Colombo, June 17, 2025 — The Colombo Stock Exchange (CSE) faces rising uncertainty as escalating geopolitical tensions in the Middle East — particularly between Iran and Israel — cast a shadow over global markets. Analysts warn that any further deterioration, including a potential closure of the strategic Strait of Hormuz or direct U.S. military involvement, could send the All Share Price Index (ASPI) into a sharp correction after months of steady recovery.

The ASPI, which recently reached a high of 17,400, may see a pullback ranging from 2% to over 30%, depending on how the situation evolves. The Strait of Hormuz is a vital passageway for nearly 20% of the world’s oil supply, and any blockade or attack could cause a global energy shock, triggering surges in oil prices and inflation in net oil-importing countries like Sri Lanka.

“The Colombo Stock Exchange is extremely sensitive to oil-driven shocks, especially amid its fragile recovery under the IMF programme,” said a senior market strategist at Frontier Capital Partners. “If oil jumps to USD 140 or above, the currency will come under pressure, inflation will spike, and investor sentiment could collapse.”

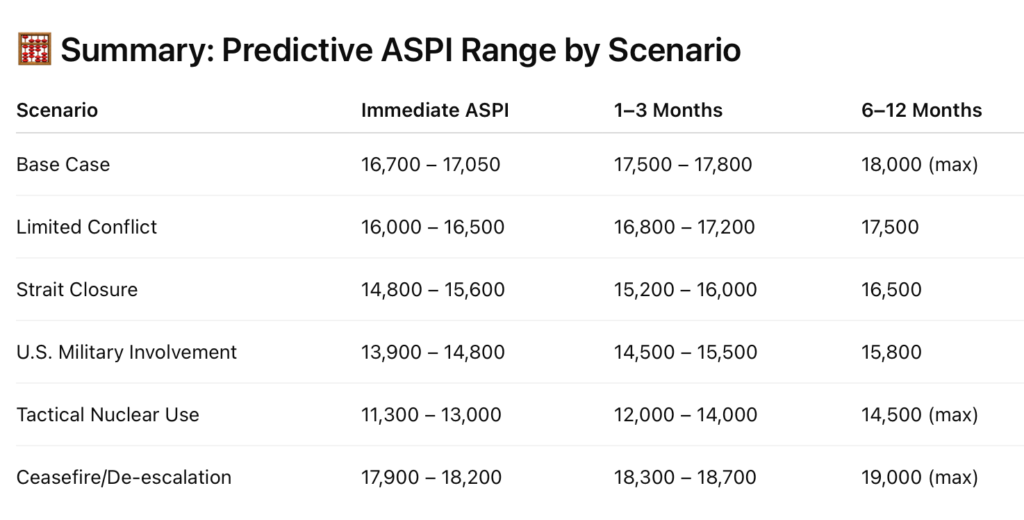

Scenario Forecasts:

- In the case of a limited conflict, ASPI is expected to fall to 16,000–16,500.

- A closure of the Strait of Hormuz could push the index as low as 14,800.

- If the U.S. enters the conflict militarily, the index could slide to 13,900 or lower.

- In a worst-case scenario involving the use of tactical nuclear weapons, the ASPI could crash to levels not seen since the 2022 crisis — potentially as low as 11,300.

However, not all outlooks are grim. Should diplomacy prevail, with a ceasefire or international mediation, markets could see a relief rally, pushing the ASPI past 18,000, analysts predict.

Sectoral Implications:

- Highly vulnerable sectors: Transport, Construction, and Energy-intensive manufacturing.

- Moderately affected: Banking and Tourism.

- Resilient sectors: FMCG, Telecommunications, and select Exporters.

Investors are urged to monitor developments closely, particularly oil price movements, global capital flows, and the government’s macroeconomic response. Market watchers believe that Sri Lanka’s external vulnerabilities and reliance on imported energy could amplify the spillover effects from any regional military conflict in the Middle East.