The recent Recovery of Loans by Banks (Special Provisions) (Amendment) Act, No. 26 of 2024 temporarily suspended the authority of banks to foreclose on collateral through public auction for defaulted loans until December 15, 2024 . This suspension aims to provide relief to small and medium-sized industries (SMEs), especially in economically fragile sectors like tourism, transportation, construction, and other critical industries affected by economic volatility. Extending this suspension could stabilize these sectors, mitigate economic fallout, and prevent disproportionate profit-taking by financial institutions at the expense of smaller entities and the economy.

What is Parate Action by Banks: Parate is an execution power on the part of banks under the Recovery of Loans by Banks (Special Provisions) Act, No. 4 of 1990, where lending banks can recover non-repaid debt by borrowers by selling assets without going through the judicial processes

1. Background: The Need for Suspension of Parate Action

Parate action, a stringent bank recovery mechanism, allows banks to auction off mortgaged properties to recover debts, often leaving defaulters financially crippled. Originally, this legal tool aimed to expedite debt recovery and ensure banking sector stability. However, this mechanism places significant strain on SMEs, especially during economic downturns, leading to job losses, reduced economic activity, and potential collapse of otherwise viable businesses.

2. Draconian Aspects of Current Bank Recovery Legislation

- Swift Foreclosure Powers: Banks can initiate foreclosures without judicial intervention, creating an imbalance of power that disproportionately affects borrowers.

- No Consideration for Economic Hardships: Current laws do not account for macroeconomic shocks or sector-specific downturns, putting industries like tourism, which was heavily impacted by COVID-19 and global instability, at risk.

- Lack of Borrower Protections: Borrowers have limited avenues to challenge foreclosures or negotiate more favorable terms, exacerbating financial distress.

