Overall, Hatton National Bank (HNB) emerges as the best performer, followed closely by Seylan Bank and Commercial Bank, with Nations Trust Bank (NTB) and Sampath Bank also showing strong performances. DFCC Bank and NDB Bank demonstrate solid profitability but have room for improvement compared to the top-performing banks.

- Hatton National Bank (HNB) stands out with the highest net profit, ROE, and ROA, indicating exceptional performance in profitability, equity returns, and asset efficiency. Its NIM is also one of the highest, reflecting effective interest income management.

- Seylan Bank demonstrates significant profit growth, high ROE, and a strong NIM, making it a top performer in terms of profitability and efficiency, though its ROA is slightly lower than HNB.

- Commercial Bank showcases excellent ROE and a solid net profit, indicating strong profitability, though its NIM is slightly lower than some peers.

- Sampath Bank and DFCC Bank both exhibit strong profitability metrics, with Sampath leading in ROE and DFCC in ROA, indicating good performance, especially in asset management.

- Nations Trust Bank (NTB) displays solid profitability, particularly in fee-based income and cost efficiency, though its ROA is slightly lower than top performers.

- NDB Bank shows solid performance, but it lags slightly behind the others in ROE and ROA, suggesting potential areas for improvement in maximizing returns on equity and assets.

Best Performer for 1H 2024

Based on the comparative analysis of profitability, ROE, ROA, and Net Interest Margin (NIM), Hatton National Bank (HNB) emerges as the best overall bank for the first half of 2024.

Key Reasons:

- Highest Profitability: HNB reported the highest net profit after tax among its peers at LKR 12.3 billion, indicating strong financial performance.

- Superior ROE: HNB had the highest Return on Equity (ROE) at 17.23%, showcasing exceptional efficiency in generating returns on shareholders’ equity.

- Strong ROA: HNB also led in Return on Assets (ROA) at 2.21%, reflecting excellent use of its assets to generate profits.

- Robust NIM: With a Net Interest Margin of 4.85%, HNB has demonstrated effective management of interest income, contributing to its strong profitability.

- Highest EPS with moderate PER: HNB shows strong performance with the highest EPS for 1H 2024 at LKR 27.59, a moderate PER of 4.54, and the highest NAV at LKR 382.36.

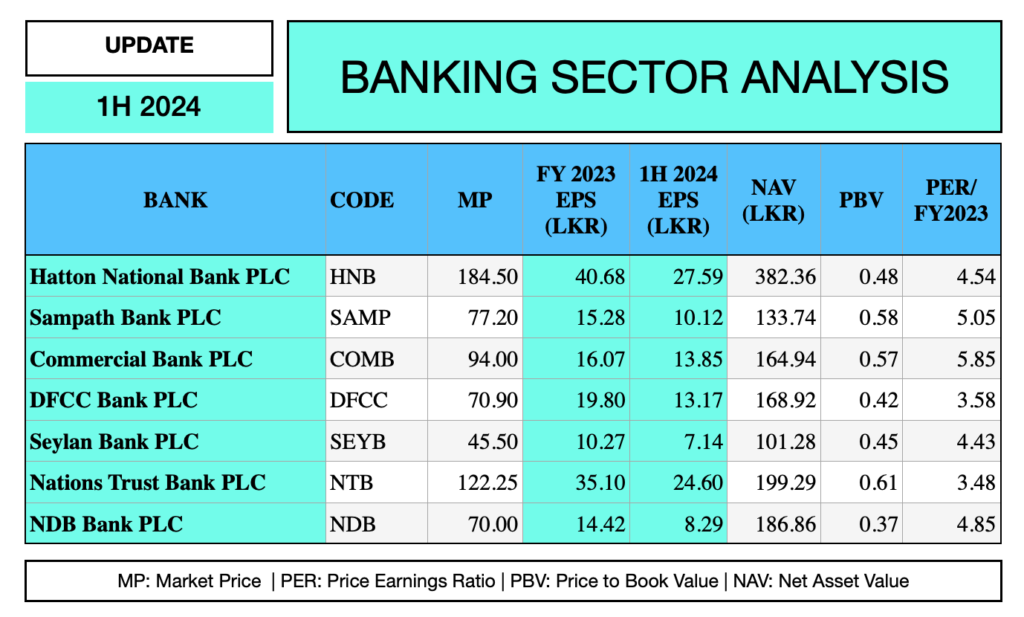

Stock Market Performance

Here’s a summary of the banks’ performance based on PER (Price Earnings Ratio), PBV (Price to Book Value), EPS (Earnings Per Share), and NAV (Net Asset Value):

- Hatton National Bank (HNB) shows strong overall performance with the highest EPS (LKR 27.59 for 1H 2024), highest NAV (LKR 382.36), a moderate PER (4.54), and a low PBV (0.48), suggesting it may be undervalued relative to its book value.

