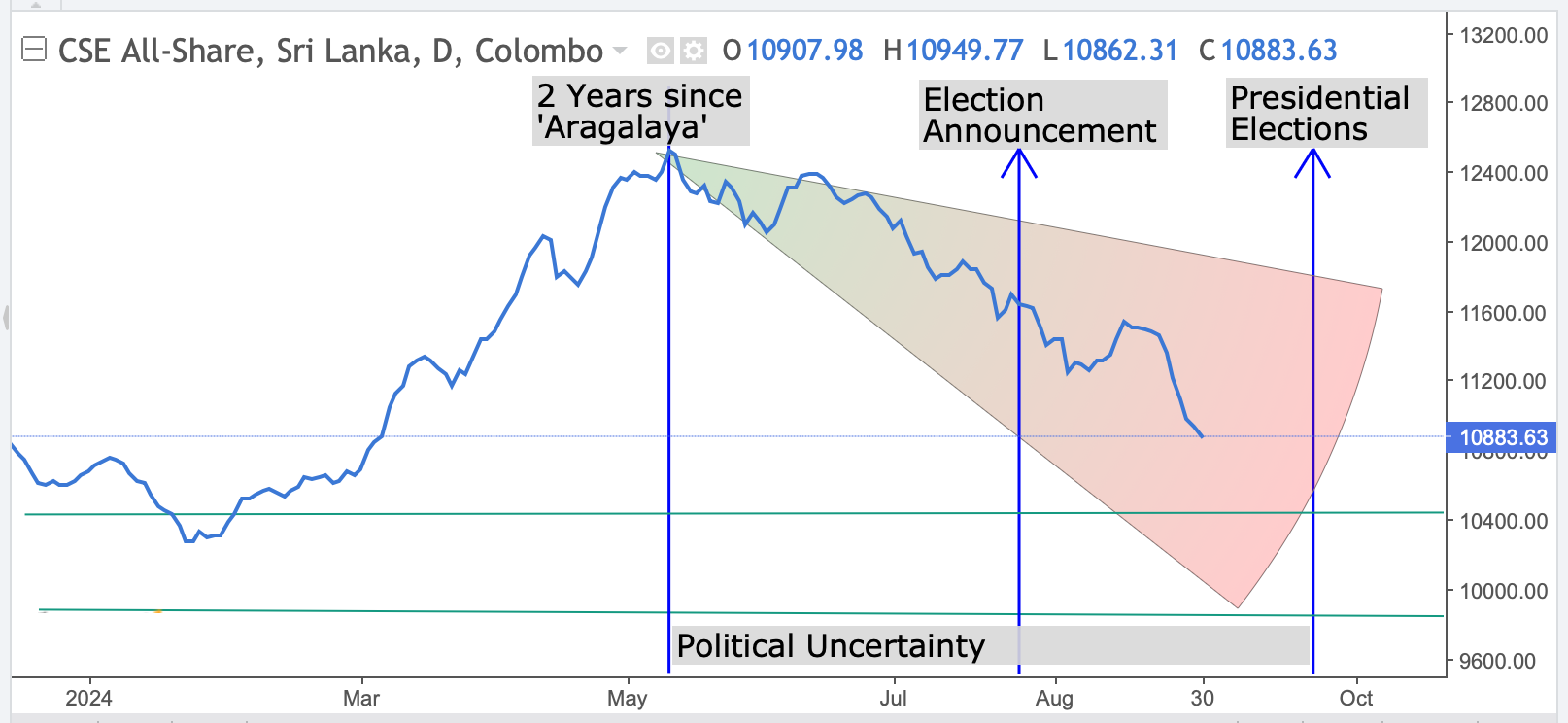

- Recent Performance: The CSE All-Share Index shows a significant uptrend leading up to the two-year mark since the “Aragalaya” protests. This period likely reflects investor optimism or a stabilization phase following the initial unrest.

- Impact of Political Events: After reaching a peak around the time of the “Aragalaya” anniversary, the market begins to show signs of volatility and decline. The election announcement appears to have marked a turning point, with the index beginning a downward trend. This suggests that political uncertainty, often heightened during election periods, has begun to impact investor confidence and market performance.

- Projected Trend: The chart’s shaded area representing “Political Uncertainty” suggests a forecast of continued market decline leading up to the presidential elections. The market appears to be pricing in potential risks associated with the elections, such as changes in economic policy, governance issues, or further political instability.

- Support Levels: Horizontal green lines on the chart indicate potential support levels for the CSE All-Share Index around the 10,400 and 9,600 points. These levels might represent thresholds where the market could stabilize if the political situation becomes clearer or if investors perceive the elections as likely to bring positive change.

- Future Outlook: Based on the chart, the near-term outlook for the CSE All-Share Index appears bearish, primarily driven by political uncertainty. If the political climate stabilizes post-election, the market may recover; however, continued instability or unfavorable policy announcements could drive further declines.

Overall, the CSE All-Share Index is expected to remain volatile in the lead-up to the presidential elections, with investor sentiment closely tied to the unfolding political landscape.

Download Full Report: https://lankabizz.net/product/stock-market-analysis-september-2024/