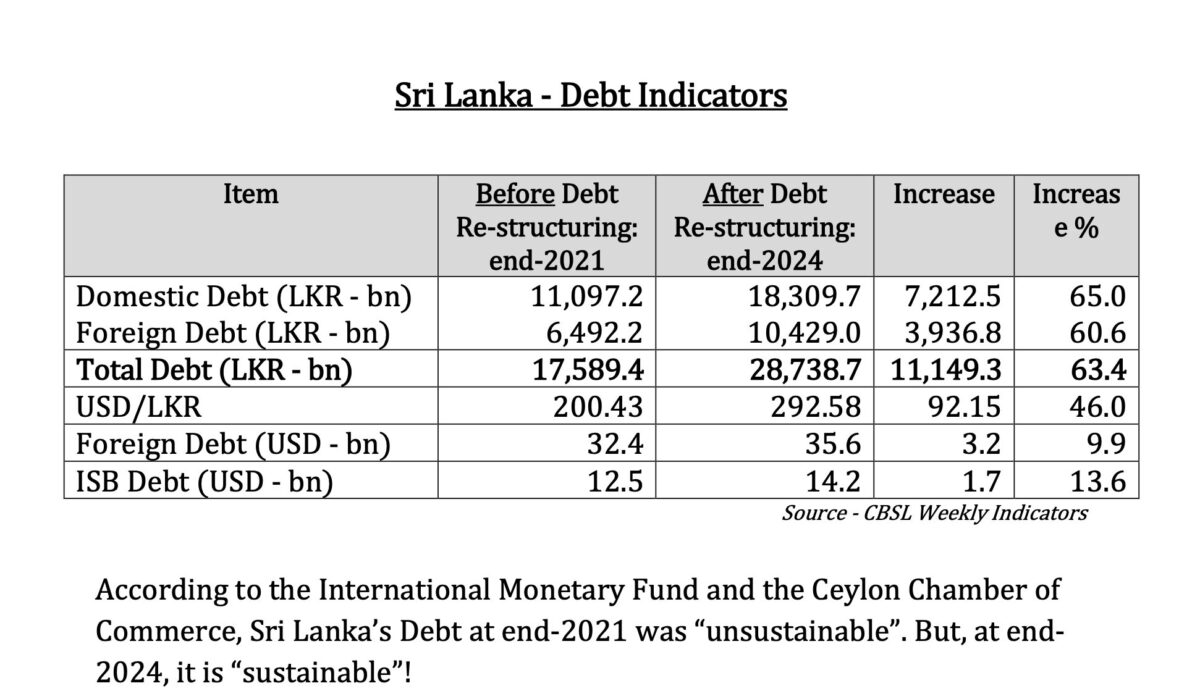

IMF says when Sri Lanka’s Debt is LKR 17.6 trillion, it is “unsustainable’. But when Sri Lanka’s Debt rises by 65% to LKR 28.7 trillion, the IMF says it is “sustainable”!

Sri Lanka’s journey from the brink of economic collapse to a narrative of debt sustainability within three years has sparked both admiration and skepticism. According to data sourced from the Central Bank of Sri Lanka, the country’s total debt rose from LKR 17.6 trillion at the end of 2021 to LKR 28.7 trillion by the end of 2024—a staggering 63.4% increase. This surge includes a 65% jump in domestic debt and a 60.6% increase in foreign debt (in rupee terms), seemingly counterintuitive to the claim of improved fiscal health.

In US dollar terms, foreign debt rose from USD 32.4 billion to USD 35.6 billion, with International Sovereign Bond (ISB) obligations climbing by 13.6% to USD 14.2 billion. The devaluation of the Sri Lankan Rupee from 200.43 to 292.58 against the US Dollar—an almost 46% depreciation—has significantly inflated the rupee value of external debt, complicating public perception.

Despite these increases, institutions such as the International Monetary Fund (IMF) and the Ceylon Chamber of Commerce now label Sri Lanka’s debt as “sustainable,” in stark contrast to its previous “unsustainable” classification in 2021. This dramatic shift raises questions about the underlying criteria for such judgments. Is this a genuine reflection of structural improvements through debt restructuring and fiscal reforms? Or is it an outcome of revised assumptions, accounting frameworks, and optimistic projections?

Critics have labeled this transformation as “amazing arithmetic,” highlighting the irony in debt levels rising while sustainability labels improve. Yet, it’s also a testament to the complex mechanisms of international financial assessments, which often weigh factors like improved debt servicing capacity, extended maturities, reduced interest burdens, and macroeconomic policy reforms rather than absolute debt figures alone.

As Sri Lanka moves forward, the challenge remains in translating statistical sustainability into lived economic stability. True success will depend not just on restructured numbers but on real reforms, enhanced revenue generation, and economic resilience that withstands future shocks.