- Nations Trust Bank (NTB) demonstrates solid performance with the second-highest EPS (LKR 24.60), the lowest PER (3.48), and the highest PBV (0.61), indicating strong market confidence despite a relatively lower NAV (LKR 199.29).

- Commercial Bank (COMB) shows mixed indicators with a moderate EPS (LKR 13.85), the highest PER (5.85), and a mid-range PBV (0.57), suggesting investors are willing to pay a premium for its earnings.

- DFCC Bank presents an interesting case with a competitive EPS (LKR 13.17), the second-lowest PER (3.58), and the lowest PBV (0.42), potentially indicating it’s undervalued by the market despite a strong NAV (LKR 168.92).

- NDB Bank has the lowest EPS (LKR 8.29) and PBV (0.37) in the group, with a moderate PER (4.85) and a relatively high NAV (LKR 186.86), suggesting it might be undervalued but facing profitability challenges.

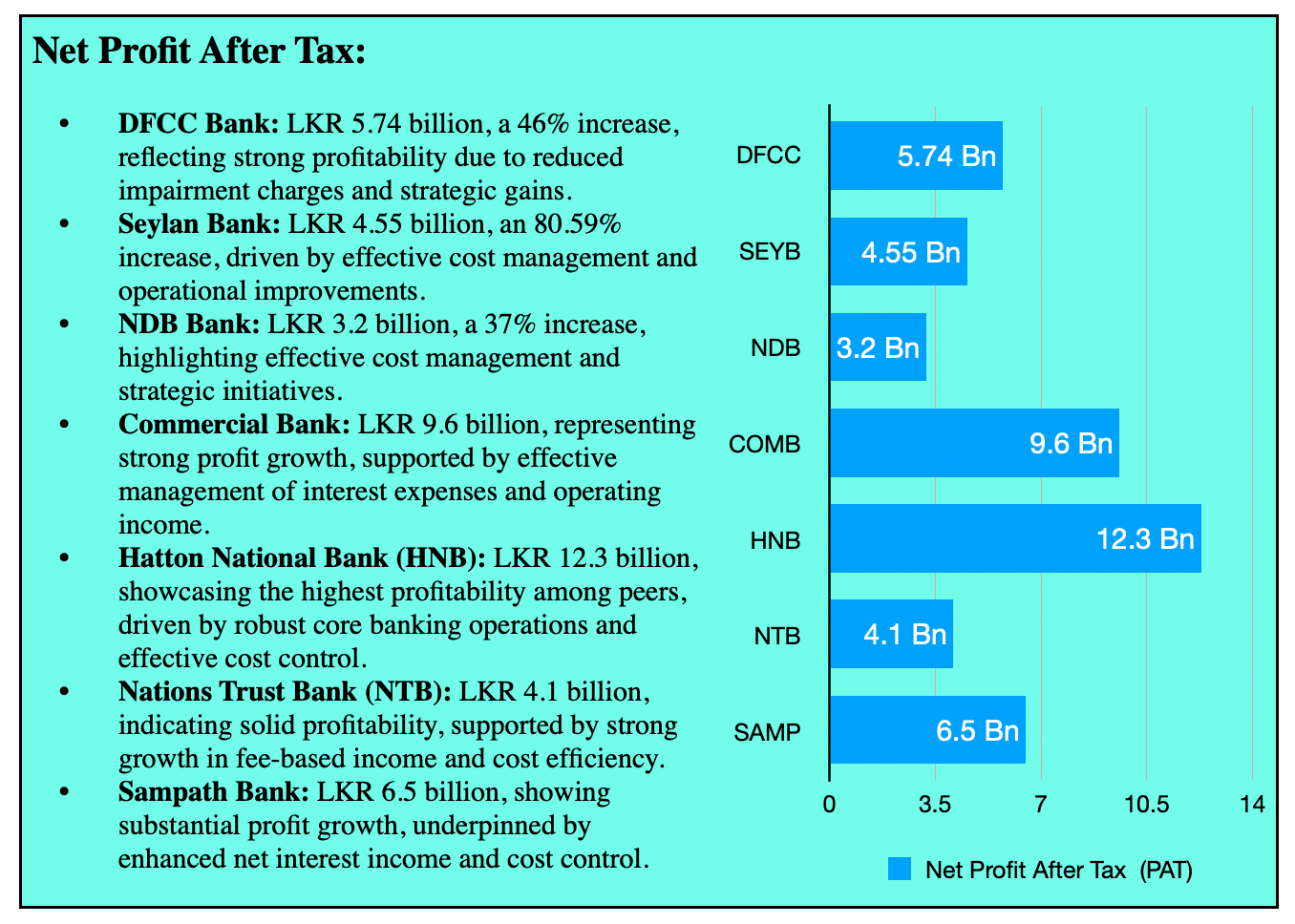

Net Profit After Tax:

- DFCC Bank: LKR 5.74 billion, a 46% increase, reflecting strong profitability due to reduced impairment charges and strategic gains.

