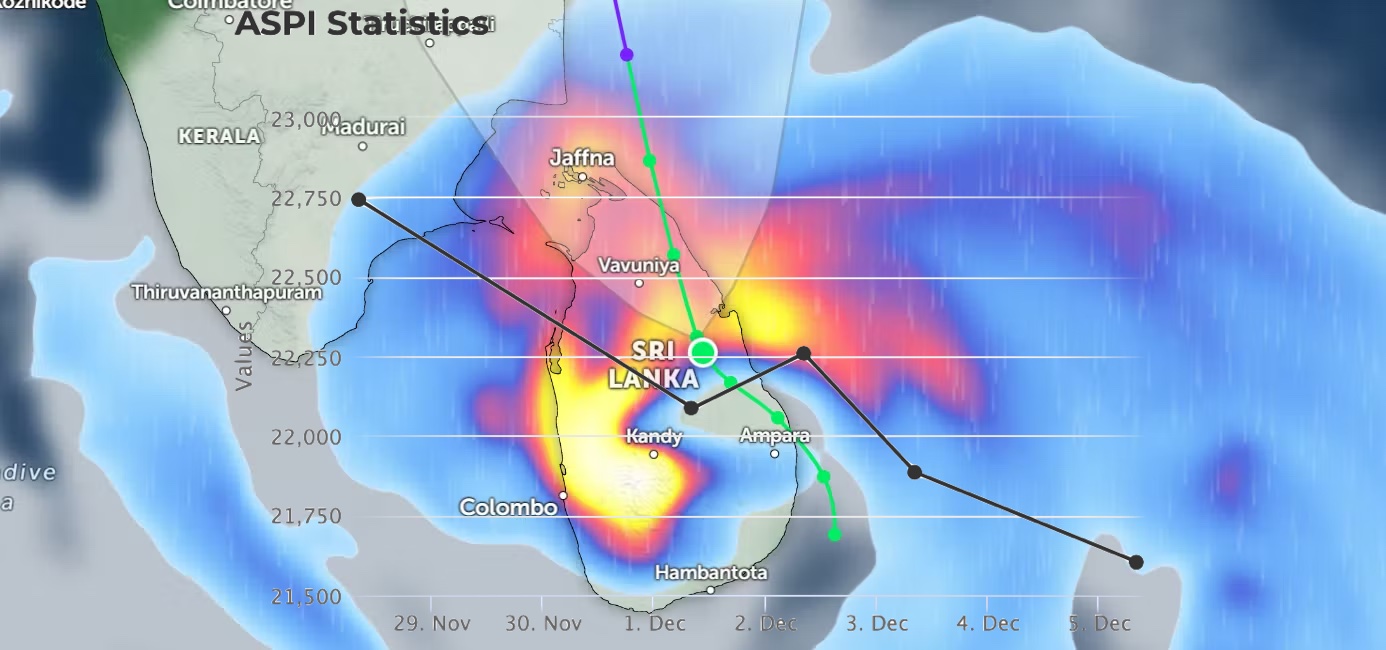

Sri Lanka’s corporate landscape is set to enter a period of sharply diverging performance as Cyclone Ditwah drives sector-specific disruptions and opportunities. While the disaster has triggered widespread flooding and damaged connectivity across all districts, its economic consequences are expected to produce clear winners and losers within equity markets over the coming year.

Insurance: Claims Surge Pressures Profitability

General insurers face one of the most immediate and severe hits, with flood-related property, motor and SME claims rising sharply. Although policy volumes are expected to expand in response to heightened risk awareness, short-term profitability will come under pressure as insurers contend with higher claims and elevated reinsurance costs. Companies with heavier exposure to SME and regional portfolios are likely to see the largest earnings strain.

Plantations: High-Grown Estates Hit Hard

Landslides, soil erosion and restricted access to transport routes have damaged tea estates concentrated in high-grown hill regions. Output is expected to fall noticeably in the coming quarters, tightening supply and pushing up prices. However, production shortfalls, quality deterioration and delayed replanting cycles will undermine earnings, particularly for companies with substantial exposure to upcountry estates.

Tourism: Recovery Slowed by Access Disruptions

Tourism operators located in the Central Province face booking cancellations and temporary loss of room capacity due to property damage. Even in regions without direct damage, road closures and logistics delays could weigh on occupancy. Forward bookings for 2026 remain largely intact, but revenue will depend heavily on how quickly affected properties and road networks can be restored.

Banks and NBFIs: Asset Quality Risks Increase

Banks and finance companies with larger SME portfolios and regional lending exposure are likely to face heightened defaults as households and businesses in flood-affected areas struggle to recover. Stage 3 loan migration is expected to rise, driving impairment charges higher. Relief measures such as moratoriums could soften the immediate deterioration, but overall credit growth is set to slow as institutions temporarily tighten lending standards.

Consumer & Retail: Higher Basket Sizes, Lower Frequency

Essential retail is expected to benefit from bulk purchasing during periods of disrupted mobility, supporting short-term revenue despite reduced store visits. However, spending on discretionary goods is likely to fall as households prioritize essentials amid income losses and higher food costs. Consumer staples with strong distribution networks are positioned to hold ground, while discretionary and FMCG subsegments may face a softer outlook.

Construction & Materials: Multi-Year Upside

Reconstruction of homes, bridges, roads and public infrastructure is set to drive sustained demand for cement, cables, aluminum products, pipes and engineering services. Contractors stand to benefit from a rising pipeline of repair and climate-resilience projects, while building materials producers may see volume recovery after an initial disruption caused by site closures during flooding.

Healthcare & Lubricants: Demand Strengthens

Hospitals and diagnostic centers are likely to see increased patient inflows due to injuries, infections and water-borne illnesses. Demand for pharmaceuticals, essential medicines and lab testing is expected to rise accordingly. Lubricant suppliers will see a sharp spike in volumes as flooded vehicles require urgent servicing, triggering increased purchases of engine and transmission oils.