- Net stage III ratio at 4%; one of the best in the industry

- Over Rs 6.5 Bn in taxes

- Tier I and total capital ratios improve further to 14.48% and 18.06% respectively

- Liquidity position remains strong with LAR and LCR well above regulatory minimum

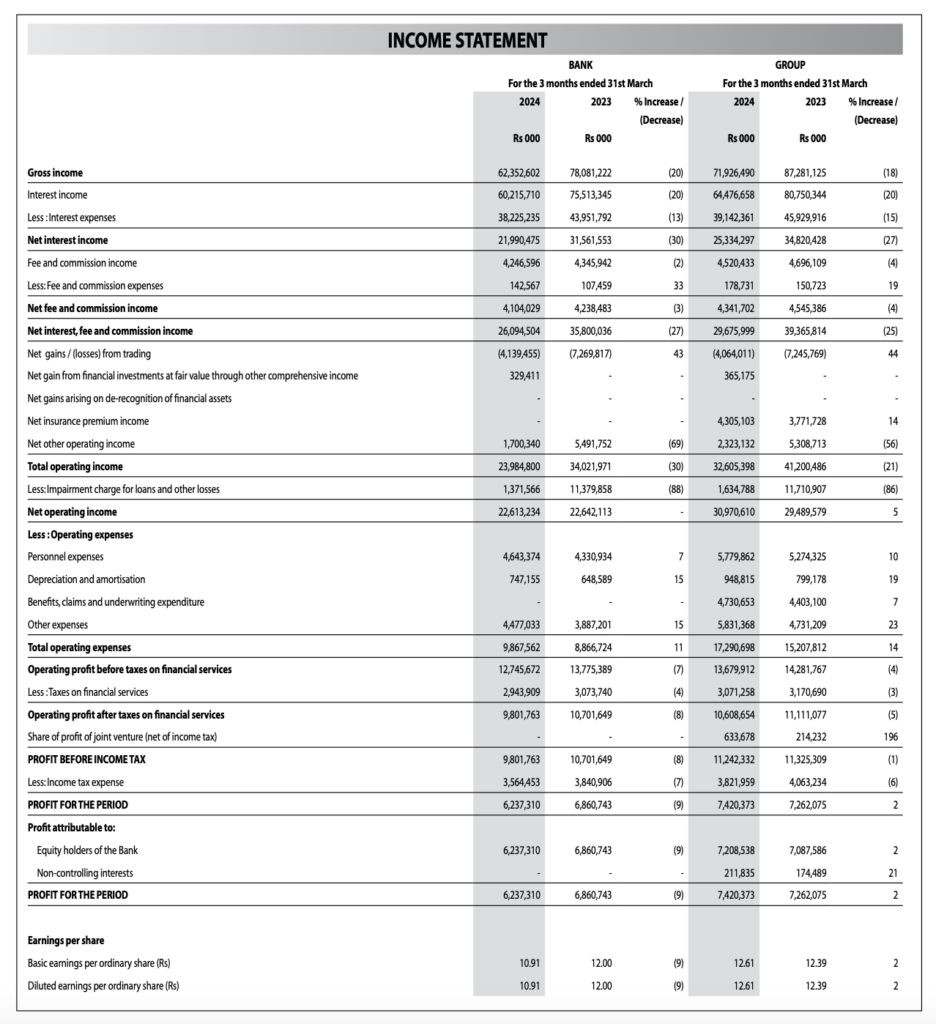

Hatton National Bank PLC (HNB) recorded a Profit Before Tax (PBT) of Rs 9.8 Bn during the first quarter of 2024 while Profit After Tax (PAT) amounted to Rs 6.2 Bn. At Group level, PBT and PAT were at Rs 11.2 Bn and Rs 7.4 Bn, respectively.

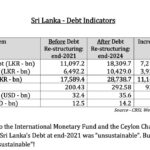

The substantial monetary policy loosening adopted by the Central Bank of Sri Lanka to revive the economy, resulted in a drop in AWPLR by 50% from 21.40% to 10.69% during the 12-month period up to March 2024. This caused interest income to decline by 20% YoY to Rs 60.2 Bn. Interest expense declined at a slower pace of 13% YoY to Rs 38.2 Bn due to the lag effect in repricing deposits. The Bank also provided sizable interest rebates to support the most vulnerable sectors of the economy. As a result, the net interest income declined by 30% YoY during 1Q 2024.

Bank’s total non-interest income for the quarter was Rs 2.0 Bn compared to Rs 2.5 Bn in the corresponding period of 2023, largely due to the appreciation of the rupee during the quarter and reversion of trade tariffs to pre-crisis levels. Nevertheless, fees from all retail and corporate digital channels recorded sound growth indicating transition into cashless transactions in line with HNB’s vision of driving a cash minimalistic economy.

HNB recognised an incremental impairment charge of Rs 1.4 Bn during the quarter, compared to Rs 11.4 Bn provided during the first quarter of last year backed by the Bank’s continuous focus on supporting customers to revive their businesses and the improvement in economic conditions.The Bank’s net stage 3 ratio stood at 4.02% and remains superior to the industry level.

HNB’s total operating expenses increased to Rs 9.9 Bn from Rs 8.9 Bn as staff costs and other expenses increased. Total effective tax rate stood at 51% in 1Q 2023 resulting in a total tax of over Rs 6.5 Bn for the quarter.

The Bank’s asset base stood at Rs 1.9 Trillion as at end of March 2024 with Group assets at over Rs 2 Trillion. The Bank maintained its gross loans at over Rs 1 Trillion with deposits over Rs 1.5 Trillion. LKR CASA base grew by 22% YoY improving the CASA ratio to 31% as at end of March 2024.

HNB reported Tier I and Total Capital Adequacy Ratios of 14.48% and 18.06% against the minimum statutory requirements of 9.5% and 13.5% respectively.The Bank has provision to drawdown further up to 250 bps on the capital conservation buffer under the concessions granted by the Central Bank of Sri Lanka. HNB’s liquidity levels also continued to be strong and well above the regulatory minimum requirements, with Statutory Liquid Assets and all currency Liquidity Coverage ratios at 49.34% (vs. a 20% requirement) and 421.55% (vs. a 100% requirement) respectively.

HNB is rated A (lka) by Fitch Ratings and has been adjudged the “Best Retail Bank in Sri Lanka” for the 14th occasion by the Asian Banker. HNB has been recognized by both Asiamoney and Euromoney as the “Market Leader” and “Best Service Provider” and by Asiamoney as the “Best SME Bank” in Sri Lanka. HNB has also secured Top 5 position on Business Today’s Top 40 rankings for 2023. HNB was ranked among Sri Lanka’s Top 10 Most Admired companies in 2022 by the American Institute of Certified Public Accountants and Chartered Institute of Management Accountants and the International Chamber of Commerce Sri Lanka.