, Bangladesh and Indonesia also face U.S. tariffs, Sri Lanka’s higher rate puts the island at a competitive disadvantage.

Rubber, Seafood, and Logistics Also Affected

Industries producing rubber goods, seafood, and packaging materials have also reported higher input prices and logistical challenges, as global shipping routes shift and trade volumes decline.

“We’re not just exporting goods — we’re part of a network. When the U.S. taxes our suppliers, that cost eventually lands on us,” said a logistics manager at the Colombo Port.

Even the port’s role as a transshipment hub has seen a dip in throughput due to broader disruptions in Asia-U.S. trade.

Economic Sustainability at Risk

The U.S. tariff hike on Sri Lankan apparel — reportedly reaching as high as 44% — poses a serious threat to employment in the country’s largest export-driven industry. With the United States accounting for more than half of Sri Lanka’s apparel exports, this steep tax severely undermines the sector’s competitiveness. In contrast, major apparel-exporting nations like India face comparatively lower U.S. tariff rates, prompting global manufacturers and buyers to reconsider their sourcing strategies. As a result, there is growing concern that apparel manufacturers may shift operations to more tax-effective destinations. Such a relocation would not only reduce export revenue but could also lead to significant job losses in Sri Lanka, particularly in regions heavily dependent on garment factories for livelihoods — exacerbating existing economic vulnerabilities and raising the risk of social instability.

Economists warn that the combined impact of slowing exports, rising input costs, and reduced investor confidence could threaten Sri Lanka’s fragile economic recovery.

There are calls for stronger trade negotiations, especially to restore access to programs like the U.S. Generalized System of Preferences (GSP), which had once allowed Sri Lankan goods to enter the U.S. duty-free.

What’s Next?

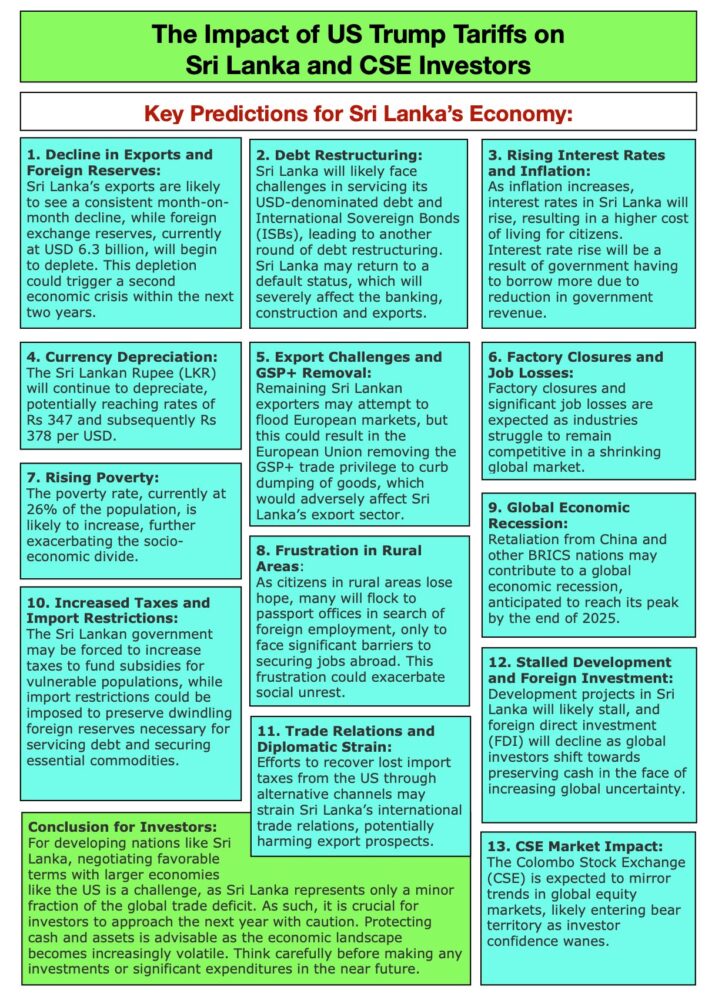

Key Predictions

Sri Lanka Faces Economic Turmoil Amid Global Trade Tensions

Sri Lanka is bracing for a potential second economic crisis as ripple effects from the US-imposed Trump-era tariffs begin to unfold. With exports on a consistent month-on-month decline and foreign reserves already down to USD 6.3 billion, the country may face mounting pressure in servicing its dollar-denominated debt. Experts warn of a likely return to default status, which could devastate key sectors like banking, construction, and exports. Simultaneously, rising inflation and interest rates, driven by falling government revenues and increased borrowing, are pushing the cost of living ever higher for citizens.

Social Strain Grows as Currency Falls and Jobs Vanish

The economic challenges are compounded by a weakening Sri Lankan Rupee, expected to fall as low as Rs 378 per USD, and fears over the possible removal of the EU’s GSP+ trade privileges. This, coupled with rising factory closures and job losses, is fuelling social unrest, particularly in rural areas. Many are turning to foreign employment as an escape, only to face limited opportunities abroad. With poverty on the rise—currently at 26%—and the Colombo Stock Exchange predicted to mirror global bear trends, investors are urged to act cautiously. Policymakers may be forced to increase taxes and enforce import restrictions, further stalling development and deterring foreign investment.

Policymakers are expected to unveil a response strategy later this month, potentially including incentives for exporters, support for innovation, and steps to reduce dependence on the U.S. market.

As the global trade environment continues to shift, Sri Lanka finds itself at a crossroads — with the challenge of turning disruption into opportunity, or risking deeper economic vulnerability.