Comparative analysis and valuation of the key insurance companies listed on the Colombo Stock Exchange based on the latest corporate results released or estimated as of 31st Dec 2023.

This analysis and information is compiled by LankaBIZ (GPT) – Sri Lanka’s First ever AI Assistant for Stock Market and Research. Click below link to ask questions about any listed company in Sri Lanka.

www.lankabizz.net

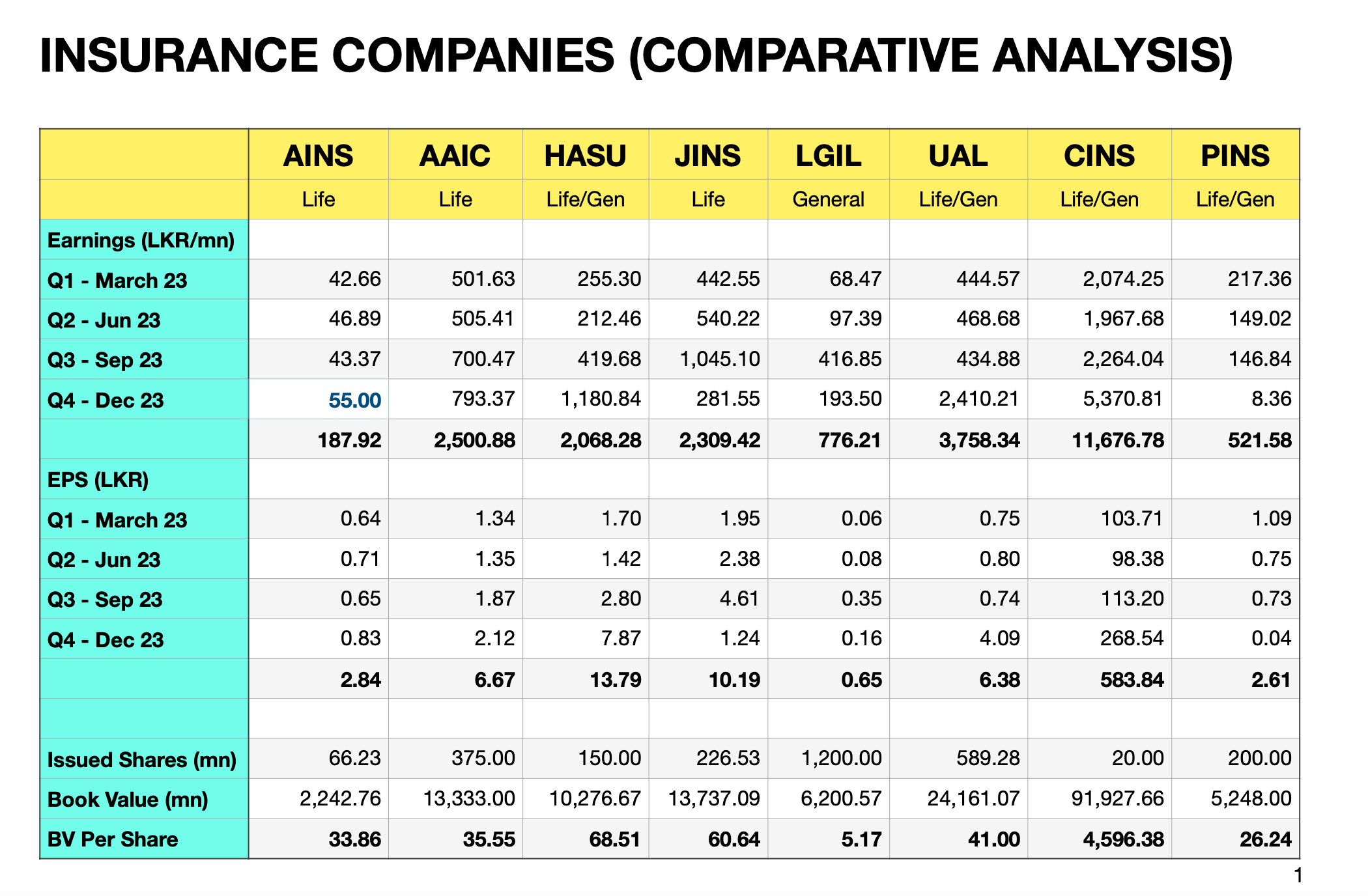

Earnings Analysis (LKR/mn):

