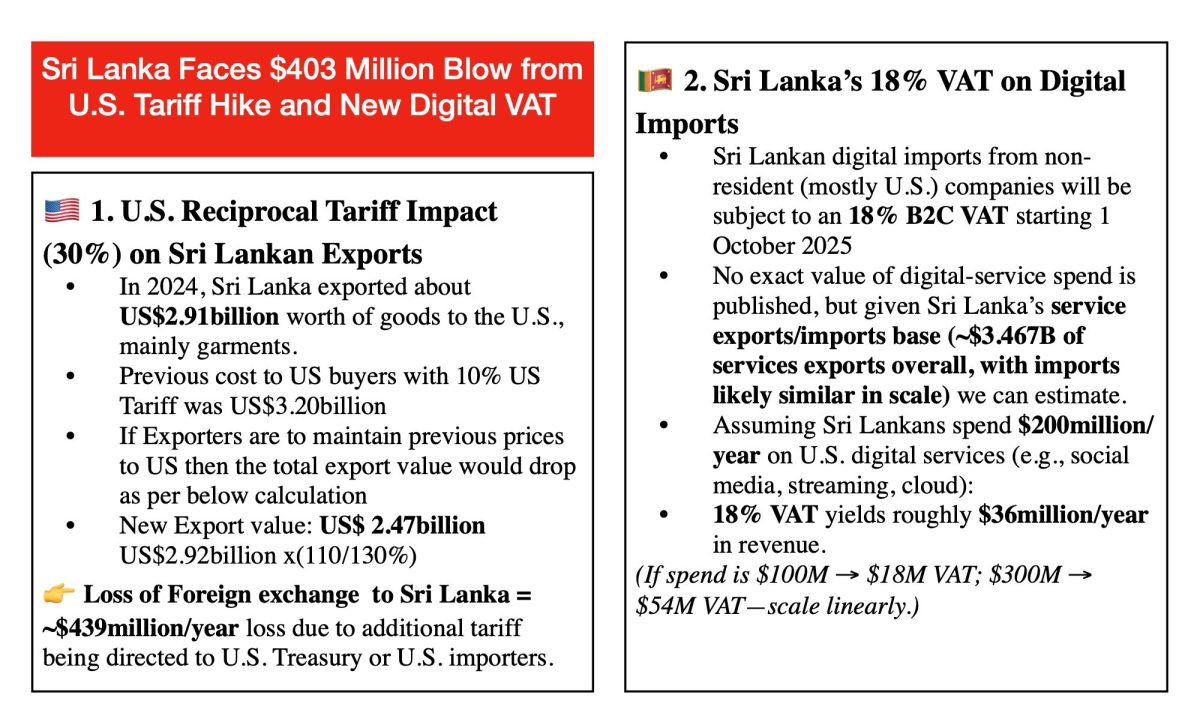

Colombo, July 12, 2025 – Sri Lanka is bracing for a significant hit to its foreign exchange earnings as the United States increases import tariffs on Sri Lankan goods from 10% to 30%, effective August 1, 2025. According to new estimates, the move will slash Sri Lanka’s net export earnings by approximately $439 million annually, assuming exporters absorb the higher tariff to maintain current U.S. price levels.

In 2024, Sri Lanka exported $2.91 billion worth of goods to the United States, primarily garments. Under the previous 10% tariff regime, the total cost to U.S. buyers was around $3.2 billion. However, to maintain the same final price point under the new 30% tariff, Sri Lanka’s export value would effectively drop to $2.47 billion a reduction of $439 million, representing lost foreign exchange earnings.

Digital VAT add fuel to current crisis

In an effort to recoup part of the fiscal damage, the Sri Lankan government will implement an 18% Value Added Tax (VAT) on digital services provided by non-resident companies (mainly U.S.-based) starting October 1, 2025. This VAT is projected to yield approximately $36 million annually, assuming Sri Lankans spend about $200 million on digital services such as cloud computing, streaming platforms, and software subscriptions.

The serious problem that arises when Sri Lanka imposes the new VAT taxes on the services rendered by US companies (Microsoft, Google, Netflix, ChatGPT, etc, from 01/10/2025 onwards, President Trump may consider those taxes as retaliatory taxes and impose an even bigger tariff than the currently imposed 30%.

Policy observers warn that Sri Lanka’s VAT move, while domestically justifiable, may provoke a harsh response from the Trump-led administration. During his previous term, Trump retaliated against similar digital service taxes introduced by France, India, and the UK, threatening tariffs and launching trade investigations.

“Sri Lanka is stepping into a minefield,” said a Washington-based trade analyst. “Trump’s team has made it clear any country that taxes U.S. companies could see trade punishment. Sri Lanka is already on his radar because of the textile trade imbalance. This VAT just adds fuel.”

In a recent rally, Trump reiterated his stance: “If any country taxes American companies unfairly, they’ll pay a price a big one. We’re done being taken advantage of.”

Net Fiscal Drain: $403 Million Per Year

The combined impact of the U.S. tariff hike and the new digital VAT results in a net annual foreign exchange loss of approximately $403 million. While the VAT introduces a new revenue stream for the government, it does little to offset the steep loss in export earnings.

| Component | Value (USD millions) |

|---|---|

| Loss from U.S. tariff increase | –439 |

| Revenue from digital services VAT | +36 |

| Net loss to Sri Lanka | –403 |

Policy Outlook

Sri Lanka is expected to seek urgent diplomatic negotiations with the U.S. to mitigate the tariff escalation before its enforcement. Simultaneously, local policymakers may explore VAT exemptions or incentives to encourage domestic digital consumption and investment in tech infrastructure.

As it stands, the net economic impact from these two policy shifts stands at a loss of roughly $403 million per year, intensifying the urgency for strategic economic planning and international trade reform.

Key Considerations

- These figures are projections based on estimated digital service imports the real VAT revenue depends on actual consumer usage.

- The garment trade downturn could spill over into job losses (~300,000 employed) and lower GDP growth, making the tariff hit even more painful

- Sri Lanka might seek:

- Negotiations to reduce the U.S. tariff before Aug 1.

- Policies to boost digital adoption (e.g. VAT exemptions) to maximize VAT returns) or to abolish VAT on import of digital services to negotiate better tariff with US.