Colombo, November 13 (LankaBIZ) – First Capital Holdings PLC leading investment bank in Sri Lanka reported a stark decline in overall financial performance for the six months ended 30th September 2024 bringing an early end to share price rise during Christmas season. The Group’s total comprehensive income dropped sharply to Rs. 904 million, a significant reduction from Rs. 9.58 billion in the prior year, representing a 90% decrease. Net income before operating expenses fell dramatically from Rs. 16.61 billion to Rs. 1.90 billion, highlighting the impact of last year’s one-off gains from a favorable interest rate environment that were not replicated this period. The Primary Dealer division, in particular, saw profit after tax plummet from Rs. 9.21 billion to Rs. 578 million, a drop of approximately 94%, largely due to reduced trading gains and lower interest income as market conditions shifted unfavorably. This challenging financial performance underscores the Group’s reliance on market-dependent gains and emphasizes the adverse impact of an unfavorable interest rate climate on its revenue streams.

Financial Highlights

- Revenue Decline: Total income for the period reached Rs. 6.3 billion, a sharp decline from Rs. 18 billion in the same period last year, reflecting an approximate 65% drop largely due to reduced trading gains and interest income as market conditions were less favorable than in 2023.

- Direct Income and Expenses: Direct income reduced to Rs. 6.3 billion from Rs. 17.9 billion (down about 65%), while direct expenses saw a decrease from Rs. 4.8 billion to Rs. 3.7 billion, indicating controlled cost measures but highlighting an overall decrease in net trading income.

- Net Trading Income: The Group’s net trading income fell significantly from Rs. 13.2 billion to Rs. 2.5 billion, marking a decrease of over 80%, mainly attributed to reduced opportunities in secondary market trading within the Primary Dealer division, which faced challenging conditions.

- Operating Expenses: Operating expenses were reduced from Rs. 2.9 billion to Rs. 0.7 billion, showing effective cost control measures, with a 76% decrease.

- Impairment Provisions: Reversal for impairment on financial assets provided Rs. 34 million, slightly higher than last year’s reversal of Rs. 32.6 million,

- Profit Before Tax: Profit before tax dropped from Rs. 13.7 billion to Rs. 1.2 billion, an approximate 91% decrease, as prior year profits had benefitted from extraordinary gains that were absent this year.

- Net Profit: Profit for the period fell from Rs. 9.6 billion to Rs. 0.9 billion, representing a significant decline in the Group’s bottom line, driven by reduced trading gains and interest income across business divisions.

Segment Performance

- Primary Dealer Division: Revenue from the primary dealer division declined approximately 87%, from Rs. 13.6 billion to Rs. 1.7 billion, as trading gains decreased significantly.

- Corporate Finance Division: Revenue dropped by 22%, from Rs. 337 million to Rs. 264 million, impacted by lower transaction volume and advisory income.

- Wealth Management Division: This segment saw revenue increase from Rs. 18 million to Rs. 49 million, a rise of 172%, attributed to growth in assets under management.

- Stock Brokering Division: Revenue for this division declined by 80%, from Rs. 31 million to Rs. 6 million, reflecting subdued market activities.

Future Outlook

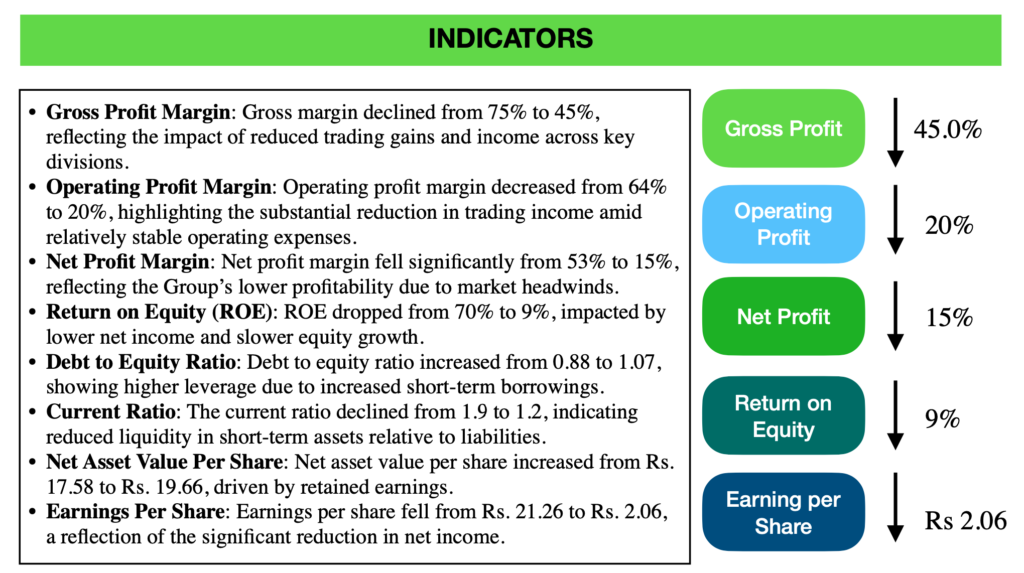

Looking ahead, First Capital Holdings PLC faces a challenging outlook as market conditions remain subdued and interest rates less favorable, limiting opportunities for trading gains. Key financial concerns include declining net income, reduced profitability, and an increased debt-to-equity ratio, which climbed to 1.07, indicating greater reliance on leverage amidst lower earnings. Liquidity concerns are also notable, as evidenced by a drop in the current ratio from 1.9 to 1.2, limiting the Group’s flexibility to meet short-term obligations. Externally, the Group’s exposure to macroeconomic factors, such as unpredictable interest rate changes and market volatility, introduces significant operational risk.

Additionally, the heavy reliance on the Primary Dealer division for revenue suggests that income stability remains vulnerable to market fluctuations, highlighting a need for diversification in income sources and further risk management strategies to mitigate performance-related challenges. With the Primary Dealer division’s performance highly sensitive to market shifts, the Group is likely to encounter continued revenue pressure, especially if interest rates remain stable or rise further. In addition, lower transaction volumes in the Corporate Finance and Stock Brokering divisions signal ongoing demand challenges, which may further constrain earnings growth. Consequently, the share price trend may reflect this pessimistic outlook, with potential for volatility or downward pressure as investors factor in reduced profitability and a constrained growth trajectory, despite the Group’s ongoing stability efforts.

Download Full Research Report: https://lankabizz.net/product/first-capital-holdings-plc-1h-2024-25/