Quarterly Earnings Growth: When comparing the quarterly earnings from Q1 to Q4 in 2023, we can observe that some companies like AAIC and HASU have shown significant growth. For instance, AAIC’s earnings grew from 501.63 mn in Q1 to 793.37 mn in Q4, and HASU’s earnings increased from 255.30 mn in Q1 to 1,180.84 mn in Q4.

Consistency in Earnings: JINS and UAL have demonstrated consistent earnings growth over the quarters, with JINS peaking in Q3 at 1,045.10 mn and UAL showing a substantial increase in Q4 at 2,410.21 mn.

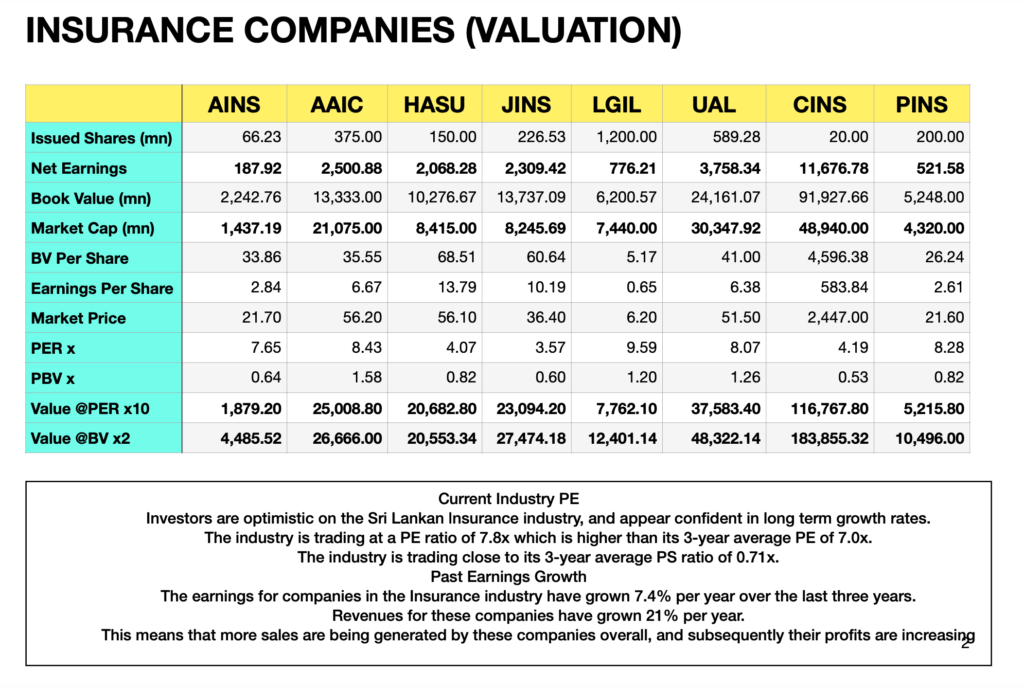

Valuation Metrics:

Price to Earnings Ratio (PER): The PER varies significantly among companies, with HASU having the lowest PER of 4.07x, indicating it may be undervalued compared to others. In contrast, AAIC has a PER of 8.43x.

Book Value Per Share: HASU has a high book value per share of 68.51, which could indicate a strong balance sheet, whereas LGIL has a lower book value per share of 5.17.

Share and Book Value Data:

Price to Book Value (PBV): CINS has the lowest PBV of 0.53x, which could suggest it is undervalued in terms of its book value, while AAIC has a higher PBV of 1.58x.

