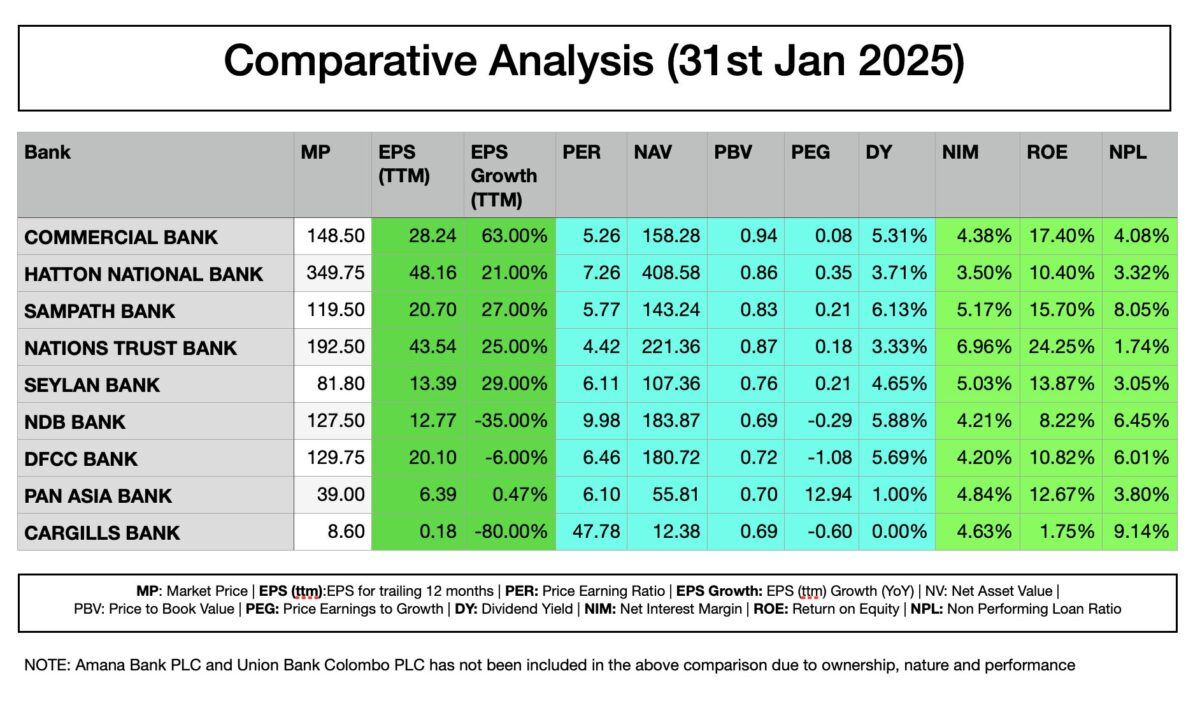

Based on the Comparative Analysis of the banking sector, investors should consider key financial metrics such as EPS growth, Price-to-Book Value (PBV), Return on Equity (ROE), and Net Interest Margin (NIM) before making investment decisions. Several banks present strong growth potential, while others carry higher risks or limited upside.

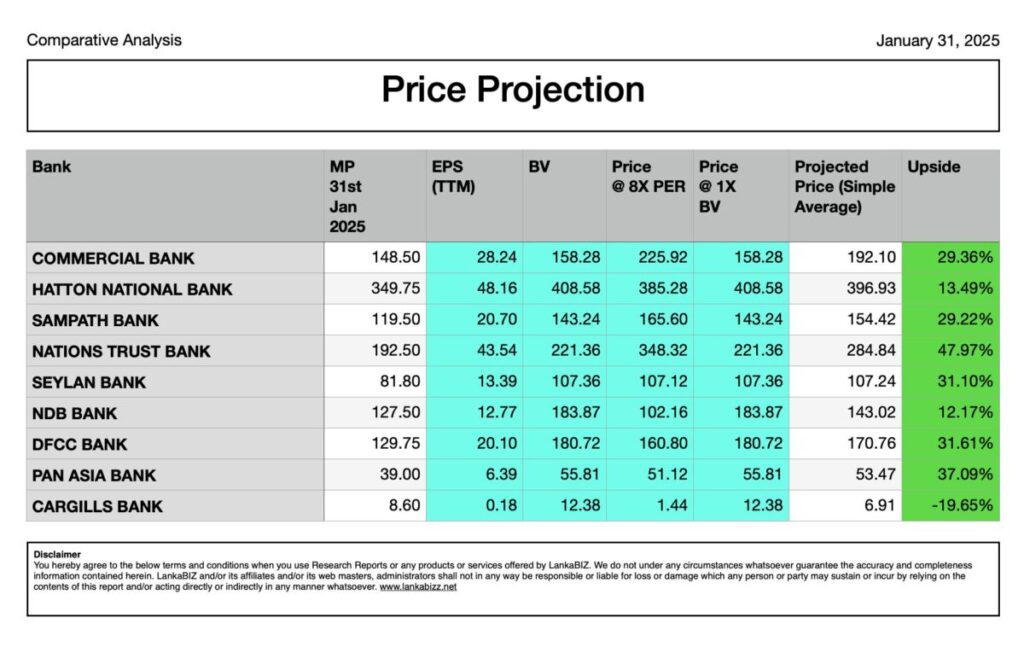

Among the top investment choices, Nations Trust Bank (NTB) stands out with the highest projected upside of 47.97%, supported by a 25% EPS growth, 24.25% ROE, and the lowest NPL ratio of 1.74%, making it a strong buy recommendation. Similarly, DFCC Bank is another attractive option, offering a 31.61% upside, undervalued PBV at 0.72, and moderate profitability, making it an ideal buy for long-term investors.

Sampath Bank and Commercial Bank also offer solid investment potential. Sampath Bank has a 27% EPS growth, 5.17% NIM, and a 29.22% upside, indicating strong profitability at an undervalued price. Meanwhile, Commercial Bank boasts the highest EPS growth (63%), 17.40% ROE, and a moderate risk profile, making it a stable long-term hold.

For more risk-tolerant investors, Pan Asia Bank could be a speculative buy, with a 37.09% projected upside and a low PBV of 0.70, despite its low EPS growth. However, banks like Cargills Bank and NDB Bank should be avoided due to negative EPS growth, weak profitability, and high risk. Hatton National Bank (HNB), while fundamentally strong, offers a limited upside of 13.49%, making it a hold rather than a buy.

In conclusion, Nations Trust Bank and DFCC Bank are the best picks for growth and value investors. Sampath Bank and Commercial Bank are solid long-term holdings, while Pan Asia Bank can be considered for speculative investment. Investors should avoid high-risk banks with declining earnings to ensure strong portfolio performance.