Banks have a critical role to play in Sri Lanka’s economic recovery, not only by securing their own financial positions but by fostering conditions for business growth. High interest rates and aggressive foreclosures do little but suppress growth, while more inclusive and flexible financial support will create sustainable profitability across industries. A responsible banking sector should balance profitability with long-term national development goals, working towards a thriving, resilient economy that benefits all stakeholders.

The excessive profitability of banks in Sri Lanka, especially during times of economic distress, poses significant challenges to the broader economy. While banks are essential to financial stability, their profit-seeking actions can harm key industries, slow economic growth, and distress borrowers. In particular, high interest rates and aggressive recovery actions, such as foreclosures, have suppressed the growth of vital sectors, creating ripple effects that stifle national economic progress.

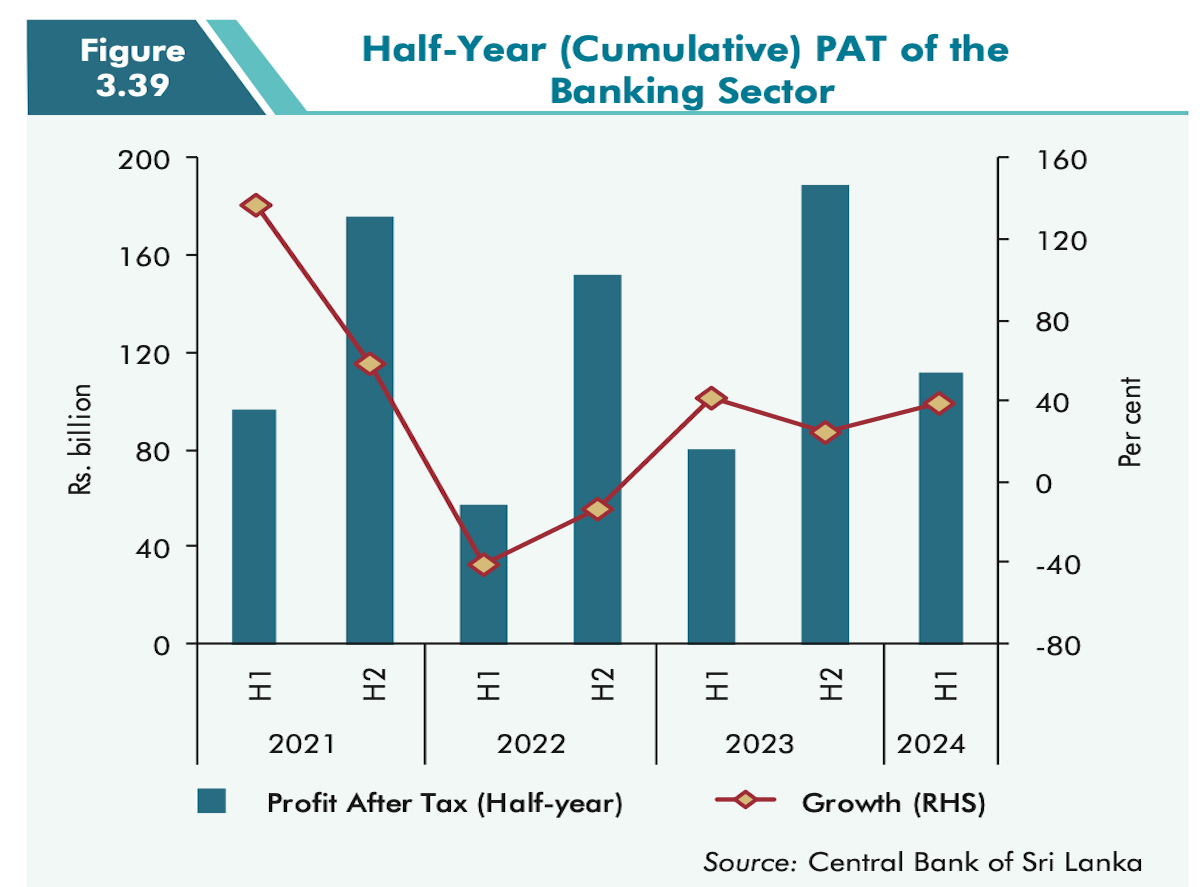

Excessive Profitability: Net profit of the Banking sector significantly increased during the first half (H1) of 2024 compared to the H1 of 2023 mainly due to the substantial reduction in interest expense. The Banking sector reported a Profit After Tax (PAT) of Rs. 111.8 billion during the H1 of 2024 compared to Rs. 80.5 billion during H1 of 2023, recording a growth of 38.8 per cent in the period under review.

Impact of Bank Profitability on Key Sectors

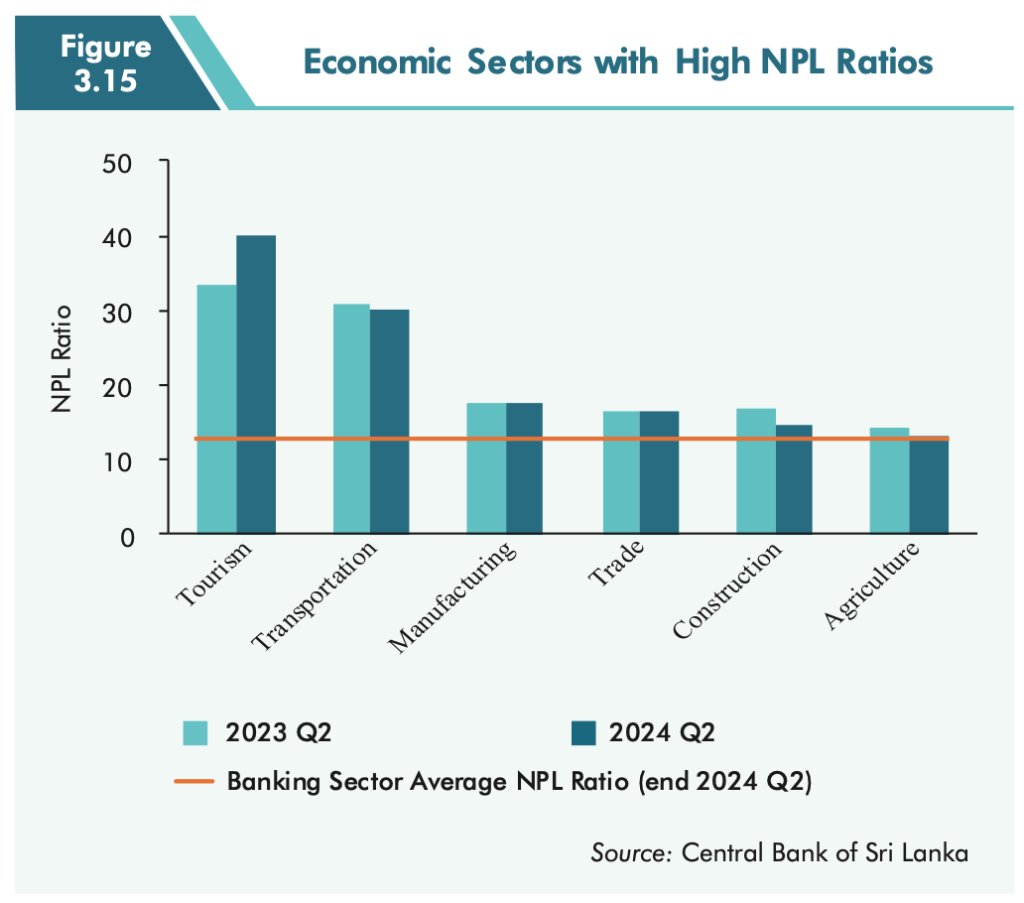

The banking sector has enjoyed enhanced profitability despite challenging macroeconomic conditions, benefiting from a higher net interest income due to falling deposit rates and a cautious lending approach. While this boosts internal profitability, it comes at the expense of struggling industries. Businesses, especially in sectors like tourism, transportation, real estate, construction, and manufacturing, are burdened by high borrowing costs and debt servicing challenges.

