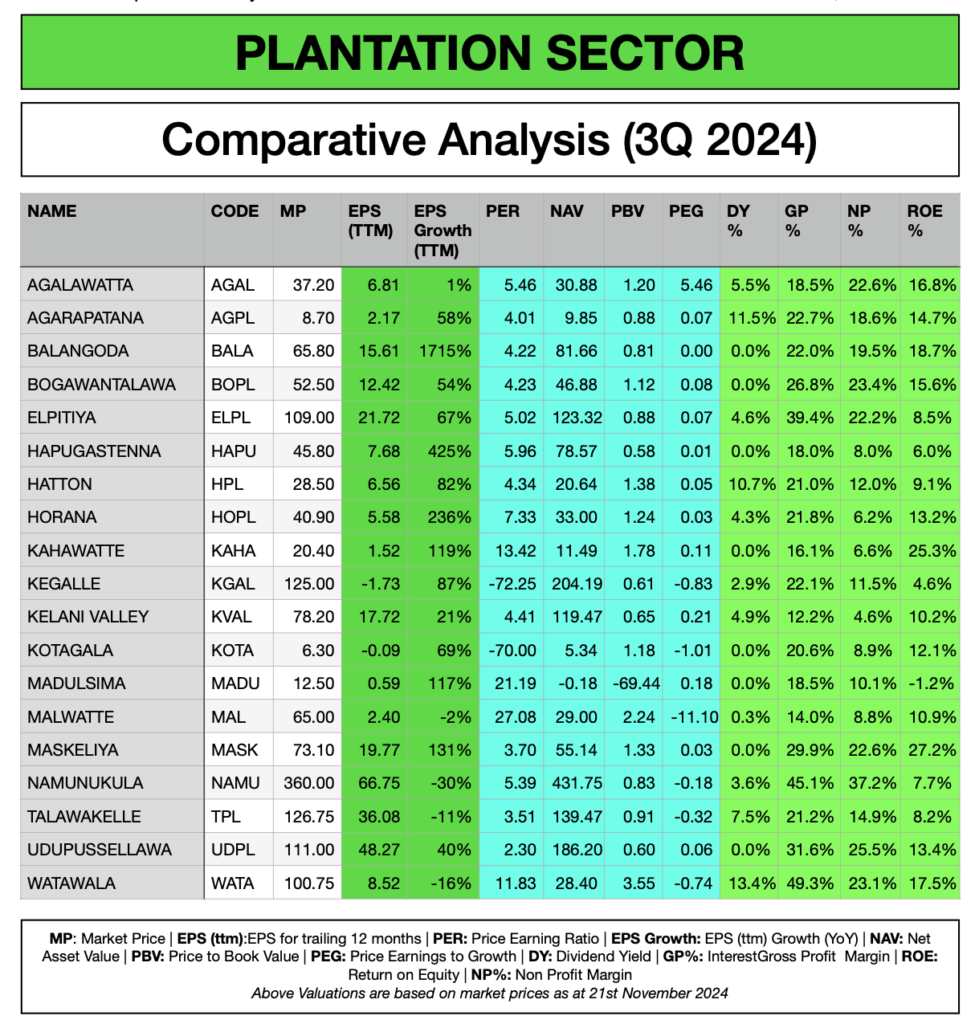

Colombo, Sri Lanka (LankaBIZ) Nov 22, 2024 – As per the latest comparative analysis carried out based on financial statements as of 30th September 2024, Talawakelle, Maskeliya, and Udupussellawa lead the plantation sector with their strong returns on equity, low PERs, and efficient profitability. Other strong performers like Balangoda, Bogawantalawa, Agarapatana, Agalawatta, and Watawala plantations also demonstrate attractive value metrics and solid dividend yields. This diverse sector offers options for both value-seeking and income-focused investors, with opportunities for growth and stability across various companies.

The plantation sector in Sri Lanka demonstrates a wide variety of valuations and profitability metrics, highlighting the diversity within this industry. This overview compares key companies based on Price-to-Earnings Ratio (PER), Price-to-Book Value (PBV), Return on Equity (ROE), and other financial metrics, identifying both top performers and strong contenders for investors.

Download Report

Top Valued Companies

Talawakelle Tea Estates (TPL), Maskeliya Plantations (MASK), and Udupussellawa Plantations (UDPL) are the top three based on valuation and profitability metrics:

- Talawakelle Tea Estates (TPL): TPL offers a low PER of 3.51 and a PBV of 0.91, indicating that it trades below its book value. With a dividend yield of 7.5% and a strong gross profit margin of 21.2%, it appeals to both value and income investors.

- Maskeliya Plantations (MASK): MASK has a PER of 3.70 and a high ROE of 27.2%, the highest in the sector, showcasing strong returns on equity at an attractive valuation. Its gross profit margin of 29.9% further highlights operational efficiency.

- Udupussellawa Plantations (UDPL): UDPL has the lowest PER at 2.30, a PBV of 0.60, and a gross profit margin of 31.6%, indicating solid profitability and a substantial discount to book value. Its ROE of 13.4% adds to its value proposition.

Additional Strong Performers

Several other companies also display favorable valuation metrics, solid returns, and profitability, making them good investment options:

- Balangoda Plantations (BALA): BALA has a low PER of 4.22 and a PBV of 0.81, trading at a discount to book value. Its ROE of 18.7% and impressive EPS growth of 1715% highlight its strong earnings performance and attractive valuation.

- Bogawantalawa Tea Estates (BOPL): BOPL trades at a PER of 4.23 and has a PBV of 1.12. Its ROE of 15.6% and a gross profit margin of 26.8% reflect robust profitability and efficient management.

- Agarapatana Plantations (AGPL): AGPL has a PER of 4.01 and a PBV of 0.88, offering value at a discount to book value. Its ROE of 14.7% and an 11.5% dividend yield make it appealing, especially for income-focused investors.

- Agalawatta Plantations (AGAL): AGAL’s PER of 5.46 and PBV of 1.20 indicate reasonable valuations with solid returns. Its ROE of 16.8% and a dividend yield of 5.5% add to its attractiveness.

- Watawala Plantations (WATA): Although WATA has a higher PER of 11.83, its ROE of 17.5% and the highest gross profit margin in the sector at 49.3% highlight its operational efficiency. The 13.4% dividend yield makes it appealing for income-seeking investors.

Other Notable Mentions

Beyond these companies, others in the sector also exhibit strong metrics and profitability:

- Hatton Plantations (HPL): With a PER of 4.34 and a PBV of 1.38, HPL combines reasonable valuation with a 10.7% dividend yield and an ROE of 9.1%, providing a balanced investment profile.

- Kelani Valley Plantations (KVAL): KVAL’s PER of 4.41 and PBV of 0.65, along with an ROE of 10.2%, make it attractive for value-focused investors.

- Kahawatte Plantations (KAHA): KAHA has a PER of 13.42 and a high ROE of 25.3%, highlighting strong profitability. While its PBV of 1.78 is higher, it reflects solid investor confidence.