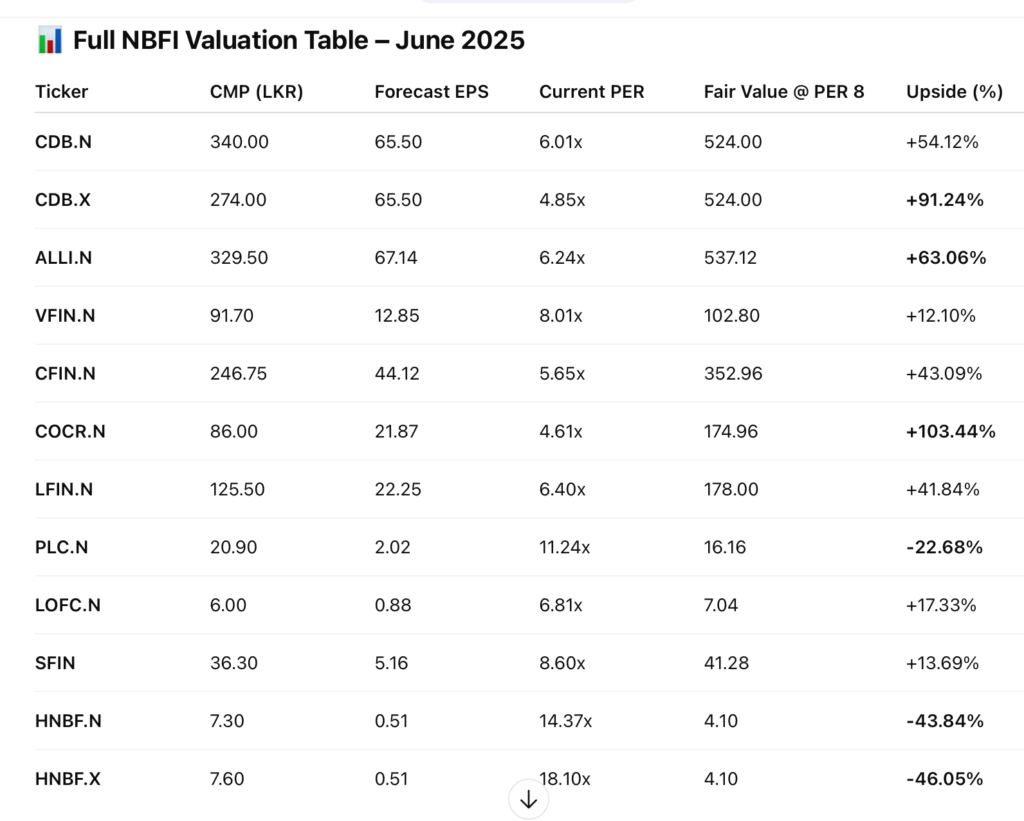

Colombo, June 29 – A fresh analysis of the Non-Banking Financial Institutions (NBFI) sector reveals significant undervaluation in several leading finance counters, with strong upside potential based on forecast earnings and fair value estimates. According to data compiled as at June 26, 2025, stocks such as CDB.X, ALLI.N, CDB.N, and CFIN.N present compelling investment opportunities for medium-term investors.

However, despite these upside opportunities, the sector is not without its inherent structural risks. A key concern is the high and persistent level of non-performing loans (NPLs) in many NBFIs, coupled with limited recovery mechanisms when compared to licensed commercial banks.

“Unlike banks, most NBFIs do not possess parate execution rights, which severely limits their ability to repossess assets and recover bad loans efficiently,” a senior credit risk analyst noted. “This means credit losses can remain unresolved for long periods, eroding profitability despite headline earnings looking strong.”

The analysis benchmarks current market prices (CMP) against forecast earnings per share (EPS) and derives fair value targets using a range of Price-to-Earnings Ratios (PER), commonly used in the market to assess valuation.

Among the top picks, Citizens Development Business Finance Voting shares (CDB.X) stand out with a current price of LKR 274.00 and a forward EPS of LKR 65.50, translating into a modest PER of 4.85x. Based on a conservative PER multiple of 8x, the fair value is estimated at LKR 524.00, offering a staggering 91% upside potential.

Alliance Finance Company PLC (ALLI.N) also features prominently, trading at LKR 329.50 with a forecast EPS of LKR 67.14. With a current PER of 6.24x, the stock remains significantly undervalued. The fair value at PER 8x stands at LKR 537.12, reflecting a 63% upside.

Meanwhile, Central Finance (CFIN.N) and Citizens Development Business Finance Non-Voting shares (CDB.N)present upside potentials of 43% and 54%, respectively. CFIN.N, in particular, is recognized for its steady performance and reliable fundamentals.

“These counters are trading well below their intrinsic value despite strong earnings forecasts. This dislocation presents an attractive opportunity for investors to enter at discounted prices,” said a market analyst reviewing the sector.

On the other hand, counters such as VFIN.N, LOFC.N, PLC.N, and HNBF.N/X appear fully valued or lack near-term earnings momentum, making them less attractive in the current environment.

Analysts warn that while PER-based valuation provides a snapshot of potential, investors should also consider sector risks such as tightening credit conditions and regulatory changes. Nevertheless, in a stable macro environment, the highlighted counters offer some of the best value propositions within the finance sector today.

Inherent Risks in the Sector

Despite the valuation upside, the NBFI sector faces serious challenges:

- High NPL Ratios: Many finance companies continue to report non-performing loan ratios above industry tolerance levels, reflecting underlying stress in their lending portfolios, especially in SME and vehicle leasing segments.

- No Parate Execution Rights: Unlike licensed commercial banks, most NBFIs lack the legal authority for parate execution, a legal mechanism that enables speedy recovery of collateralized loans without lengthy court proceedings. This results in prolonged litigation and diminished asset recovery, directly impacting liquidity and profitability.

- Macro Sensitivity: NBFIs are particularly sensitive to interest rate volatility and economic slowdowns. In periods of weak economic activity, their earnings and collections suffer more acutely compared to the banking sector.