Ceylon Cold Stores PLC has demonstrated a robust financial performance for the year ended 31st March 2024. The company’s profitability has shown significant improvement, as evidenced by the following key financial metrics:

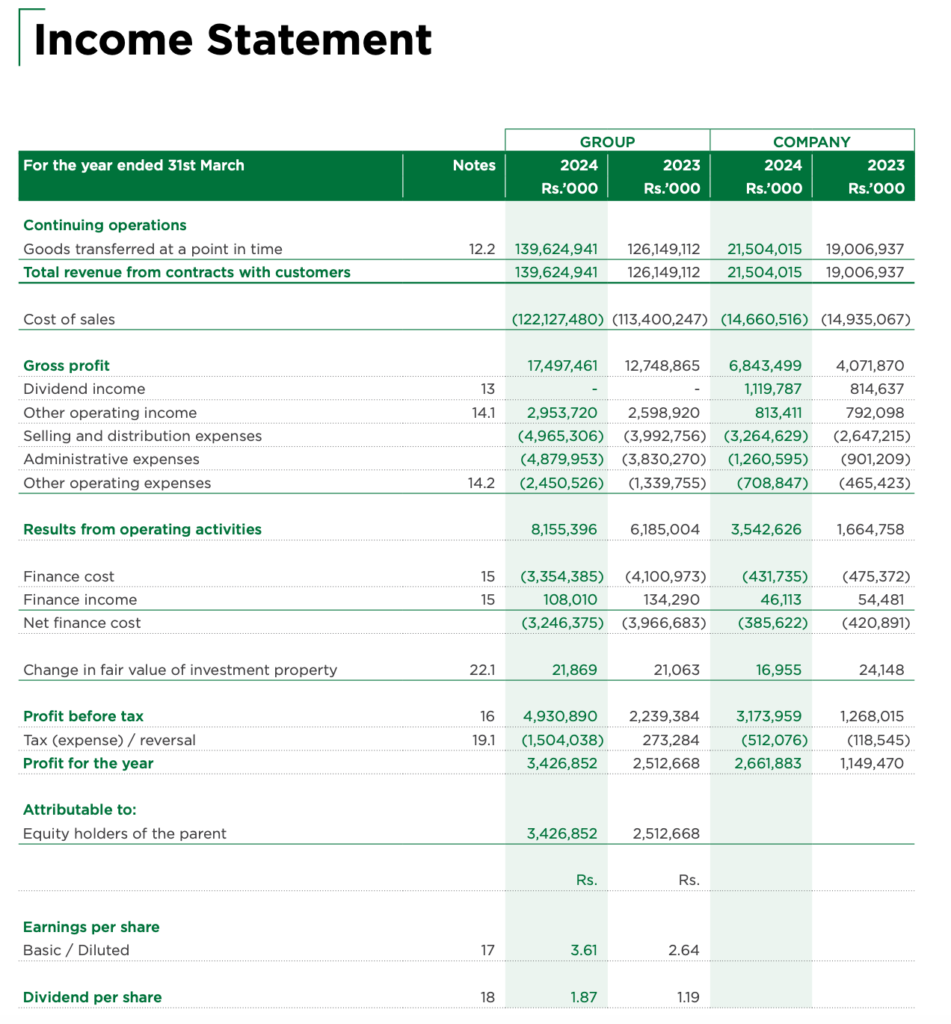

- Revenue: The company’s revenue increased from Rs. 126,149 million in the previous year to Rs. 139,625 million in 2024, marking an 11% year-over-year growth. This indicates a strong sales performance and an expanding market presence.

- Profit Before Tax (PBT): The Profit Before Tax saw a substantial increase of 120%, rising from Rs. 2,239 million in the previous year to Rs. 4,931 million in 2024. This remarkable growth in PBT suggests effective cost management and operational efficiency.

- Profit After Tax (PAT): The Profit After Tax also grew by 36%, from Rs. 2,513 million in the previous year to Rs. 3,427 million in 2024. This growth in net income reflects the company’s ability to translate revenue growth into bottom-line results.

- Earnings Per Share (EPS): The Earnings Per Share increased from Rs. 2.64 in the previous year to Rs. 3.61 in 2024, which is indicative of the company’s increased profitability on a per-share basis.

- Dividend Per Share: The dividend per share increased from Rs. 1.19 in the previous year to Rs. 1.87 in 2024, showing the company’s commitment to returning value to its shareholders.