- Seylan Bank: LKR 4.55 billion, an 80.59% increase, driven by effective cost management and operational improvements.

- NDB Bank: LKR 3.2 billion, a 37% increase, highlighting effective cost management and strategic initiatives.

- Commercial Bank: LKR 9.6 billion, representing strong profit growth, supported by effective management of interest expenses and operating income.

- Hatton National Bank (HNB): LKR 12.3 billion, showcasing the highest profitability among peers, driven by robust core banking operations and effective cost control.

- Nations Trust Bank (NTB): LKR 4.1 billion, indicating solid profitability, supported by strong growth in fee-based income and cost efficiency.

- Sampath Bank: LKR 6.5 billion, showing substantial profit growth, underpinned by enhanced net interest income and cost control.

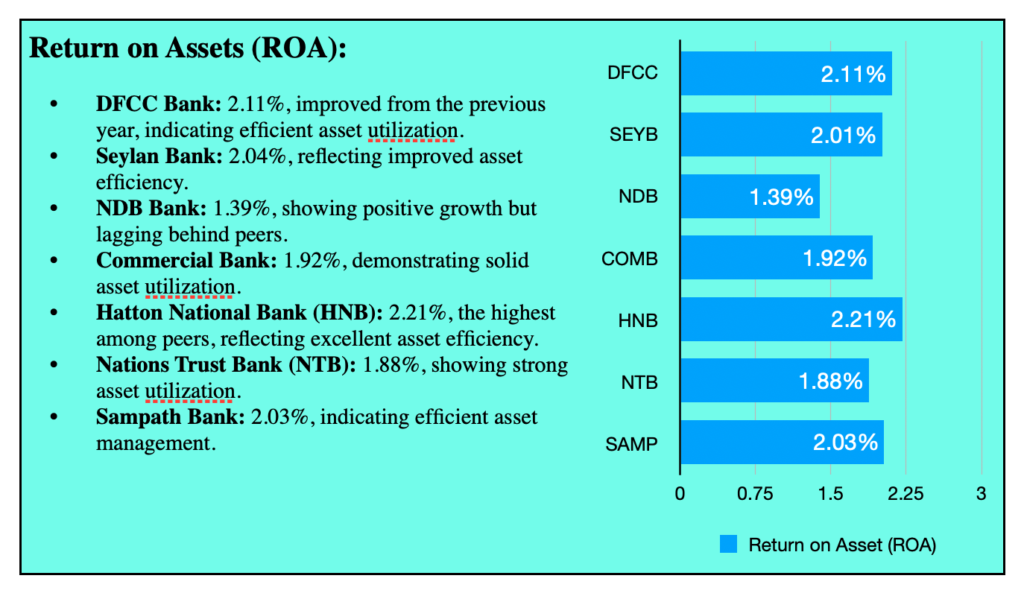

Return on Assets (ROA):

- DFCC Bank: 2.11%, improved from the previous year, indicating efficient asset utilization.

- Seylan Bank: 2.04%, reflecting improved asset efficiency.

- NDB Bank: 1.39%, showing positive growth but lagging behind peers.

- Commercial Bank: 1.92%, demonstrating solid asset utilization.

- Hatton National Bank (HNB): 2.21%, the highest among peers, reflecting excellent asset efficiency.

- Nations Trust Bank (NTB): 1.88%, showing strong asset utilization.

- Sampath Bank: 2.03%, indicating efficient asset management.