Non-performing loans (NPLs) remain elevated in sectors like tourism, transportation, construction and small and medium-sized enterprises (SMEs), which face the brunt of high interest rates and harsh recovery measures . Instead of acting as economic facilitators, banks have prioritized internal growth, further aggravating financial instability in key sectors. Such actions prevent businesses from investing in growth, innovation, and productivity improvements, slowing the nation’s overall recovery.

High Interest Rates: A Barrier to Growth

Market interest rates, though declining, are still high, suppressing demand for credit in sectors critical to the country’s economic recovery. Banks, rather than lowering lending rates in line with monetary easing, maintain upward rigidity in lending rates. This prevents businesses from accessing affordable credit and raises the cost of capital, deterring investment in production and expansion. In turn, the credit-to-deposit ratio of the banking sector continues to decline, underscoring the lack of financial support provided to industries.

Foreclosures and Business Closures: An Economic Setback

Aggressive recovery actions by banks, such as foreclosing on businesses unable to meet debt obligations, further exacerbate economic woes. These actions result in job losses, reduced consumer spending, and diminished economic activity. In addition to straining corporate balance sheets, these practices disincentivize innovation and investment, leading to a stagnant economy.

The Role of Banks in Supporting Economic Growth

Rather than focusing solely on profitability, banks should shift their focus toward becoming facilitators of economic growth. By offering affordable credit, especially to SMEs, and working collaboratively with distressed borrowers through business revival initiatives, banks can help industries stabilize and expand . Encouraging lending to key growth sectors like real estate, construction, and agriculture would fuel economic activity, generate employment, and improve overall financial health.

The Central Bank’s recent policies emphasize macroeconomic stability and stress the importance of prudent lending. This includes supporting credit growth while managing risks, which banks should adhere to in order to facilitate balanced growth across sectors .

Impact of Bank Profitability Consumer spending and cost of living

The excessive profitability of banks, driven by high interest rates and restrictive lending practices, has directly impacted consumers in Sri Lanka, worsening their financial burdens and elevating the cost of living. As banks prioritize their own financial gains, consumers, particularly households, face higher borrowing costs, which in turn increases the cost of everyday goods and services.

