National Development Bank PLC, Sri Lanka’s fourth largest listed bank commenced the financial year on a positive note, with resilient performance for the first quarter of the year ended 31 March 2024. NDB’s Director/ Chief Executive Officer Mr. Kelum Edirisinghe commented that the Bank continued to face challenges on relatively low credit demand due to subdued economic activity. Strong alignment to our strategic blueprint built on three core focus areas viz. optimizing cost of funds, enhancing fee based income through transaction banking and enhancing portfolio quality enabled us to withstand the challenges and deliver consistent value to our shareholders. We remain committed to driving bottom line growth and enhancing shareholder value through customer-centric, innovative and sustainable banking practices, he reiterated.

Analysis of financial performance Profitability

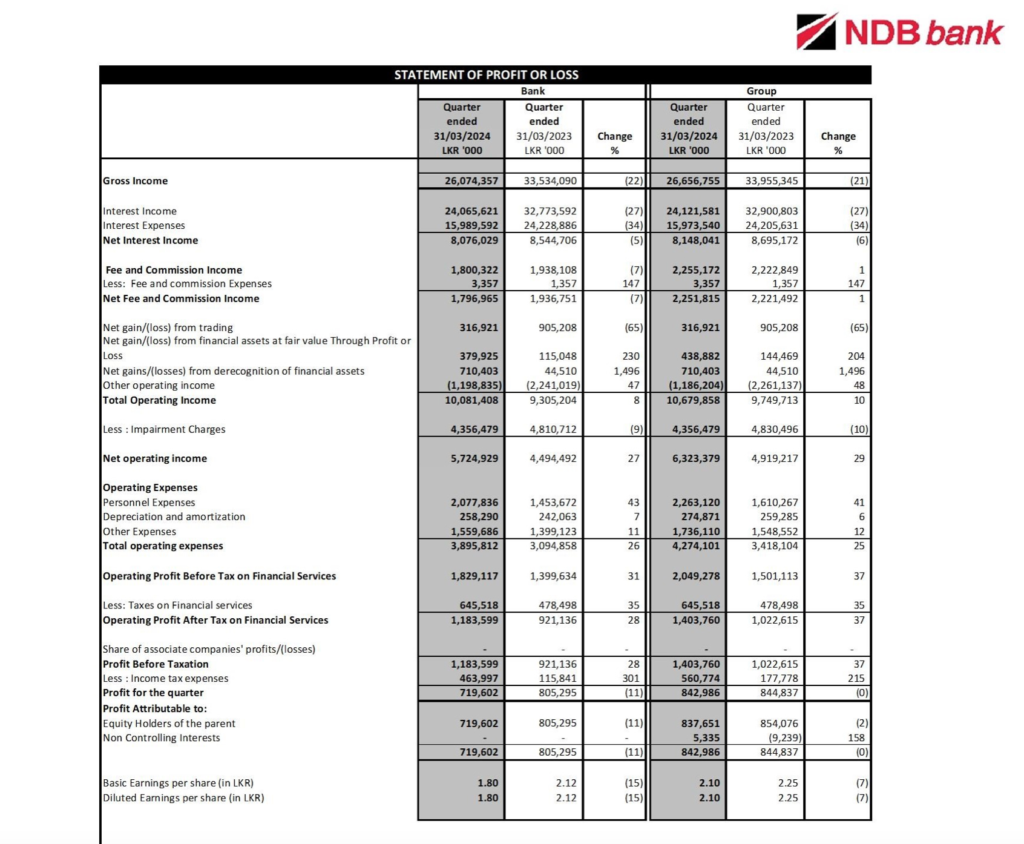

NDB recorded a pre-tax profitability of Rs. 1.8 Bn for the three months ended 31 March 2024 (period under review), an impressive increase of 31% over the same period in 2023 (YoY). Total operating income for the period was Rs. 10.1 Bn a YoY increase of 8%, driven by net interest income of Rs. 8.1 Bn, net fee and commission income of Rs. 1.8 Bn and other income of Rs. 208 Mn. The twin impact of a descaled loan book, re-priced down in tandem with declining anchor interest rates as a part of the relaxing monetary policy of Central Bank of Sri Lanka led to a YoY reduction in net interest income. The Bank’s concerted efforts in managing cost of funds led to an improvement in the net interest margin to 4.23% from 3.96% in 2023 thereby easing out the pressure from reduced interest income. Other non-fund based income posted a notable increase of 118% mainly driven by income categories of net gains from financial assets at fair value through profit or loss and net gains from derecognition of financial assets. With the appreciation of the Sri Lankan Rupee, Bank’s foreign exchange reserves of the FCBU book recorded a revaluation loss amounting to Rs. 1.3 Bn, accounted for under the Other Income category.

Impairment charges for the quarter netted Rs. 4.4 Bn, a decrease of 9% compared to the same quarter in 2023. Impairment (Stage 3) to Stage 3 loans Ratio improved to 44.74% from 41.11% in financial year 2023, reflecting further build-up of impairment to absorb potential losses in Stage 03 category, as a part of our prudent credit risk management efforts. Impaired Loans (Stage 3) Ratio was 8.27% a marginal movement from 8.58% in financial year 2023. NDB continued to maintain provisions on investments in foreign currency bonds, for the expected International Sovereign Bond (ISB) restructuring to be announced by the Government of Sri Lanka during the year.

Total operating costs for the quarter was Rs. 3.9 Bn, within which the increase in other expenses category comprising administration, marketing, etc. susceptible to general price level increases

was contained at 11% – a direct outcome of strong cost discipline maintained across the Bank. The Bank’s capital and discretionary expenses of certain expenses classes above a set threshold continued to be governed by a Board subcommittee in ensuring the effectiveness of such expenses on overall performance of the Bank.

Balance Sheet Performance, Liquidity and Capital Adequacy

NDB’s total assets stood at Rs. 757 Bn as at end 31 March 2024, a 3% de-growth compared to the total asset base as of 31 December 2023 (YTD). Total assets behaved in close congruence to

overall market direction, where negative growth continued but at a slower pace. Gross loans to customers also decelerated at a slower pace, at 2% YTD and closed in at Rs. 486 Bn. Customer

deposits stood at Rs. 614 Bn, with a marginal decline of 0.2%. Within total deposits rupee deposits grew by 4%, whilst foreign currency denominated deposits declined by 12% attributable to the appreciation in exchange rate, which if excluded would have led to a growth. Total assets at the Group level stood at LKR 765 Bn.

Outlook

As the economy continues on the recovery mode, the Bank remains well poised in catering to emerging financial and advisory needs of the country and its people. The clearly articulated three- pronged strategy spanning the mid-term with adaptability to evolving socio, political and economic landscapes will guide the Bank towards shareholder wealth maximization and value creation.