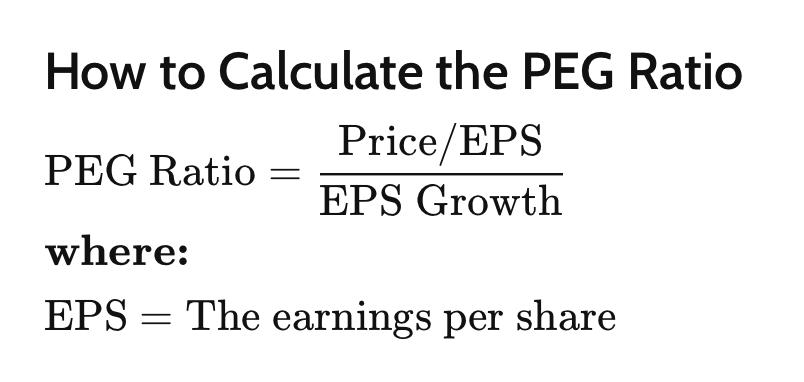

The price/earnings-to-growth, or PEG ratio is a valuation metric used for stocks. PEG builds on the P/E ratio by considering expected earnings growth and not just current earnings. A PEG ratio of under 1.0 can indicate a stock is undervalued and a potential buy. A PEG above 1.0 can indicate an overvalued stock.

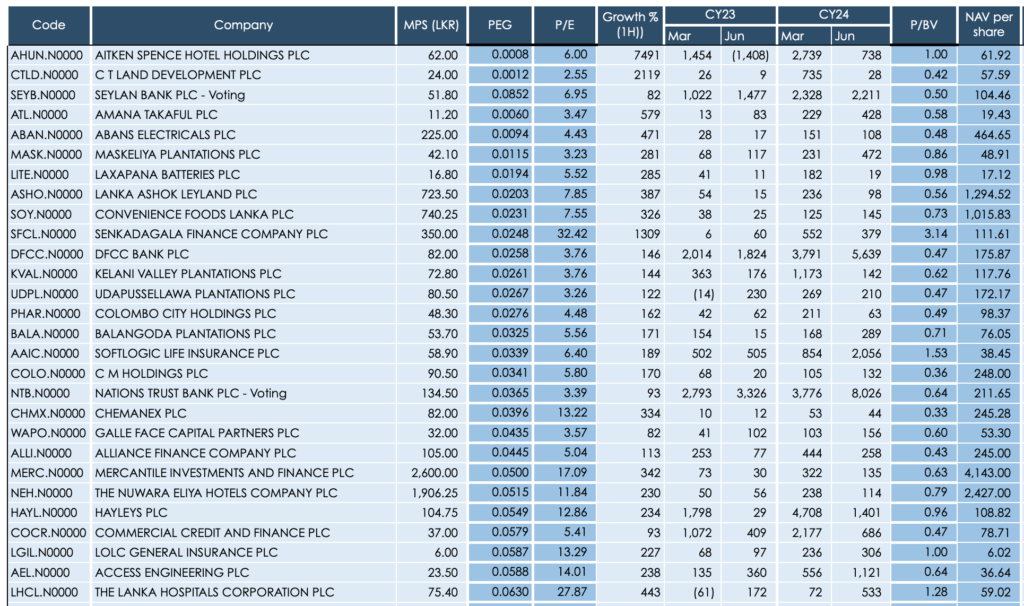

List of Sri Lanka Top Stocks with lowest PEG Ratios based on Growth (1H 2024 Vs 1H 2025) and PER Based on trailing 12 months Earnings

The price/earnings-to-growth ratio, or PEG ratio, divides a company’s price-to-earnings (P/E) ratio by its earnings growth rate over a specific period. It strengthens the P/E ratio by taking into consideration the growth rate of earnings.

The PEG ratio is a stock valuation measure that investors and analysts can use to get a broad assessment of a company’s performance and to evaluate investment risk.

In theory, a PEG ratio value of 1 represents a perfect correlation between the company’s market value and its projected earnings growth. PEG ratios higher than 1.0 are generally considered unfavorable, suggesting a stock is overvalued. Conversely, ratios lower than 1.0 are considered better, indicating a stock is undervalued.

Is a High or Low PEG Ratio Better?

A lower PEG is generally a better indicator of a buy. In particular, a PEG ratio under 1.0 suggests that the stock price is not currently accounting for expected earnings growth. On the other hand, higher PEGs (above 1.0) point to a stock price that isn’t necessarily supported by growth forecasts.

What Does a Negative PEG Ratio Mean?

A negative PEG can arise from a negative P/E ratio or else negative earnings growth estimates. In either case, it points to a company that is losing money or is expected to have negative growth.

What Are Some Limitations of the PEG Ratio?

Getting an accurate PEG ratio depends highly on what factors are used in the calculations. Investors may find that PEG ratios are inaccurate if they use historical growth rates, especially if future ones may deviate from the past. In order to make sure the calculations remain distinct, the terms “forward” and “trailing” PEG are often used.

The Bottom Line

The PEG ratio is used to determine a company’s value while taking into consideration growth. It is more robust than the P/E ratio, which only looks at price-to-earnings and does not factor in growth.

When evaluating stocks, those that have a PEG ratio below 1.0 are considered to be undervalued and could be a potential investment opportunity. With all financial ratios, it’s best not to use them in isolation but along with others to get a complete picture of an asset.

Valuation Guide

Valuation Guide (2Q2024)

Stock Market Valuation Guide to pick stocks through renowned valuation Matrices based on corporate results for quarter ended 30th June 2024