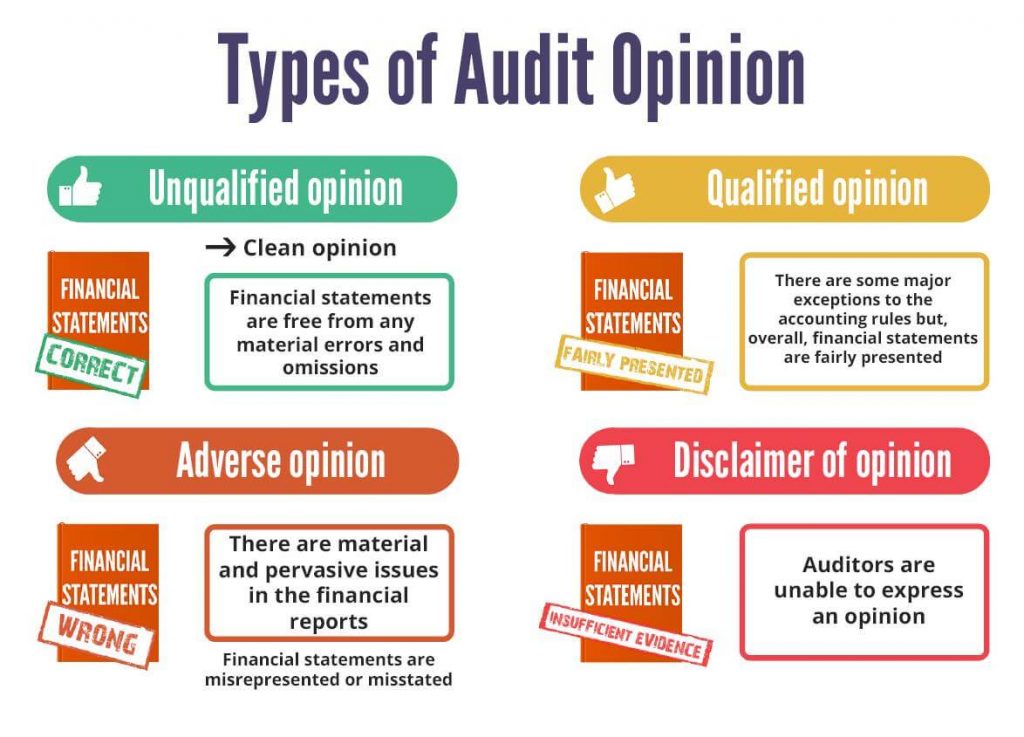

What is Qualified Audit Opinion: A qualified opinion is issued when the auditor has identified material misstatements in the financial statements, but these misstatements are not pervasive. In simpler words, the financial statements are still largely reliable despite the identified issues.

If a company listed on the Colombo Stock Exchange (CSE) main board receives a qualified audit opinion from its auditors, several steps must be taken to address the matter, especially if the company is listed on an exchange like the Colombo Stock Exchange (CSE). According to the CSE Listing rules, the following actions should be considered:

- Immediate Disclosure: The company must make an announcement to the market, informing investors of the qualified audit opinion and stating that its securities will be transferred to the “Watch List” within five market days.

- Remedial Action Plan: The company must communicate the remedial action it plans to take to resolve the issues leading to the qualified opinion. The time frame for resolving these issues should also be included in the announcement.

- Continuous Reporting: The company must provide monthly updates to the market about the progress of the remedial actions until the issues are fully resolved.

- General Meeting Disclosure: The company must notify its shareholders at the next general meeting about the qualified audit opinion and the steps taken or proposed to resolve it.

- Resolution Time Frame: If the issues are not resolved within 15 months, trading in the company’s securities may be suspended. If the suspension continues for 12 months without resolution, the securities could be delisted.

- Impact Report: If the qualification can be quantified, the company must submit an “Impact Report” detailing how the qualification would have impacted its financials if recognized, including effects on net assets, profits, and other key figures.

- Auditor Verification: Once the company resolves the issues, an independent auditor must verify the resolution before the company’s securities can be transferred out of the Watch List.

Following these steps ensures transparency, investor protection, and regulatory compliance while working towards resolving the audit issues.