Rising Debt Burden on Households

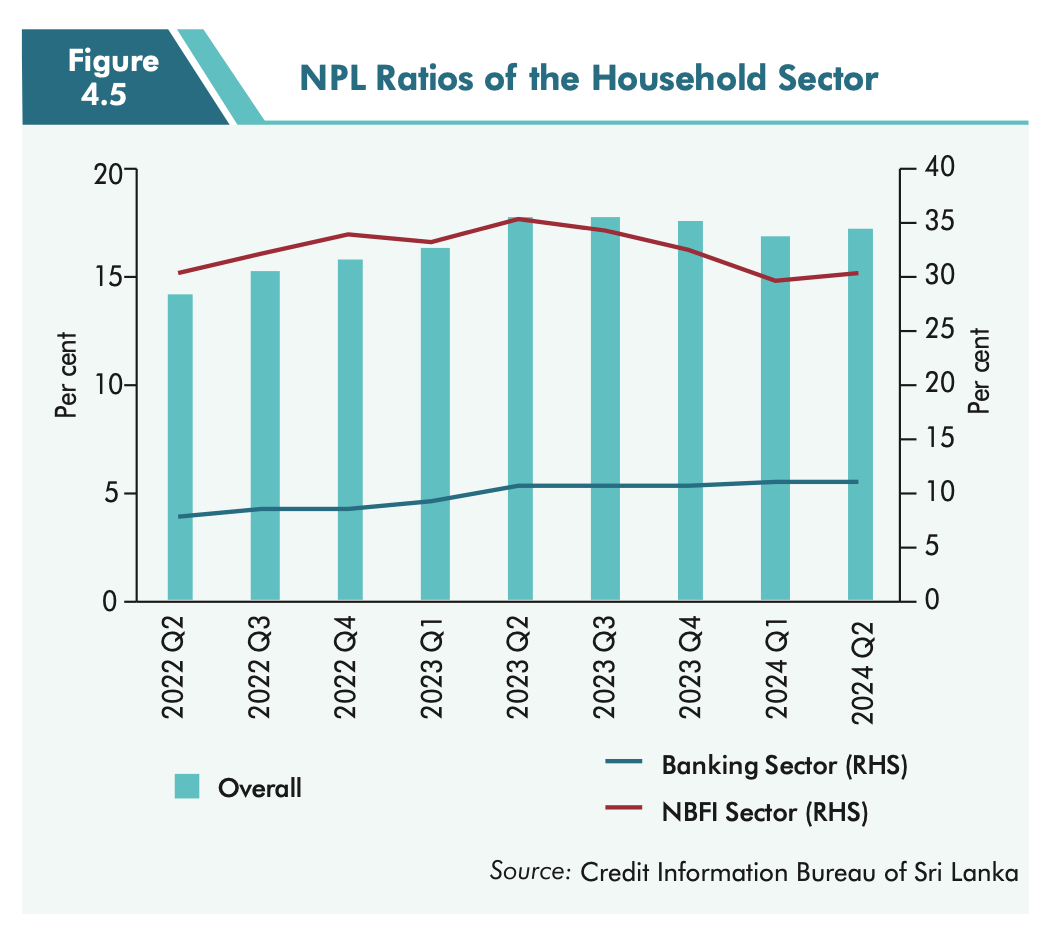

With high interest rates, consumers who rely on credit for major expenses, such as housing, education, or vehicles, find themselves trapped in a cycle of rising debt. According to the Financial Stability Review, the Non-Performing Loan (NPL) ratio for household debt remains elevated(fsr_2024e), indicating that many families are struggling to meet their repayment obligations. This results in increased financial stress, limiting their ability to spend on essential goods and services, thereby negatively affecting their overall quality of life.

Elevated Cost of Living

High interest rates trickle down to consumers in several ways. First, businesses facing increased borrowing costs pass these expenses onto consumers in the form of higher prices for goods and services. Additionally, sectors like housing and real estate, which are heavily reliant on financing, have seen increased property prices, making it harder for families to afford homes(fsr_2024e). Combined with rising inflation, this pushes up the cost of living for average households, leaving them with less disposable income to meet daily needs.

Credit Accessibility Challenges

The decline in credit accessibility also exacerbates the financial hardships of consumers. As banks tighten lending practices to safeguard their profits, individuals, especially those in lower-income brackets, struggle to access affordable loans(fsr_2024e). This restricts their ability to make essential purchases or invest in opportunities that could improve their living conditions, further contributing to financial inequality and social strain.

In essence, the excessive profitability of banks, supported by high interest rates and aggressive recovery actions, not only suppresses business growth but also intensifies financial pressure on consumers. With limited access to affordable credit and rising costs across sectors, consumers bear the brunt of these policies, leading to a higher cost of living and diminished economic security. For the welfare of the economy and society, banks must balance profitability with social responsibility, ensuring that their practices support both businesses and households.

Conclusion:

In conclusion, while the profitability of banks is vital for financial stability, an excessive focus on internal gains at the expense of borrowers and key industries can harm the broader economy. High interest rates, stringent recovery actions, and cautious lending practices suppress the growth of critical sectors, exacerbate financial distress, and stifle national economic recovery. To foster long-term economic resilience, banks must act as facilitators of growth by offering affordable credit, supporting struggling businesses and aligning their operations with the broader goal of national development. A balanced approach where banks prioritize sustainable lending and collaboration over aggressive profit-seeking will not only drive the growth of industries but also contribute to a thriving economy that benefits all stakeholder.

Economic Stability Review 2024 by Central Bank of Sri Lanka