What if? Sri Lanka adopts Trump Style Reciprocal Tax (Case Study)

The core objective of the Trump Tariff policy was to correct unfair trade imbalances by introducing reciprocal tariffs on countries that imposed high duties on U.S. exports. The approach was rooted in the belief that if a trading partner levies, for example, a 25% tariff on American goods, the U.S. should respond with a similar tariff on that country’s exports. This strategy aimed to protect domestic industries, reduce trade deficits, and pressurize countries into negotiating more favorable trade terms for the U.S.

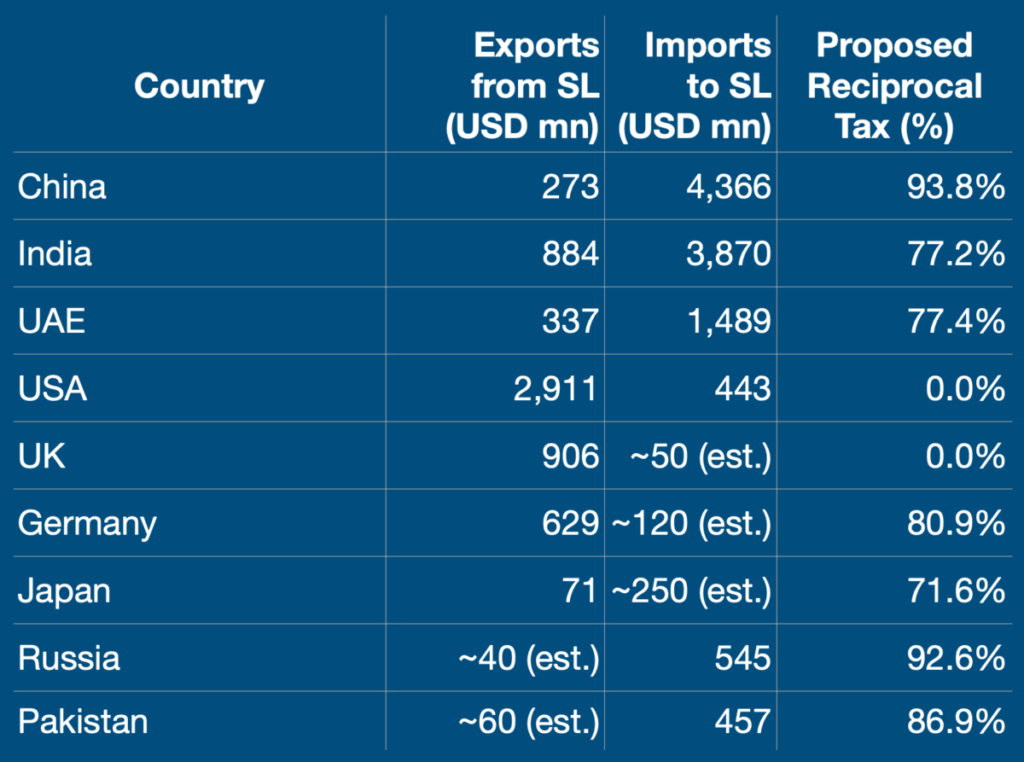

If Sri Lanka were to adopt a similar reciprocal tariff strategy, it could, in theory, help reduce its persistent trade deficits, particularly with countries like China, India, and the UAE, where imports heavily outweigh exports. By imposing higher tariffs on imports from such countries, Sri Lanka could encourage domestic production, protect local industries, and possibly increase government revenue through import duties.

However, there are significant reasons why Sri Lanka should not fully adopt the Trump-style tariff model. First, Sri Lanka is a small, import-dependent, open economy that relies heavily on global supply chains, particularly for fuel, machinery, raw materials, and consumer goods. Aggressive tariffs could increase the cost of living, raise production costs, and trigger retaliation, damaging critical export markets.

Moreover, such a strategy could breach WTO commitments, undermine existing free trade agreements (like ISFTA and PSFTA), and disrupt investor confidence, all of which are crucial at a time when Sri Lanka is rebuilding its economy post-crisis. Instead of unilateral tariffs, Sri Lanka should pursue balanced trade reforms, diversify export markets, and invest in strengthening competitiveness to sustainably improve its external sector.

Download Report