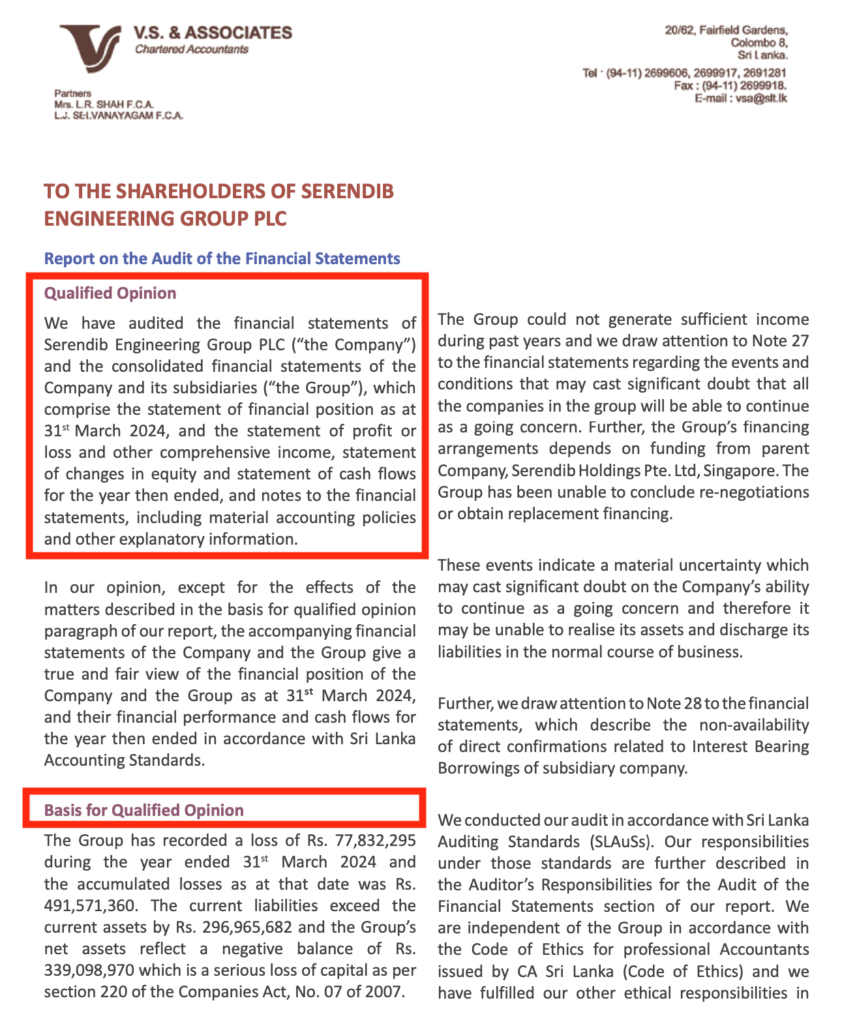

Example: Qualified Audit Opinion

Timeline available to resolve the issue relating to Qualified Opinion

The maximum timeline and possible extensions available to resolve matters resulting in a qualified audit opinion, as per the Colombo Stock Exchange (CSE) rules are outlined below:

- Initial Resolution Timeline:

- The company is given 15 months from the date its securities are transferred to the Watch List to resolve the issues that led to the qualified audit opinion.

- Trading Suspension:

- If the matters are not resolved within this 15-month period, the trading of the company’s securities will be suspended.

- Delisting Timeline:

- If the company remains unable to resolve the issues within 12 months from the date of suspension, the securities will be delisted from the CSE.

- Extensions and Deferments:

- The company can apply for a deferment from the Securities and Exchange Commission (SEC) to extend the suspension period. The deferment request must be made within 12 months from the date of transferring the securities to the Watch List, giving the company more time to resolve the issues.

- Additionally, the company may seek further deferment from delisting. This application must be made within 9 months from the date of suspension of trading. If granted, the SEC may allow additional time beyond the initial 12-month suspension period to resolve the issues.

In summary:

- The maximum timeline for resolution without extensions is 15 months from Watch List transfer, with suspension after this period.

- A total potential deferment could extend the timeline beyond 15 months, subject to SEC approval, and the trading suspension can last up to an additional 12 months before delisting occurs.

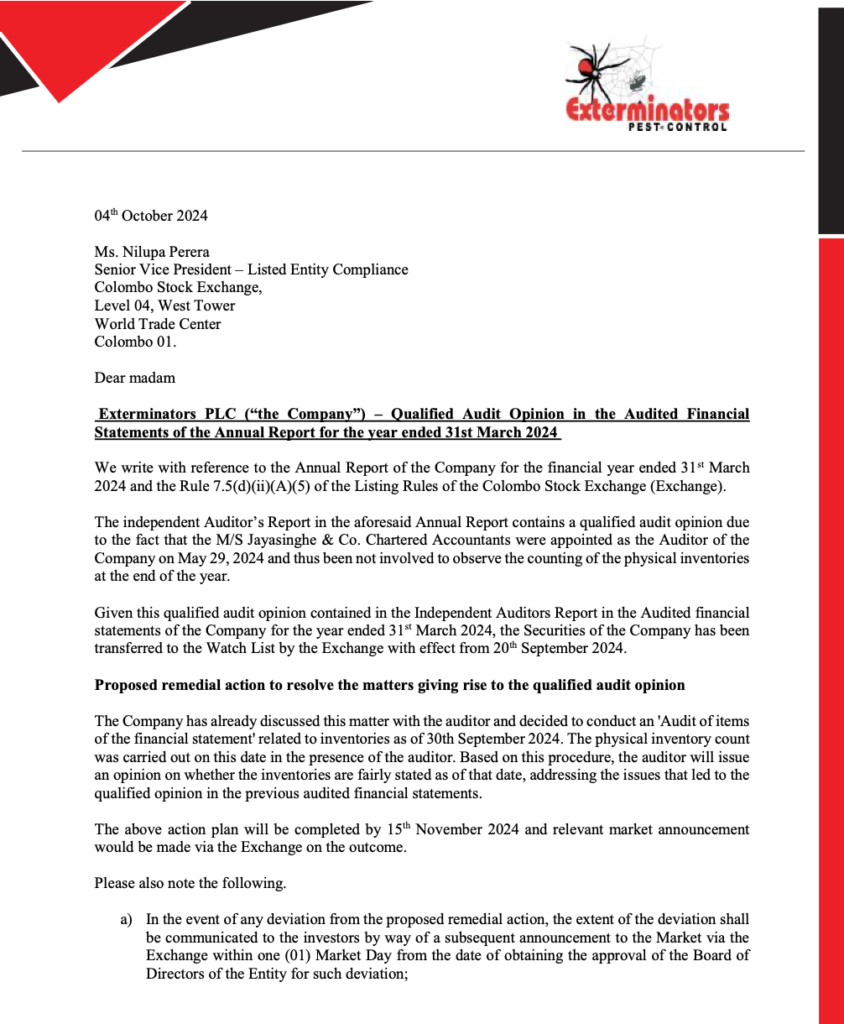

Example: Remedial Action Plan

Listing Rules Relating to Audit Opinions

https://cdn.cse.lk/pdf/listing-rules/Section-7-Continuing-Listing-Requirements.pdf