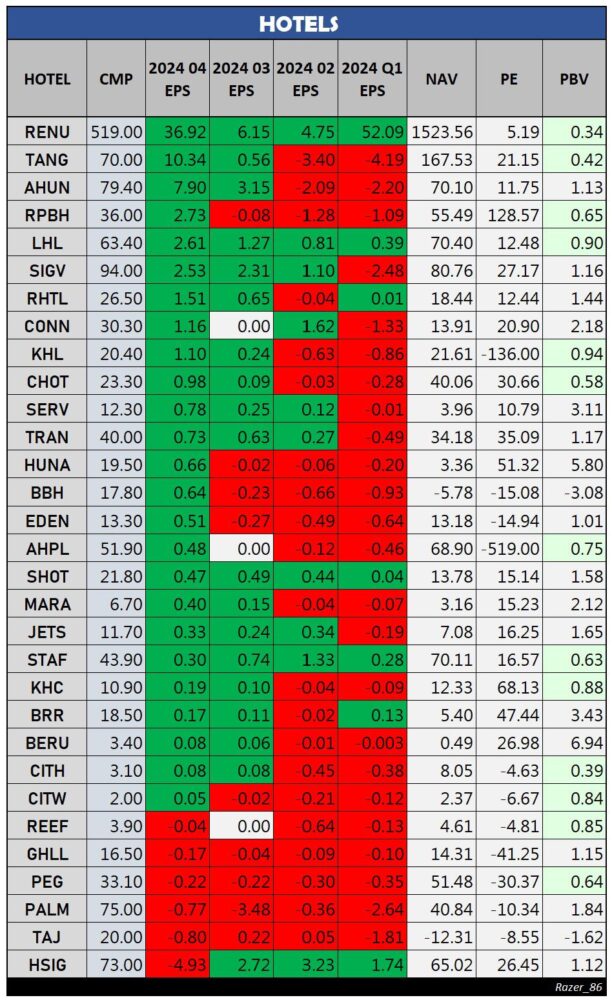

The hotel sector performance provides a comparative snapshot of 32 listed hotel companies based on their earnings per share (EPS) for the four quarters of FY2024, alongside valuation indicators such as Net Asset Value (NAV), Price to Earnings (PE), and Price to Book Value (PBV) ratios. This data allows for a comprehensive analysis of profitability trends, valuation positioning, and market sentiment across the sector.

Earnings Momentum and Profitability:

RENU (Renuka Hotels) stands out prominently with strong and consistent profitability across all quarters, culminating in an exceptional Q1 EPS of Rs. 52.09 and a trailing twelve-month EPS of Rs. 108.99, indicating substantial recovery or exceptional gains. TANG and AHUN also posted notable gains in Q4, with EPS of Rs. 10.34 and Rs. 7.90 respectively, reflecting either operational improvements or seasonal upticks. In contrast, HSIG recorded a sharp decline in Q4 with a negative EPS of Rs. -4.93 after three strong quarters, suggesting a one-off impact or cost pressure. Other perennial underperformers include PALM and TAJ, which posted negative EPS figures across most quarters, indicating structural challenges.

Valuation Perspective:

Despite strong earnings, RENU trades at a low PE of 5.19 and a PBV of only 0.34, suggesting deep value and potential undervaluation if earnings are sustainable. In contrast, speculative valuations are evident in counters like RPBH and SIGV, which trade at sky-high PE ratios of 128.57 and 27.17 respectively, despite modest EPS levels. KHL and AHPL exhibit highly negative PE due to prior losses, while CHOT, JETS, and STAF maintain relatively balanced PE and PBV ratios, reflecting moderate investor confidence.

NAV and PBV Indicators:

NAVs range widely, with RENU again leading at Rs. 1,523.56, reinforcing its asset-rich profile. Companies like RHTL, SERV, and CITH have very low NAVs, yet their PBV multiples are elevated, hinting at speculative interest or anticipated turnarounds. The highest PBVs are seen in REEF (3.11), BRR (3.43), and HUNA (5.80), which may not be supported by fundamentals and thus could be vulnerable to corrections if earnings don’t catch up.

Overall Sector Insight:

The sector appears bifurcated between asset-rich undervalued plays (e.g., RENU, AHPL, CONN) and low-cap speculative counters with inconsistent earnings but high trading multiples (e.g., RPBH, SIGV, BRR). Many players are still recovering from pandemic-era disruptions, with improving quarterly trends indicating potential for recovery in the medium term. However, persistent losses in companies like PALM, TAJ, and GHLL suggest deep-seated challenges, possibly due to high debt, poor occupancy, or management inefficiencies.

Outlook:

As tourism inflows stabilize and foreign arrivals pick up, a gradual improvement across the board is anticipated, but stock selection must be earnings-backed. Value plays like RENU, STAF, and CONN offer better margin of safety, while speculative names require caution. Investors should closely monitor Q1 FY2025 results for consistency in earnings momentum to validate current valuations.