- Records 91% growth in Q1 PAT

- Advances up by 8%

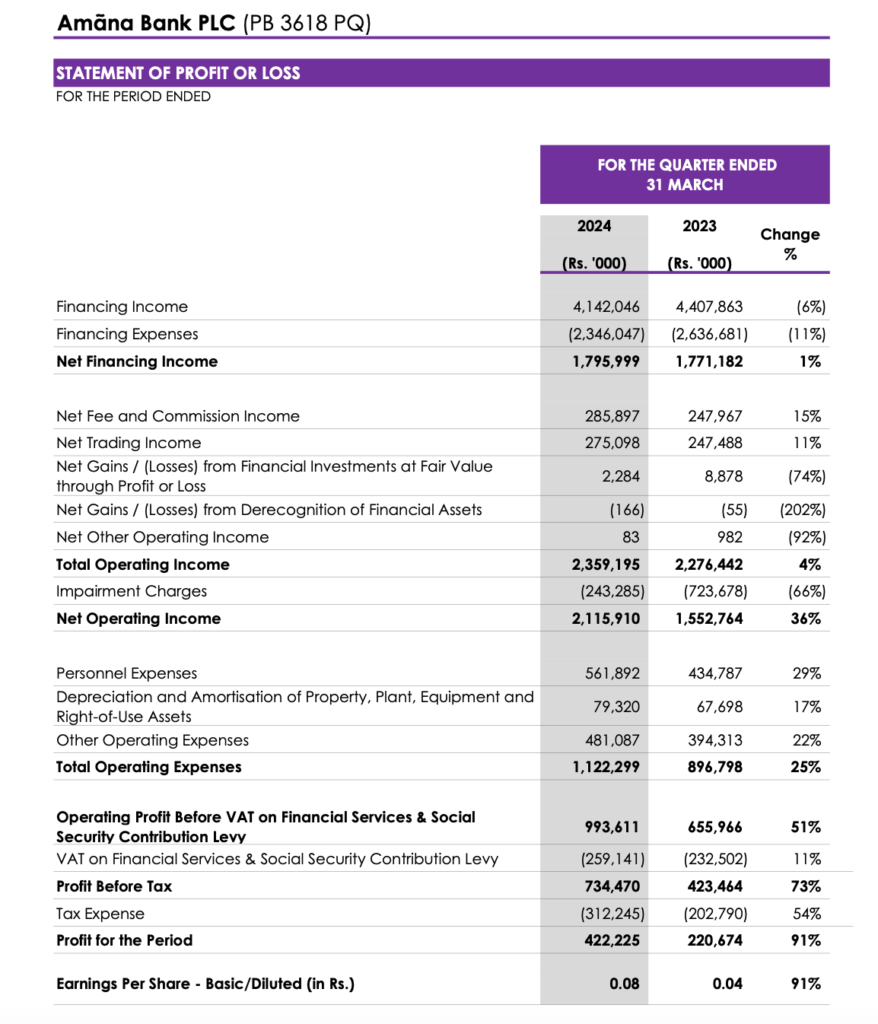

Amana Bank continued its robust performance trend as it completed a successful first quarter recording a notable 73% YoY increase in Profit Before Tax to reach LKR 734.5 million compared to LKR 423.5 million booked a year back while Profit After Tax surged by 91% YoY to post LKR 422.2 million as against LKR 220.7 million recorded in Q1 2023.

The Bank’s top line witnessed a marginal decline to close at LKR 4.1 billion, owing to the drop in market rates in line with the Central Bank’s economic revival policies. However by maintaining a healthy Financing Margin of 4.5%, Net Financing Income improved to close at LKR 1.8 billion.The Bank’s Fee and Commission Income and Trading Income grew YoY by 15% and 11% to close at LKR 285.9 million and LKR 275.1 million respectively resulting in the Bank’s Total Operating Income reaching LKR 2.4 billion. After accounting for impairment charges, which showed a reduction compared to Q1 2023, reflecting prudent risk management, customer engagement and resultant revival, the Bank’s Net Operating Income closed at LKR 2.1 billion reflecting a healthy 36% YoY growth.

The Bank continued to maintain a healthy cost to income ratio of 48%, resulting in a 51% YoY growth in Operating Profit before VAT on Financial Services to post LKR 993.6 million. The Bank’s aggregate tax contribution of LKR 571.4 million accounted for a significant 58% of the Bank’s Operating Profit before all taxes.Owing to growing acceptance of its development focused banking model, the Bank’s Advances grew by a commendable 8% to close at LKR 97 billion. Local currency deposits grew by over LKR 1 billion during the quarter but the overall portfolio remained at LKR 132 billion after considering effects of Rupee appreciation against the US Dollar for foreign currency deposits. The Bank continued to grow its advance base while maintaining an industry low Stage 3 Impaired Financing Ratio of 1.6%. The Bank closed the first quarter with Total Assets of LKR 161.6 billion.Given the strong financial performance in the quarter, Amana Bank’s ROE and ROA grew to 7.8% and 1.8% respectively compared to 6.2% and 1.2% respectively to the corresponding period of 2023.

As at 31 March 2024, Amana Bank’s Common Equity Tier 1 and Total Capital ratios stood at 15.6% and 18.3% respectively, well above the regulatory minimum requirement of 7% and 12.5%.Commenting on the Bank’s first three months performance Chairman Asgi Akbarally said “Amana Bank has continued to demonstrate its resilience with a strong Q1 performance in the backdrop of a challenging yet progressively improving economic landscape. This promising start serves as a catalyst for continued future growth and prosperity. I am thankful for the management and our staff for their dedication and unwavering commitment, which has been instrumental in ensuring Amana Bank’s continued success.”Also sharing his sentiments Managing Director/CEO Mohamed Azmeer stated “The strong financial performance in the first quarter affirms Amana Bank’s aggressive outlook towards 2024.

Our commitment to providing development focussed and people friendly banking solutions which is also in sync with the revival efforts of the Central Bank, coupled with Bank’s prudent risk management framework, has driven our advances growth trajectory, which I am confident will continue through the rest of the year. I would like to commend our team for their hard work and dedication in achieving these excellent results as well as for their commitment towards our mission of enabling growth and enriching lives amongst all Sri Lankans through our unique banking model”. Through a Rights Issue in Q4 2023, the Bank successfully raised its capital to cross Rs 20 billion thereby meeting the enhanced minimum capital requirement in line with regulatory directions as well as fuelling the Bank’s ambitious growth and expansion plans. The Bank also recently announced its decision to consolidate the shares of the Bank in the proportion of consolidating 10 existing ordinary shares to 1 ordinary share subject to shareholder and regulatory approval. There will be no change in the stated capital of the bank as a result of the consolidation.

Amãna Bank PLC is a stand-alone institution licensed by the Central Bank of Sri Lanka and listed on the Colombo Stock Exchange, with Jeddah-based IsDB Group being the principal shareholder of the Bank. The IsDB Group is a ‘AAA’ rated multilateral development financial institution with a membership of 57 countries. Testifying its position as a leading practitioner of the non-interest based banking model, Amãna Banks continued to be recognised amongst the Top 100 Strongest Islamic Bank’s in the World by The Asian Banker.

Amãna Bank does not have any subsidiaries, associates, or affiliated institutions apart from its engagement with OrphanCare as its Founding Sponsor.