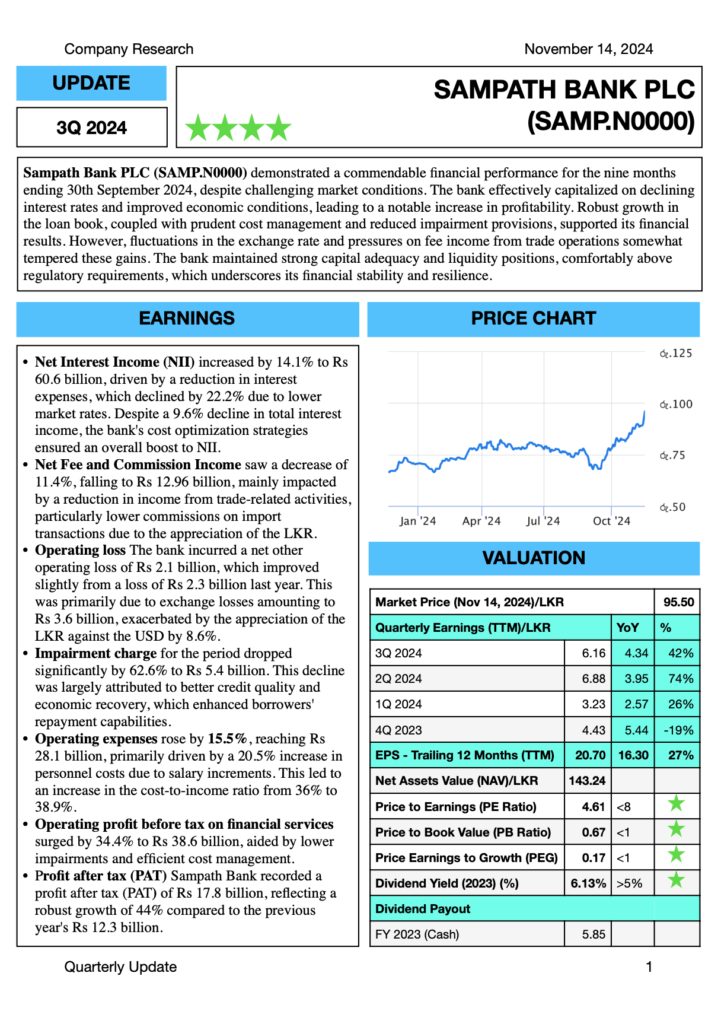

Key financial highlights for the period ended 30th September 2024

- Net Interest Income (NII) increased by 14.1%.

- Net fee and commission income decreased by 11.4%, primarily due to a decline in income from trade-related operations.

- An exchange loss of Rs 3.6 Bn was incurred due to the LKR appreciation against the USD byRs 27.75.

- The total impairment charge decreased by 62.6%.

- The LKR loan book grew by Rs 38 Bn.

- The LKR deposit portfolio saw robust growth, reaching Rs 140 Bn.

- The Tier 1 and Total Capital Adequacy Ratios stood at 16.72% and 19.54%, respectively, comfortably exceeding the regulatory minimum requirements

Fund based incomeThe Bank reported a total interest income of Rs 139 Bn for the nine-month period, reflecting a 9.6% decline compared to the same period last year, primarily due to a decrease in the AWPLR while interest expense for the period amounted to Rs 78 Bn, a decline of 22.2% due to decreasing market interest rates. The reduction in interest expense, which exceeded the decline in interest income, resulted in a 14.1% increase in Net Interest Income (NII), reaching Rs 61 Bn for the period under review.In contrast, the Net Interest Margin (NIM) decreased by 15 basis points, from 5.16% as of 31st December 2023, to 5.01% as of the reporting date. This decline was primarily driven by lower yields on the Bank’s interest-earning asset portfolio, resulting from decreasing market interest rates.Non-Fund based incomeThe Bank’s Net fee and commission income amounted to Rs 13.0 Bn, reflecting a 11% decline compared to the previous period, due to reduced income from trade-related activities primarily driven by lower commission rates on import transactions and the impact of LKR appreciation during the period. However, fees generated from other channels, including credit, electronic transactions, cards and operations-related activities recorded growth compared to the same period last year.The Bank reported a Net Other Operating Loss of Rs 2.1 Bn during the reporting period, (3Q 2023: loss of Rs 2.3 Bn), primarily due to an exchange loss of Rs 3.4 Bn resulting from the appreciation of the LKR against the USD by 8.6%. Additionally, the Bank recorded a net trading loss of Rs 0.2 Bn, compared to a gain of Rs 1.7 Bn in the previous period, due to revaluation losses on forward exchange contract. Consequently, the Bank’s total exchange loss from foreign exchange operations for the period ended 30th September 2024 amounted to Rs 3.6 Bn, compared to the Rs 1.4 Bn loss reported in the corresponding period of 2023.

Impairment ChargeThe Bank recorded a total impairment charge of Rs 5.4 Bn for the period under review, a significant decrease of 63% compared to the corresponding period last year. Of this, Rs 3.1 Bn was attributed to loans and advances (3Q 2023: Rs 12.5 Bn), while Rs 1.2 Bn was related to other financial instruments (3Q 2023: Rs 1.8 Bn). Additionally, an impairment charge of Rs 1.1 Bn was recorded against credit-related commitments and contingencies (3Q 2023: Rs 0.2 Bn).

