Pan Asia Banking Corporation PLC (PABC.N0000) showcased a robust overall performance during the first half of 2024. The bank achieved significant growth in its core income streams, driven by a substantial increase in net interest income and fee-based income, demonstrating effective management of interest margins and fee generation. The strategic focus on cost management led to improved efficiency ratios, highlighting the bank’s ability to control expenses while enhancing operational performance. The asset quality improved, with a reduction in non-performing loans and stronger provision coverage, reflecting prudent risk management practices. The bank maintained strong capital adequacy and liquidity positions, well above regulatory requirements, underscoring its financial stability and resilience. Positive market sentiment was evident in the upward movement of the share price, indicating growing investor confidence.

- Net Interest Income: Increased by 29% to Rs. 5,853 million, driven by a significant drop in interest expenses by 32%, despite an 18% decrease in interest income. compared to the corresponding period last year.

- Net Fee and Commission Income: Rose by 24% to Rs. 855 million, primarily due to increased fee income from loans and advances resulting from higher demand for credit in a low-interest-rate environment.

- Operating Profit: Achieved an increase of 32%, reaching Rs. 2,725 million, indicating effective cost management and portfolio re-alignment.

- Expenditure: Operating expenses increased by 19% to Rs. 3,410 million, primarily driven by higher personnel costs, which rose by 36%, and other operating expenses, which grew by 7%.

- Profit Before Tax: Increased by 32% to Rs. 1,996 million, supported by improved net interest income, net fee & commission income, and other operating income.

- Profit After Tax: Increased by 11% to Rs. 1,025 million, showcasing the bank’s resilience and strong performance despite external economic challenges.

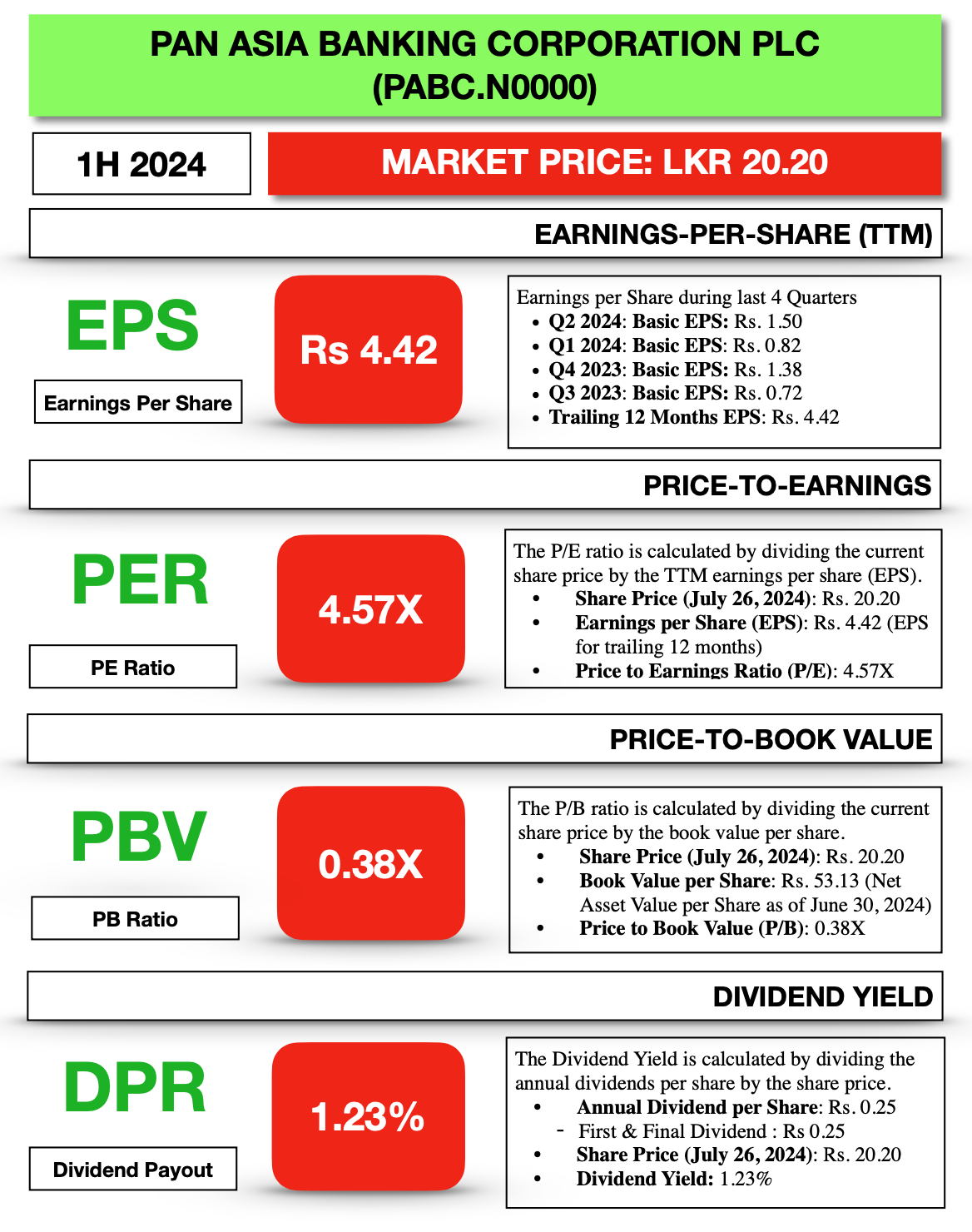

- Earnings Per Share (EPS): Reported an EPS of Rs. 2.32 for the first half of 2024, which is an increase of 11% compared to the corresponding period last year.

Download Full report: https://lankabizz.net/product/pan-asia-banking-corporation-plc-1h2024/