The financial statements also reflect a healthy balance sheet with a total equity increase from Rs. 17,858,176 thousand as at 1 April 2022 to Rs. 19,077,463 thousand as at 31 March 2023, and then maintaining at the same level as at 1 April 2023. This stability in equity suggests that the company has managed to sustain its growth without significant dilution to shareholders’ value.

Overall, Ceylon Cold Stores PLC’s financial performance in the year ending 31st March 2024 indicates a strong and profitable operation, with significant growth in revenue and profits. The company’s strategic focus on sustainable growth and recovery of the macroeconomic environment in Sri Lanka has likely contributed to these positive outcomes.

Key Ratios

Based on the provided context from Ceylon Cold Stores PLC’s annual report for the year ended 31st March 2024, the key financial ratios are as follows:

Return on Assets (ROA): 4.71%

- This ratio has increased from 3.72% in the previous year, indicating an improvement in the company’s efficiency in using its assets to generate profit.

Return on Equity (ROE): 17.23%

- There is an increase from the previous year’s ROE of 13.40%, showing that the company has been more effective at generating income relative to the equity held by its shareholders.

Debt to Equity Ratio: 82.32%

- This ratio has significantly improved from 118.02% in the previous year, suggesting that the company has reduced its reliance on debt to finance its assets or has increased its shareholders’ equity.

Interest Cover: 2.43 times

- This ratio has increased from 1.51 times in the previous year, indicating that the company is in a better position to meet its interest obligations from its earnings before interest and taxes (EBIT).

Current Ratio: 0.66 times

- The current ratio is slightly lower than the previous year’s 0.68 times, which may suggest a tighter liquidity position, although this ratio alone does not provide a complete picture of liquidity without considering the industry context and the company’s specific operating cycle.

These ratios provide insights into Ceylon Cold Stores PLC’s financial health and performance. The improvements in profitability ratios (ROA and ROE) and the interest cover ratio suggest that the company has had a strong year. The significant decrease in the debt to equity ratio indicates a healthier capital structure. However, the slight decrease in the current ratio may require further analysis to understand the implications for short-term liquidity.

Future Prospects and Potential Risks

Based on the information provided in the annual report for the year ending 31st March 2024, Ceylon Cold Stores PLC has outlined several strategic priorities and is aware of the risks that could impact its future performance. Here are the future prospects and risks as identified in the report:

Future Prospects:

- Product Expansion: The company plans to expand customer choice through the extension of the canned beverage range and the launch of new products in the Frozen Confectionery segment.

- Operational Excellence: There is an emphasis on operational excellence to enhance productivity, efficiency, and cost rationalization.

- Digital Transformation: Leveraging data analytics and digital platforms is a priority to respond swiftly to evolving market conditions.

- Brand Engagement: Ongoing emphasis on enhancing brand engagement among consumers is expected to drive customer loyalty and market share.

- Employee Value Proposition: The company aims to enhance its employee value proposition to attract and retain talent, which is crucial for sustaining growth.

- Sustainability and Corporate Responsibility: Ceylon Cold Stores PLC is strengthening its commitment to sustainability and corporate responsibility, which is increasingly important to consumers and stakeholders.

Potential Risks:

- Environmental Risks: The company is exposed to environmental risks such as adverse weather events, water stress, and increased environmental regulations, which could impact supply chains and operational costs.

- Economic Uncertainties: The Sri Lankan economy’s recovery trajectory could be affected by uncertainties, which would require the company to adapt its strategies accordingly.

- Supply Chain Costs: Increases in fuel and electricity tariffs have already impacted supply chain costs, logistics, and consumer spending, and these could continue to pose challenges.

- Risk Management: The Group has pursued cost rationalizations and stringent cash flow management to maintain business continuity, but the risk landscape is dynamic, necessitating robust risk management.

- Consumer Preferences: The company must continue to adapt to evolving consumer preferences and market trends to maintain its competitive edge.

- Regulatory Changes: Increased environmental consciousness among consumers and potential regulatory changes could lead to higher operational costs or require changes in business practices.

In conclusion, Ceylon Cold Stores PLC appears to be positioning itself for growth by focusing on product expansion, operational excellence, and digital transformation while being mindful of the environmental, economic, and regulatory risks that could impact its future performance. The company’s proactive approach to risk management and strategic planning suggests that it is well-prepared to navigate these challenges and capitalize on opportunities.