Tourism has long been a key pillar of Sri Lanka’s economy, contributing significantly to foreign exchange earnings and employment. Despite facing multiple disruptions—including the 2019 Easter Sunday attacks, the COVID-19 pandemic, and economic instability—the industry is experiencing a strong resurgence, with record-breaking arrivals and revenue growth in 2024.

Historical Tourism Revenue Trends

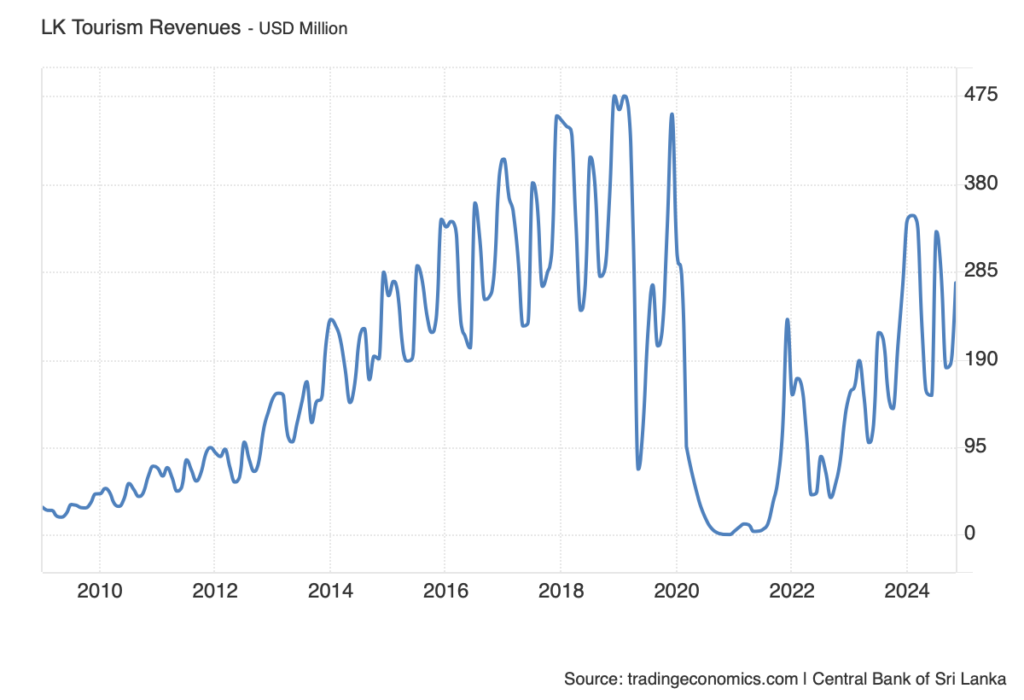

The chart below illustrates the fluctuations in Sri Lanka’s tourism revenue from 2010 to 2024, revealing key growth periods and challenges:

- 2010 – 2018: Steady Growth and Peak Years

- Tourism revenues followed a consistent upward trend, driven by increased visitor arrivals, improved infrastructure, and global recognition of Sri Lanka as a top destination.

- By 2018, monthly tourism earnings exceeded $450 million, marking the industry’s peak before disruptions.

- 2019 – 2021: Crisis and Collapse

- The Easter Sunday attacks in April 2019 caused a sharp drop in tourism revenue as security concerns led to travel advisories and cancellations.

- COVID-19 in 2020 devastated the sector, with revenues plunging close to zero for several months due to international travel restrictions.

- The industry remained dormant through most of 2021, only beginning a gradual recovery in late 2021 as restrictions eased.

- 2022 – 2024: Strong Recovery and Future Growth

- Tourism began bouncing back in 2022, with a steady increase in visitor arrivals and revenue.

- By 2023, revenues had climbed to $2.07 billion, and in 2024, they surged to $3.17 billion, reflecting a 38.07% year-on-year growth.

- Government initiatives, including a six-month visa-free program for travelers from 35 countries, have further accelerated the industry’s recovery.