3. Economic Consequences of Foreclosure for SMEs and businesses

3.1 Impact on Key Sectors

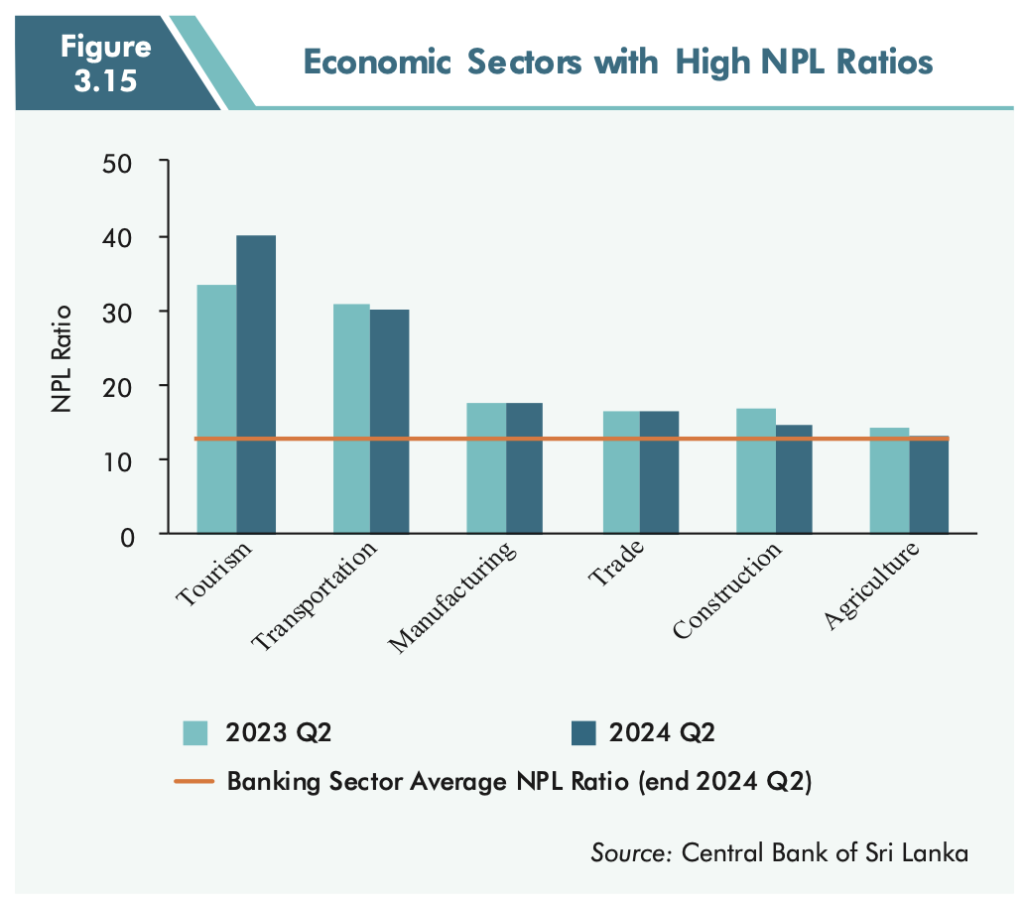

- Tourism Sector: The tourism industry, a significant driver of foreign exchange and employment in Sri Lanka, remains vulnerable to parate action. Many tourism-related businesses, including hotels, resorts, and travel operators, rely on bank loans for operational and infrastructural investments. If banks proceed with foreclosures, particularly during a period of gradual recovery post-pandemic, it could lead to widespread closures within the industry. This would not only impact employment in tourism but also reduce foreign currency inflows, weakening the broader economy. Additionally, forced foreclosures could dampen the sector’s ability to attract future investments, further delaying its recovery and reducing Sri Lanka’s competitiveness as a global travel destination.

- Construction Sector: As a sector deeply connected to national development, construction is highly dependent on bank financing for large projects, from infrastructure development to residential housing. Parate action on construction firms would disrupt ongoing projects, leading to significant financial losses for companies and contractors, and ultimately halting economic development initiatives. Additionally, widespread foreclosures could impact thousands of workers, creating unemployment spikes and affecting livelihoods across the country. Since many construction projects are interconnected with government and private sector investments, this ripple effect would also discourage future investment, stalling growth in infrastructure, housing, and commercial real estate.

- Transportation Sector: The transportation industry is integral to Sri Lanka’s economic connectivity and mobility, serving as a backbone for commerce, tourism, and essential public services. Parate actions by banks, if unchecked, could disrupt transportation companies that rely on financed assets such as buses, trucks, and fleet vehicles. As transportation firms face liquidity challenges due to economic volatility, sudden foreclosures on their vehicles would severely impact their ability to operate, diminishing the movement of goods and people. This reduction in transport services could lead to increased costs for businesses across industries, particularly those reliant on logistics, ultimately slowing down economic recovery and leading to job losses within this sector.

- Manufacturing Sector: The manufacturing industry, a key contributor to Sri Lanka’s GDP and employment, is particularly vulnerable to parate action. Manufacturing companies often rely on debt-financed machinery, equipment, and facilities to sustain production levels. Parate action could force foreclosure on these essential assets, disrupting production lines, halting operations, and limiting the sector’s output. This would not only diminish Sri Lanka’s domestic productivity but also reduce export capabilities, affecting foreign exchange inflows. Furthermore, foreclosures in this sector could erode investor confidence, reduce employment, and have a ripple effect on the supply chain, affecting multiple downstream industries reliant on manufacturing inputs.

- Other SMEs: SMEs in various sectors contribute to innovation, employment, and regional development. Foreclosures in these businesses could decrease productivity and further exacerbate economic inequities.

3.2 Social and Economic Ramifications

- Unemployment: High foreclosure rates lead to job losses, increasing social welfare burdens on the state.

- Reduction in Economic Activity: Foreclosures contribute to a contraction in overall economic activity, decreasing demand for goods and services and negatively impacting supply chains.

- Bank-Debtor Relations: Aggressive recovery actions strain relationships, creating mistrust and discouraging future entrepreneurs from engaging in business ventures.

