The financial performance of Alumex PLC as of March 2024, based on the unaudited interim financial statements, can be summarized as follows:

Revenue:

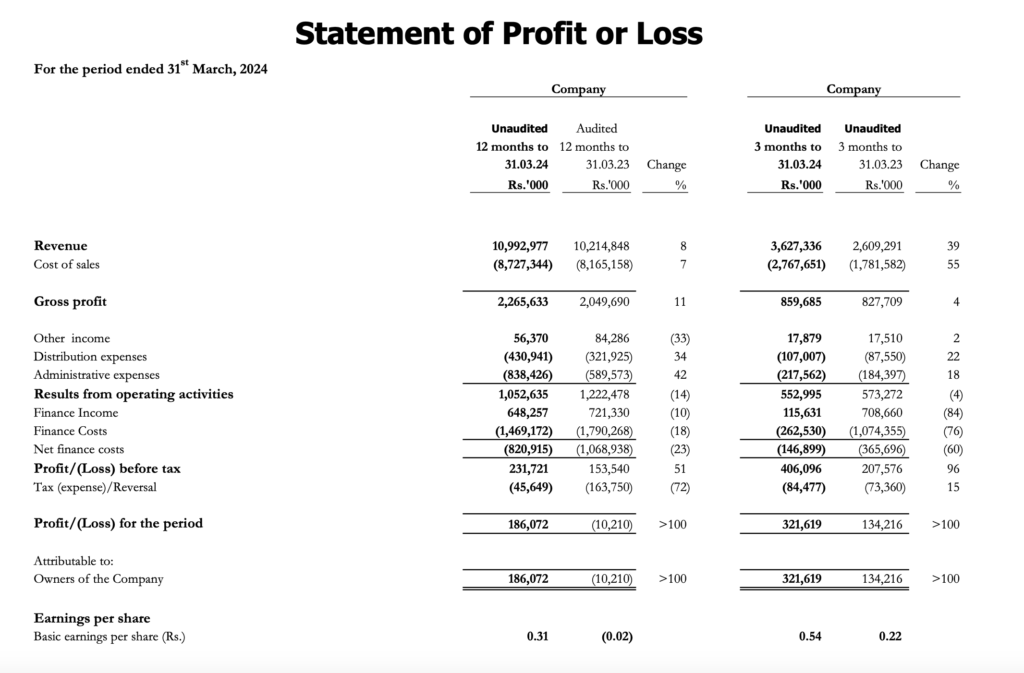

- For the twelve months ended 31st March 2024, Alumex PLC reported a revenue of Rs. 10,992,977,000, which is an 8% increase from the previous year’s revenue of Rs. 10,214,848,000.

Profitability:

- The company turned around its performance with a profit for the period of Rs. 186,072,000 for the twelve months ended 31st March 2024, compared to a loss of Rs. (10,210,000) for the same period in the previous year.

- Basic earnings per share (EPS) for the twelve months ended 31st March 2024 were Rs. 0.31, a significant improvement from the negative EPS of Rs. (0.02) reported for the twelve months ended 31st March 2023.

Share Performance:

- The last traded price of Alumex PLC’s shares as of 31st March 2024 was Rs. 9.60, up from Rs. 8.20 the previous year.

- The highest price recorded for the three months ending 31st March 2024 was Rs. 10.00, and the lowest was Rs. 8.00.

- The market capitalization of Alumex PLC as of 31st March 2024 was Rs. 5,747 million.

Financial Ratios:

- Net assets per share increased to Rs. 6.36 as of 31st March 2024, up from Rs. 6.03 the previous year.

- The price earnings ratio (annualized) was 30.88 times, a significant improvement from the negative ratio of the previous year.

- Return on Equity (ROE) was positive at 5.02%, and Return on Assets (ROA) was 1.44%, both showing a positive trend compared to the negative figures from the previous year.

Other Financial Highlights:

- The company reported other comprehensive income related to actuarial gains on defined benefit plans of Rs. 21,105,000, with an income tax effect of Rs. (6,332,000).

This summary indicates that Alumex PLC has experienced a positive turnaround in its financial performance during the twelve months ended 31st March 2024, with increased revenue, profitability, and improved share performance. The positive financial ratios suggest a healthier financial position and may contribute to a favorable outlook for the company’s future performance.

Future Outlook:

- Market Position: Alumex PLC’s market capitalization has increased, indicating a potentially stronger market position.

- Profitability: The improvement in financial ratios such as ROE and ROA suggests that the company’s profitability has turned positive in the recent period, which could be a favorable sign for future performance.

- Share Price: The increase in the last traded share price and the positive movement in the highest and lowest recorded share prices suggest investor confidence and a potentially positive outlook for the share price.

- Challenges and Opportunities: While the company faced a loss in the nine months ended 31st December 2023, the improvement in key financial ratios and share price performance indicates that Alumex PLC may be overcoming previous challenges. The company’s future performance will likely depend on its ability to maintain profitability, manage costs, and capitalize on market opportunities.

It is important to note that these insights are based on unaudited financial statements and should be considered with caution. Investors and stakeholders should also review audited financial statements, industry trends, and broader economic conditions when evaluating the company’s future prospects.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net