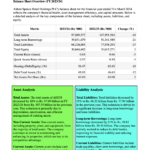

Based on the provided context from the interim financial statements of Singer Finance (Lanka) PLC for the twelve months ended 31st March 2024, the financial performance can be summarized as follows:

Revenue and Income:

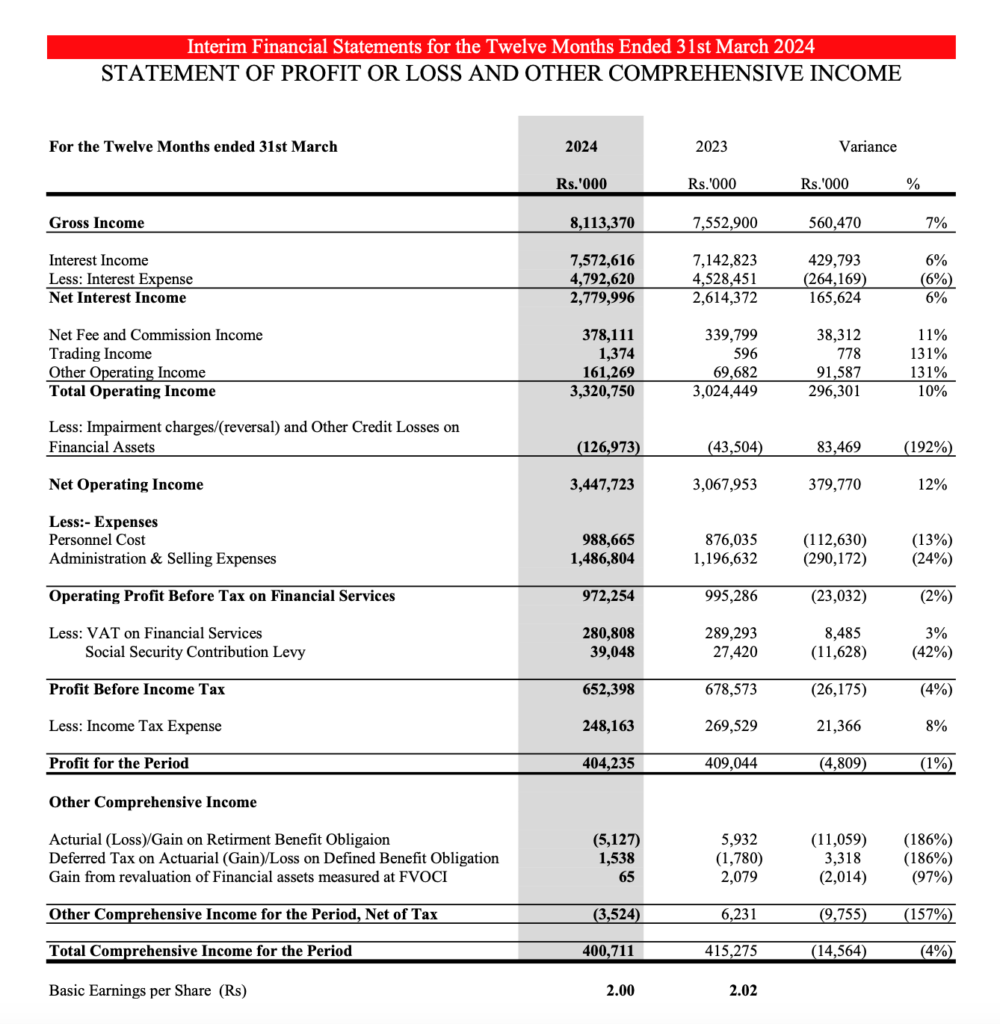

- Gross Income for the twelve months ended 31st March 2024 was Rs. 8,113,370,000, a 7% increase from the previous year’s Rs. 7,552,900,000.

- Interest Income also increased by 6% to Rs. 7,572,616,000 from Rs. 7,142,823,000 in the previous year.

Expenses:

- Interest Expense for the period was Rs. 4,792,620,000, which is a 6% increase from the previous year’s Rs. 4,528,451,000.

Profitability:

- Basic Earnings per Share (EPS) decreased slightly from Rs. 2.02 in the previous year to Rs. 2.00 for the twelve months ended 31st March 2024.

Assets:

- Cash and Cash Equivalents increased significantly to Rs. 3,825,976,000 from Rs. 2,535,435,000 in the previous year.

- Placement with Banks decreased to Rs. 254,023,000 from Rs. 1,413,997,000.

- Financial assets at amortised cost for Finance Lease Receivables were Rs. 10,935,835,000, up from Rs. 8,887,364,000.

Liabilities and Equity:

- Details on liabilities and equity were not provided in the context, but the company’s financial position appears to have improved based on the increase in assets and profitability.

Segment Reporting:

- The company’s primary business segments include Finance Lease, Loans & Advances, and Other, with each segment showing performance for the period.

Shareholder Information:

- Singer (Sri Lanka) PLC holds the majority of shares at 79.93%.

- The top five shareholders include Singer (Sri Lanka) PLC, Employees Trust Fund Board, Mr. A. M. Weerasinghe, Associated Electrical Corporation Ltd, and Mr. A. M. C. S. Atapattu.

Debentures:

- The company has listed debentures with details provided regarding face value, interest frequency, interest rate, date of allotment, and maturity date.

Overall, Singer Finance (Lanka) PLC’s financial performance for the twelve months ended 31st March 2024 shows an increase in gross income and interest income, a slight decrease in EPS, and a significant increase in cash and cash equivalents. The company’s strategic business units have contributed to its performance, and its financial position appears to be strong based on the available data.

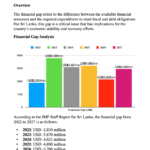

Key Financial Ratios

The financial ratios of Singer Finance (Lanka) PLC as of 31st March 2024, based on the provided context, are as follows:

Debt Equity Ratio:

- As of 31st March 2024: 5.83

- As of 31st March 2023: 5.23

Interest Cover Ratio:

- As of 31st March 2024: 1.14

- As of 31st March 2023: 1.15

Quick Assets Ratio:

- As of 31st March 2024: 1.01

- As of 31st March 2023: 1.33

Liquid Asset Ratio:

- As of 31st March 2024: 29.20%

- As of 31st March 2023: 21.20%

Tier I Ratio:

- As of 31st March 2024: 15.62%

- As of 31st March 2023: 20.01%

Total Capital Ratio:

- As of 31st March 2024: 18.54%

- As of 31st March 2023: 25.60%

These ratios provide insights into the company’s financial leverage, ability to cover interest payments, liquidity, and regulatory capital adequacy. The Debt Equity Ratio has increased, indicating higher leverage compared to the previous year. The Interest Cover Ratio has slightly decreased, suggesting a tighter coverage for interest expenses. The Quick Assets Ratio has decreased, indicating a potential decrease in the company’s ability to meet short-term obligations without selling inventory. The Liquid Asset Ratio has improved, showing better liquidity. The Tier I and Total Capital Ratios have decreased, which could be a point of consideration for regulatory capital requirements and financial stability.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net