4. High Profitability of Banks

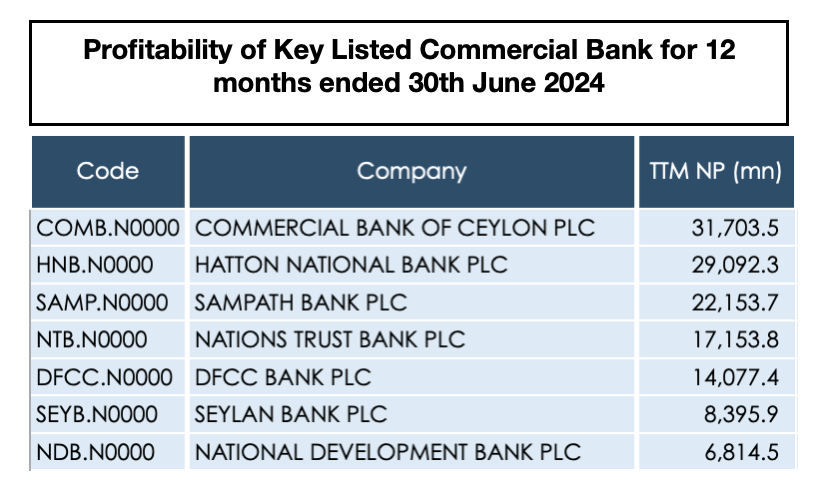

Banks and lending institutions have reported high profits despite economic struggles faced by borrowers. The disparity arises as banks are able to leverage legal recovery options like parate action to secure their financial interests at the expense of vulnerable industries. Provisions that protect banks, without adequately accounting for economic hardships faced by borrowers, enable banks to maintain profitability during periods of widespread economic strain.

The banking sector has enjoyed enhanced profitability despite challenging macroeconomic conditions, benefiting from a higher net interest income due to falling deposit rates and a cautious lending approach. While this boosts internal profitability, it comes at the expense of struggling industries. Businesses, especially in sectors like real estate, construction, and manufacturing, are burdened by high borrowing costs and debt servicing challenges.

Non-performing loans (NPLs) remain elevated in sectors like construction and small and medium-sized enterprises (SMEs), which face the brunt of high interest rates and harsh recovery measures . Instead of acting as economic facilitators, banks have prioritized internal growth, further aggravating financial instability in key sectors. Such actions prevent businesses from investing in growth, innovation, and productivity improvements, slowing the nation’s overall recovery.

Banks have a critical role to play in Sri Lanka’s economic recovery, not only by securing their own financial positions but by fostering conditions for business growth. High interest rates and aggressive foreclosures do little but suppress growth, while more inclusive and flexible financial support will create sustainable profitability across industries. A responsible banking sector should balance profitability with long-term national development goals, working towards a thriving, resilient economy that benefits all stakeholders.

The excessive profitability of banks in Sri Lanka, especially during times of economic distress, poses significant challenges to the broader economy. While banks are essential to financial stability, their profit-seeking actions can harm key industries, slow economic growth, and distress borrowers. In particular, high interest rates and aggressive recovery actions, such as foreclosures, have suppressed the growth of vital sectors, creating ripple effects that stifle national economic progress.

5. Recommendations

- Extend the Suspension Period: Extending the suspension of parate action for another year would provide SMEs the time needed to stabilize financially, especially as sectors such as tourism and construction gradually recover.

- Implement Alternative Recovery Mechanisms: Introduce gradual or structured debt recovery processes, allowing SMEs to continue operations while repaying loans.

- Strengthen Borrower Protections: Amend legislation to ensure borrowers have reasonable means to negotiate loan terms, restructuring options, and protections against arbitrary foreclosures.

- Encourage Bank Support Programs for SMEs: Banks could benefit from government-backed incentives to offer loan restructuring and recovery plans for businesses in crisis, fostering goodwill and long-term economic stability.

6. Conclusion

Extending the suspension of parate action aligns with the country’s broader economic recovery objectives and offers necessary relief to key sectors. By protecting SMEs from aggressive bank foreclosures, the government can facilitate economic resilience, support job retention, and encourage equitable growth. Additionally, a balanced approach between bank profitability and borrower protections will foster a healthier, more stable financial ecosystem in Sri Lanka.