Colombo Stock Market: Exit Points based on market gains/ Return on Investments (ROI).

- Base ASPI – 10,277 (24th Jan 2024)

- 10% Gain/ROI: ASPI 11,304

- 17% Gain/ROI: ASPI 12,024

- 20% Gain/ROI: ASPI 12,332 (Current Market Level)

- 25% Gain/ROI: ASPI 12,845

- 30% Gain/ROI: ASPI 13,360

ASPI – Historical Movement

Colombo Stock Market has currently gained more than 77% ROI since April 2022. Sri Lanka declared bankruptcy in April 2022 and during this period ASPI felt below 7000 levels.

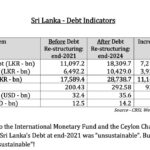

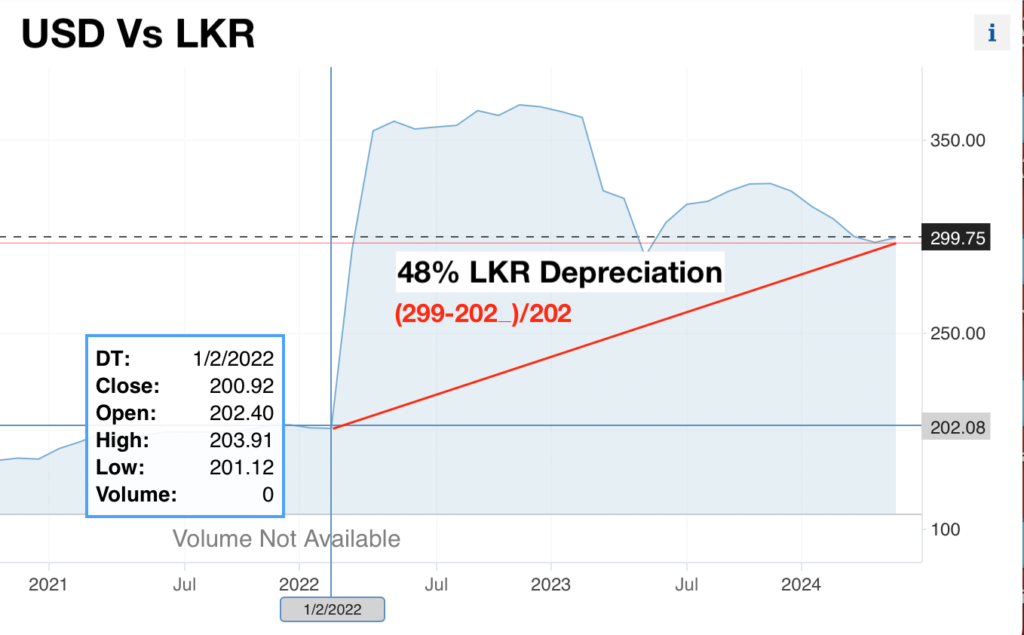

Stock Market Vs LKR Depreciation

Colombo Stock market ASPI has appreciated 77% whereas LKR has still depreciated more than 48% against USD since April 2022. This indicate that stock market over reaction and over valuation.

FUTURE OUTLOOK

The future outlook of the Colombo Stock Market in 2024 can be assessed by considering various economic indicators, historical data, and expert projections. Based on the information provided in the context documents, here are some factors that could influence the Colombo Stock Market in 2024:

- Global Economic Trends: The IMF expects global growth to stabilize around 3.0% in 2024, with advanced economies projected to see a slowdown to approximately 1.3%. This global economic environment could impact investor sentiment and the performance of the Colombo Stock Market.

- Inflation and Interest Rates: Inflation is anticipated to remain above pre-pandemic levels, gradually declining to about 4.3%. The Central Bank of Sri Lanka’s (CBSL) monetary policy, particularly interest rate decisions, will be crucial in managing inflation and could affect market liquidity and investor confidence.

- Foreign Investment: The Colombo Stock Exchange (CSE) has seen varying levels of foreign investment, with net foreign inflows observed in 2022. The continuation of this trend could provide support to the market, while any reversal could lead to volatility.

- Domestic Economic Stability: Sri Lanka’s economic stability, particularly following the 2022 crisis, will be a significant factor. If the country continues to show signs of recovery and stability, it could boost investor confidence and market performance.

- Government Policies and Reforms: Proposed tax amendments, inflation management, and energy pricing will influence the market. The government’s ability to implement long-overdue structural reforms and manage debt could also impact investor sentiment.

- Sector-Specific Developments: The performance of key sectors within the CSE, such as banking, tourism, and infrastructure, will contribute to the overall market outlook. For instance, the Port City Colombo project’s success could attract investments and positively affect related sectors.

- Market Indicators: The All Share Price Index (ASPI) displayed resilience in 2023 with a 25.5% increase, and the market capitalization increased as well. However, the average daily turnover declined by 43% in 2023 compared to 2022. These indicators will need to be monitored for trends in liquidity and market depth.

- Political Stability: The political climate in Sri Lanka will continue to play a role in the market’s performance. Political stability and effective governance are essential for maintaining investor confidence.

Considering these factors, while there are positive signs of recovery and resilience, the Colombo Stock Market in 2024 may still face challenges due to global economic conditions, domestic economic stability, and political factors. Investors should remain cautious and closely monitor the evolving economic and political landscape for a clearer assessment of the market’s direction.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net