Market Capitalization (mn): UAL has the highest market cap at 30,347.92 mn, indicating a larger company size relative to others like PINS with a market cap of 4,320.00 mn.

Issued Shares (mn): LGIL has the highest number of issued shares at 1,200.00 mn, while CINS has the least with 20.00 mn.

Industry Outlook:

Earnings Growth: The insurance industry has seen an earnings growth of 7.4% per year over the last three years, with revenues growing at 21% per year, suggesting a healthy increase in sales and profitability.

Investor Sentiment: The industry is trading at a PE ratio of 7.8x, which is higher than its 3-year average of 7.0x, indicating investor optimism and confidence in long-term growth.

Challenges and Opportunities:

Challenges: The insurance sector faces challenges such as a mismatch between product offerings and customer preferences, and scepticism or mistrust leading to low adoption rates.

Opportunities: There are opportunities for differentiation through regulatory compliance, innovation stimulated by government policies, and the development of specialized products to address political risks.

Regulatory and Economic Impact:

Domestic Debt Optimisation (DDO): The insurance sector benefited from the exclusion from DDO, which was limited to Treasury bond holdings of pension funds and SLDBs.

Interest Rate Risk: The sector is advised to consider portfolio duration carefully to minimize market losses due to high interest rate risk.

This analysis provides a snapshot of the insurance sector’s performance, valuation, and outlook based on the data provided in the context. It is important to note that this analysis is based on historical data and does not predict future performance.

Industry Overview:

The insurance industry in Sri Lanka consists of 29 companies.

These companies are divided into those focusing on Long-term Insurance (15 companies), General Insurance (13 companies), and one operating in both segments.

The insurance penetration rate, which is the percentage of total premiums relative to GDP, decreased to 1.1% in 2022, down from 1.3% in the previous year.

Insurance density, or the insurance premium per person, increased to Rs. 11,636 in 2022 from Rs. 10,540 the previous year.

Performance Metrics:

Gross Written Premium (GWP) in the long-term and general insurance sectors grew by 10.4% and 7.2% respectively during the first half of 2023, year-over-year.

Asset growth in the long-term insurance sector was ahead of general insurance by the end of Q2 of 2023, with year-over-year asset growth of 14.4% for long-term insurance compared to 9.3% for general insurance.

Challenges and Opportunities:

The industry faces challenges such as low penetration, trust issues, and intense competition.

Digital transformation strategies have improved customer experience.

There is a need for careful examination of the recovery’s pace and its impact on different income segments, especially lower-income groups, due to their impact on insurance affordability.

Consumer Confidence and Awareness:

A study by the Insurance Regulatory Commission of Sri Lanka (IRCSL) and the Department of Demography at the University of Colombo (UOC) revealed an average confidence index of 50.2, indicating room for improvement.

Confidence levels remain similar across demographics, with the highest confidence in Colombo and Gampaha. Life insurance users show significantly higher confidence compared to non-users.

Life insurance has the highest product awareness at 83%, followed by motor insurance at 77%, but there is a significant drop for health insurance awareness at 42%.

Company-Specific Data:

Janashakthi Insurance PLC has been operating for 29 years, offering 16 life insurance solutions and has a network of 75 branches across Sri Lanka.

The company emphasizes innovation, customer service, and personalized solutions to meet the evolving insurance needs of the nation.

Market Penetration:

The value of insurance premiums as a percentage of GDP was 1.39% in 2020, which is low compared to the international average of 6.8%.

The number of insured persons is about 10–13% of the population, indicating a significant opportunity for market growth.

Investor Optimism:

Investors are optimistic about the Sri Lankan insurance industry and confident in its long-term growth rates.

This analysis provides a snapshot of the current state of the insurance sector in Sri Lanka, highlighting key performance indicators, challenges, consumer confidence, and market penetration opportunities.