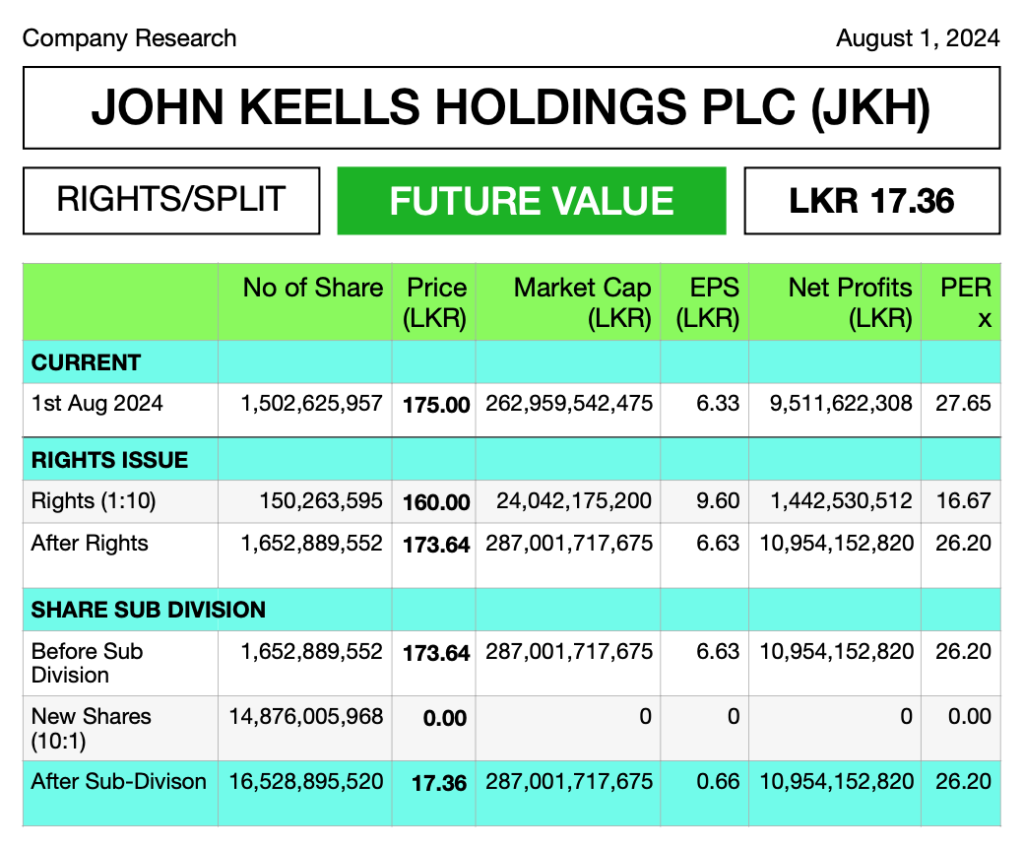

Share Price of John Keells Holding PLC (JKH.N000) after the proposed Rights Issue and Subdivision of Shares expected to be around LKR 17/= per share according theoretical (Ex Rights. Ex Sub-division) calculation. Download the full report.

Download Report: https://lankabizz.net/product/john-keells-holdings-plc-undefined-future/

Current Market Status (as of August 1, 2024):

John Keells Holdings PLC (JKH) is a leading player in the Sri Lankan market, with a robust market capitalization of LKR 262,959,542,475, driven by an outstanding share count of 1,502,625,957 and a share price of LKR 175.00. The company’s financial strength is highlighted by its Earnings Per Share (EPS) of LKR 6.33 and net profits totaling LKR 9,511,622,308. With a Price-to-Earnings Ratio (PER) of 27.65, JKH is perceived as a high-value investment, demonstrating investor confidence in its growth trajectory and market positioning.

Rights Issue Details:

In a strategic move to bolster its financial standing, JKH conducted a rights issue, offering one new share for every ten existing shares at a price of LKR 160.00. This initiative led to the issuance of 150,263,595 additional shares, raising LKR 24,042,175,200 in capital. The rights issue was designed to strengthen JKH’s balance sheet by reducing leverage and supporting strategic projects. Following the issue, the company’s EPS adjusted to LKR 9.60, reflecting an immediate impact on shareholder value and a new PER of 16.67, indicative of the company’s enhanced market attractiveness.

Market Position Post-Rights Issue:

After the rights issue, JKH’s total shares outstanding increased to 1,652,889,552, and the share price adjusted to LKR 173.64. The company’s market capitalization rose to LKR 287,001,717,675, signaling strong investor confidence in its strategic direction. The adjusted EPS stood at LKR 6.63, with net profits climbing to LKR 10,954,152,820, showcasing JKH’s improved earnings capacity. The PER of 26.20 post-rights issue reflects sustained investor optimism about the company’s future prospects and ability to generate value.

Share Sub-Division Strategy:

Following the rights issue, JKH implemented a share sub-division, splitting each existing ordinary share into ten new shares. This action increased the total number of shares from 1,652,889,552 to 16,528,895,520, significantly enhancing share liquidity and accessibility for a broader investor base. Despite this increase in shares, the company’s market capitalization remained stable at LKR 287,001,717,675, ensuring that the overall company value was not diluted. The share price adjusted to LKR 17.36 post-sub-division, aligning with the new share structure.