Current Status of Sri Lanka’s Tourism Sector

As of 2024, Sri Lanka welcomed over 2.05 million tourists, with revenues reaching $3.17 billion. Several key factors have contributed to this resurgence:

- Visa-Free Entry Initiative: Introduced in October 2024, allowing free 30-day visas for visitors from the U.S., U.K., India, China, and 31 other countries.

- Improved Airline Connectivity: Major carriers have increased flight frequencies, making Sri Lanka more accessible.

- Diversification of Offerings: Growth in eco-tourism, wellness retreats, adventure travel, and digital nomad-friendly accommodations has expanded Sri Lanka’s appeal.

- Luxury and Mid-Range Hotel Expansion: Investments in new resorts and boutique hotels are enhancing the visitor experience.

Investment Opportunities in the Hotel Sector via the Stock Market

With the tourism sector’s resurgence, investors have a prime opportunity to capitalize on Sri Lanka’s hospitality industry through the Colombo Stock Exchange (CSE). Several publicly listed companies operate major hotel brands and resorts, offering lucrative investment prospects.

Top Hotel Stocks to Watch on the Colombo Stock Exchange (CSE)

- John Keells Holdings PLC (JKH.N0000)

- Operates Cinnamon Hotels & Resorts, one of Sri Lanka’s largest hotel chains.

- Strong presence in luxury and mid-range hotels across Sri Lanka and the Maldives.

- Diversified revenue streams, including port operations, consumer goods, and retail, provide financial stability.

- Aitken Spence PLC (SPEN.N0000)

- Owns and operates Heritance and Adaaran resorts in Sri Lanka and the Maldives.

- Strong focus on eco-friendly and luxury tourism.

- Benefits from investments in renewable energy, logistics, and port management.

- The Kingsbury PLC (SERV.N0000)

- A premier luxury hotel in Colombo, catering to business and high-end leisure travelers.

- Positioned for growth with Sri Lanka’s recovery in corporate and MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism.

- Ceylon Hotels Corporation PLC (CHOT.N0000)

- Operates a mix of heritage hotels, beach resorts, and city hotels.

- Focus on expanding mid-range and boutique hotel offerings.

- Benefiting from Sri Lanka’s rising domestic and international travel demand.

- Hunas Holdings PLC (HUNA.N0000)

- Specializes in boutique and nature tourism in scenic locations.

- Well-positioned in Sri Lanka’s growing eco-tourism and sustainability segment.

Why Invest in Sri Lanka’s Hospitality Sector?

- Post-Pandemic Tourism Surge: With revenge travel still driving demand, Sri Lanka is experiencing record-high visitor numbers.

- Undervalued Market: Many Sri Lankan hospitality stocks remain undervalued, presenting a great opportunity for long-term investors.

- Government Support: Policy initiatives, such as tax incentives and infrastructure development, support the sector’s expansion.

- Foreign Investment Interest: The tourism rebound is attracting international hotel brands and foreign investors, further boosting sector growth.

Future Growth and Strategic Outlook

The Sri Lanka Tourism Development Authority (SLTDA) has set ambitious targets:

- 3 million tourist arrivals and $5 billion in revenue by the end of 2025.

- 5+ million tourists annually and earnings between $8.5 to $10 billion by 2030.

To achieve these goals, the government is focusing on:

- A Unified National Tourism Brand: Moving away from campaign-specific taglines to a consistent global branding strategy.

- Sustainable Tourism Development: Promoting eco-tourism, heritage conservation, and community-based tourism.

- Enhancing Infrastructure: Expanding airports, road networks, and digital connectivity to support a larger influx of travelers.

Conclusion

Sri Lanka’s tourism sector is witnessing a remarkable revival, with record-breaking visitor arrivals, increased revenue, and strategic government support. The industry’s historical trends highlight both its resilience and future potential, making it an attractive sector for investors.

For those looking to capitalize on Sri Lanka’s tourism boom, hospitality stocks on the Colombo Stock Exchange (CSE) offer strong growth potential. With rising global interest, infrastructure investments, and policy support, Sri Lanka is well on its way to becoming a leading travel destination and a hotspot for tourism-related investments.