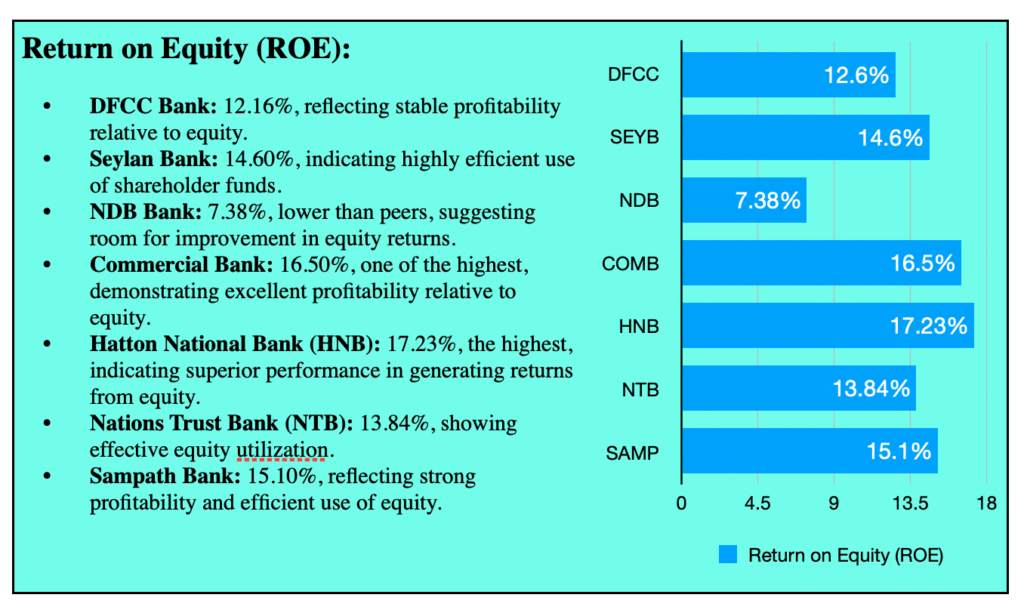

Return on Equity (ROE):

- DFCC Bank: 12.16%, reflecting stable profitability relative to equity.

- Seylan Bank: 14.60%, indicating highly efficient use of shareholder funds.

- NDB Bank: 7.38%, lower than peers, suggesting room for improvement in equity returns.

- Commercial Bank: 16.50%, one of the highest, demonstrating excellent profitability relative to equity.

- Hatton National Bank (HNB): 17.23%, the highest, indicating superior performance in generating returns from equity.

- Nations Trust Bank (NTB): 13.84%, showing effective equity utilization.

- Sampath Bank: 15.10%, reflecting strong profitability and efficient use of equity.

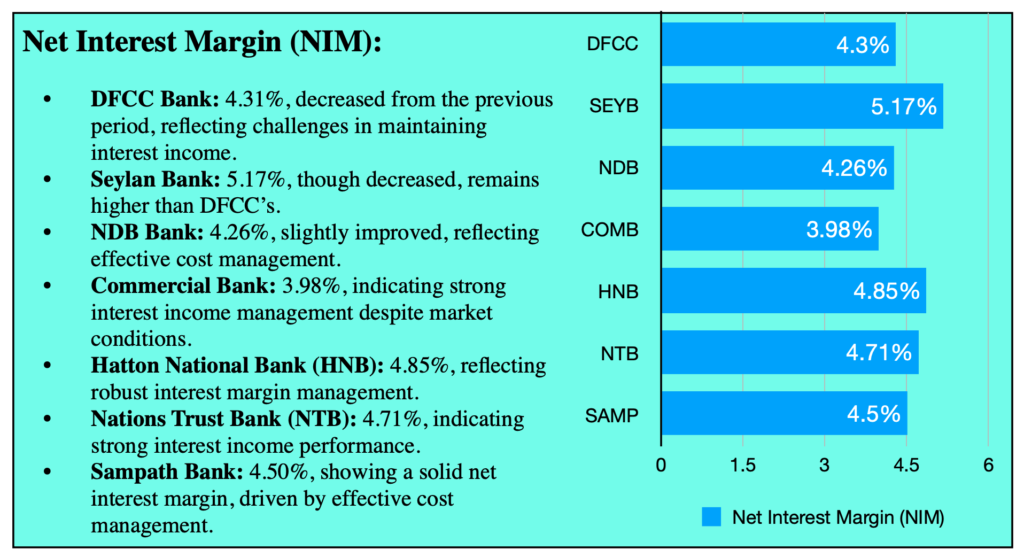

Net Interest Margin (NIM):

- DFCC Bank: 4.31%, decreased from the previous period, reflecting challenges in maintaining interest income.

- Seylan Bank: 5.17%, though decreased, remains higher than DFCC’s.

- NDB Bank: 4.26%, slightly improved, reflecting effective cost management.

- Commercial Bank: 3.98%, indicating strong interest income management despite market conditions.

- Hatton National Bank (HNB): 4.85%, reflecting robust interest margin management.

- Nations Trust Bank (NTB): 4.71%, indicating strong interest income performance.

- Sampath Bank: 4.50%, showing a solid net interest margin, driven by effective cost management.

Download Full Report: https://lankabizz.net/product/banking-sector-analysis-1h-fy2024/