Dialog Finance PLC (the “Company”) announced, Wednesday 8th May 2024, its financial results for the three months ended 31st March 2024.

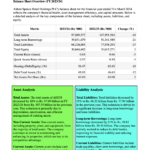

The lending book of the Company recorded a healthy growth of 13.1% Year-on-Year (“YoY”) to record net loans and advances of Rs. 3.4 Bn as at 31 March 2024. Despite the expansion in lending activities, total operating income declined by 19.6% YoY to reach Rs. 176.6 Mn for Q1 2024. This decline was primarily attributed to the decline in the investment portfolio and the drop in the net interest margin. The decrease in the investment portfolio was mainly due to the withdrawal of a fixed deposit investment of LKR 2.2 Bn made by a related party company. Furthermore, the decline in the net interest margin was driven by the reduction in lending and investment yields in line with the market interest rates.

Total operating expenses increased by 23.2% YoY mainly driven by increased cost stemming from the acquiring business. The Company introduced its acquiring business proposition, including Genie Business, subsequent to obtaining the Payment Acquiring license from the Central Bank of Sri Lanka. Furthermore, this increase in cost was contributed by investments made on human capital, technology and customer experience to support business strategies and business growth. However, the Company continued to drive the aggressive cost management and rationalization initiatives along with the streamlining of processes which are expected to deliver both service excellence and cost efficiency.

Consequently, Profit After Tax (PAT) for Q1 2024 was recorded negative at Rs. 32.6 Mn compared to the net profit of Rs. 28.8 Mn recorded for Q1 2023.

During the period under review, the Company maintained capital and liquidity levels well above the statutory minimum requirements. The Tier I capital adequacy ratio (CAR) and total CAR recorded at 40.07% and 41.16%, respectively as at 31 March 2024, which were well above the CBSL’s prescribed minimum thresholds of 8.5% for Tier 1 CAR and 12.5% for Total CAR.

Dialog Finance PLC provides a wide range of financial products tailored to meet the needs of diverse customer segments, including consumers, retailers & merchants, and SMEs. The Company is setting itself to be at the forefront of innovation in the finance industry in Sri Lanka and has a vision to propel the nation’s finance technology to a level of advancement on par with the developed world. Dialog Finance PLC recognises the need to deliver convenient, accessible, and affordable financial tools to the unbanked and underbanked segments of society and continues steadfast with its unifying mission in introducing cutting edge technology to launch industry-leading financial products and services.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net