Financial Impact of Share Sub-Division:

Post-sub-division, JKH’s EPS adjusted to LKR 0.66, reflecting the expanded share count. This adjustment maintains the company’s earnings efficiency, supporting its financial stability amidst a larger shareholder base. The consistent net profits of LKR 10,954,152,820 underscore JKH’s ability to sustain strong financial performance. With the PER remaining at 26.20, the market’s confidence in JKH’s earnings potential and valuation remains robust, demonstrating the success of the strategic financial maneuvers.

John Keells Holdings PLC (JKH.N0000) experienced steady growth across key sectors despite some challenges in the six months ending September 30, 2024. A robust macroeconomic environment in Sri Lanka and favorable post-election conditions bolstered business and consumer confidence, positively impacting several segments. The group saw notable growth in revenue, with strong performances in the Consumer Foods, Retail, and Financial Services sectors. However, the Leisure sector faced margin pressures due to pre-opening costs for new projects and currency impacts in its Maldivian operations. Continued strategic investments, operational efficiencies, and portfolio expansion helped the group achieve a balanced performance amidst the evolving economic landscape.

Despite a promising outlook, JKH faces certain financial concerns, particularly its elevated debt levels used to fund expansive projects, which may pressure interest obligations and liquidity in the near term. The increase in short-term liabilities to support working capital, coupled with currency fluctuations that impact overseas earnings, poses additional risks. Moreover, the Leisure sector’s profitability remains challenged due to ongoing pre-opening costs and competitive pressures in the Maldivian market. These factors could constrain margins in certain segments if not managed carefully, affecting the group’s overall profitability in the medium term.

Three Star Company

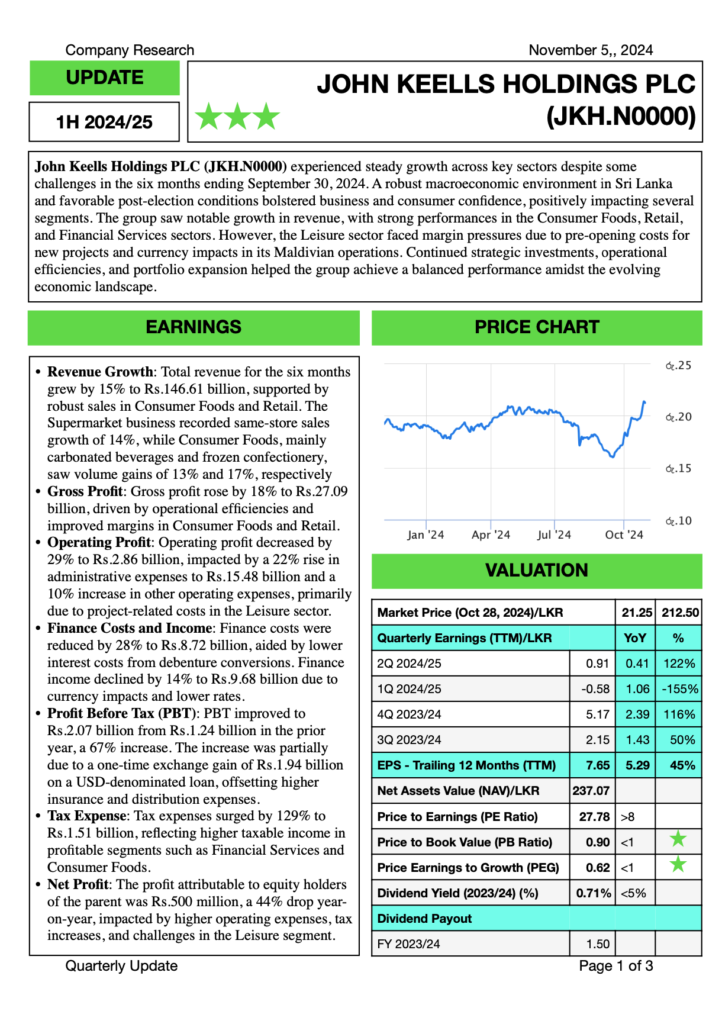

- Revenue Growth: Total revenue for the six months grew by 15% to Rs.146.61 billion, supported by robust sales in Consumer Foods and Retail. The Supermarket business recorded same-store sales growth of 14%, while Consumer Foods, mainly carbonated beverages and frozen confectionery, saw volume gains of 13% and 17%, respectively

- Gross Profit: Gross profit rose by 18% to Rs.27.09 billion, driven by operational efficiencies and improved margins in Consumer Foods and Retail.

- Operating Profit: Operating profit decreased by 29% to Rs.2.86 billion, impacted by a 22% rise in administrative expenses to Rs.15.48 billion and a 10% increase in other operating expenses, primarily due to project-related costs in the Leisure sector.

- Finance Costs and Income: Finance costs were reduced by 28% to Rs.8.72 billion, aided by lower interest costs from debenture conversions. Finance income declined by 14% to Rs.9.68 billion due to currency impacts and lower rates.

- Profit Before Tax (PBT): PBT improved to Rs.2.07 billion from Rs.1.24 billion in the prior year, a 67% increase. The increase was partially due to a one-time exchange gain of Rs.1.94 billion on a USD-denominated loan, offsetting higher insurance and distribution expenses.

- Tax Expense: Tax expenses surged by 129% to Rs.1.51 billion, reflecting higher taxable income in profitable segments such as Financial Services and Consumer Foods.

- Net Profit: The profit attributable to equity holders of the parent was Rs.500 million, a 44% drop year-on-year, impacted by higher operating expenses, tax increases, and challenges in the Leisure segment.

Latest Research Report of John Keells Holdings PLC