Impairment charge on loans and advances: During the reporting period, the Bank reported a significant 75% reduction in the impairment charge on loans and advances. This improvement is largely attributed to prudent provisioning measures implemented during the previous years, coupled with a resurgence in the economic activity that has enhanced customers’ repayment capabilities.

As of 30th September 2024, the Bank conducted a careful evaluation of its individually significant customers (ISL) and made adequate provisions in its Financial Statements to address the unique risk profiles associated with each customer. With improved customer repayment capacity driven by lower interest rates and favorable macroeconomic conditions, the Bank does not anticipate the need to maintain an overlay allowance for most of the previously stressed economic segments.

Impairment charge on other financial instruments: The Bank recorded a net impairment charge of Rs 1.2 Bn against other financial instruments during the period, primarily due to an additional charge recognised for Sri Lanka International Sovereign Bonds (SLISB) in 1Q 2024. Following the government’s announcement on updated terms for the restructured SLISBs, we are confident that no further charges are necessary, as the Bank has adequately provided for all anticipated losses and contingencies.

Operating Expenses: During the reporting period, the Bank’s operating expenses rose by 15.5% compared to the same period in 2023, with personnel costs increasing by 20.5%, primarily due to annual salary increments. The Bank’s cost-to-income ratio (CIR) rose by 290 basis points, reaching 38.9% from 36.0% in the corresponding period of 2023. This increase in CIR was mainly driven by the rise in total operating expenses outpacing growth in total operating income.

Taxation: The total tax charge increased to Rs 20.9 Bn in the current period, up from Rs 16.4 Bn in the corresponding period last year. However, the Bank’s effective tax rate decreased to 54.0% during the reporting period, compared to 57.1% in 3Q 2023.

Key Ratios: The Return on Average Shareholders’ Equity (after tax) increased to 15.7% as of 30th September 2024 up from 12.7% reported at the end of 2023. The return on Average Assets (before tax) stood at 2.5% as of 30th September 2024, compared to 2.1% at the end of 2023.

Capital and Liquidity: During the reporting period, Sampath Bank maintained all capital and liquidity ratios comfortably above minimum regulatory requirements. As of 30th September 2024, the Bank’s CET 1, Tier 1, and Total capital ratios stood at 16.72%, 16.72%, and 19.54%, respectively, compared to 16.35%, 16.35%, and 19.56% at the end of 2023.

Similarly, the Bank’s liquidity levels remained robust and well above the minimum regulatory requirements, with the all-currency Liquidity Coverage Ratio at 303.25% and Net Stable Funding Ratio at 198.60% as of 30th September 2024, compared to 312.47% and 184.2% at the end of 2023.

Assets: As of 30th September 2024, the Bank’s total asset base expanded by 9.2%, reflecting an annualized growth rate of 12.3%, reaching Rs 1.68 Tn. The growth was driven by increased investments in government debt securities and the expansion of the loan portfolio. Total gross loans grew by

Rs 41 Bn, from Rs 877 Bn as of 31st December 2023, to Rs 918 Bn by the end of September 2024 mainly due to a Rs 38 Bn increase in LKR-denominated loans, while the growth in foreign currency

loans was limited to Rs 3 Bn, impacted by the appreciation of the LKR against the USD during the period. Additionally, balances with foreign banks and placements as of year-end 2023 were redirected to foreign investments classified under amortized cost and FVOCI during the year.

Liabilities: The Bank’s total liabilities increased by 9.6%, reflecting an annualized growth rate of 12.8%. This growth was primarily driven by an expansion in the Bank’s total deposit portfolio, which rose by Rs 129 Bn, from Rs 1,264.5 Bn at the end of 2023 to Rs 1,393.8 Bn as of 30th September 2024. LKR deposits grew by Rs 140 Bn, while foreign currency (FCY) deposits declined by Rs 11 Bn during the period due to the appreciation of the LKR against the USD. The CASA ratio of the Bank stood at 33.9% as of 30th September 2024, compared to 33.4% reported at the end of 2023.

Commitment to Stakeholder Well-being: As a responsible corporate citizen in Sri Lanka, Sampath Bank has consistently played a crucial role in supporting the nation’s economy amidst significant challenges in recent years. Through its Business Revival Unit, the Bank has remained dedicated to assisting stressed borrowers by offering a range of tailored measures designed to revitalize their businesses. These initiatives are customized to reflect each borrower’s unique circumstances and the specific industries in which they operate. This commitment has not only helped many borrowers restore their businesses but has also enabled them to enhance their credit profiles, fostering greater financial stability and growth.

In today’s Age of Responsibility, sustainability is at the core of the Bank’s CSR initiatives. As a national institution, the Bank actively addresses economic, social and environmental challenges through partnerships with communities. Key initiatives include ‘Wewata Jeewayak’ for irrigation restoration, ‘A Breath to the Ocean’ for ocean ecosystem preservation, ‘Sampath Saviya’ to support MSME development, ‘Hope for Life’ for healthcare assistance, and the tree-planting campaign ‘Gasai Mamai Pubudu Pothai.’ These programs are designed to enhance livelihoods, conserve the environment, and build resilient communities, exemplifying the Bank’s enduring commitment to a sustainable future for all Sri Lankans.

Sampath Bank was honored as ‘Asia’s Best Bank for Corporate Responsibility’ at the prestigious Euromoney Awards for Excellence 2024. This accolade recognises the Bank’s exceptional contributions to corporate responsibility and sustainability, underscoring its commitment to impactful initiatives across these critical areas.