Financial Highlights

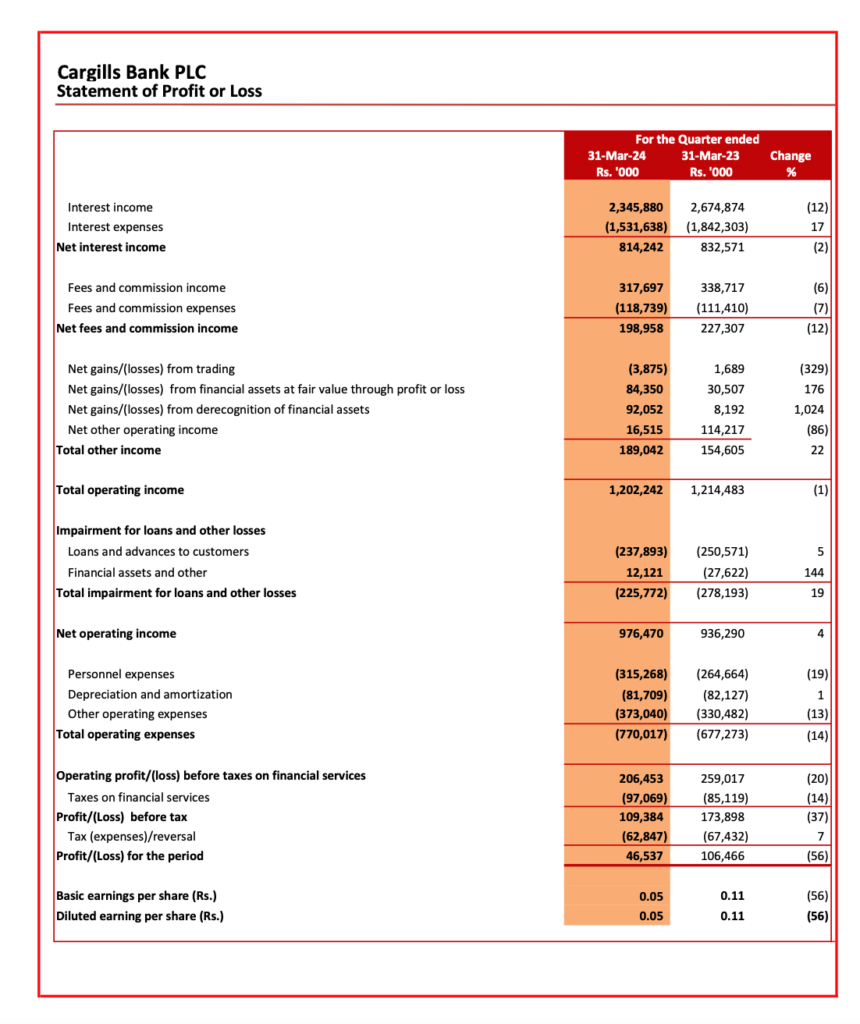

- Profit after Income Tax for the quarter – Rs. 46 Mn

- Bank maintains strong capital adequacy, Total Capital Ratio (CAR) at 22.18%

- Total Assets grow by Rs. 1.6 Bn

There was moderate growth in our Deposit and Loan portfolios amidst stiff competition from our peers. The Bank continued support to its customers to help them meet challenges they faced.Continuous downward revisions of lending rates, with lagged repricing of deposits, eroded net interest margins and exerted considerable pressure on the Bank’s bottom line. This was the main cause of the comparatively lower results in Q1 2024. Focus on business expansion continues, with attention to technological innovations.In managing its investment portfolio in Q1 2024, the Bank recorded a net fair value gain of Rs. 171 Mn on financial assets measured at fair value through other comprehensive income. The Bank recorded a gain of Rs. 92 Mn on the realization of some of these assets in Q1.Prudent management of credit exposures continued to be a priority amidst ongoing amendments to debt recovery laws. Impairment provisioning reflected a careful scrutiny of credit exposures in the context of the current operating environment.

Based on the provided interim financial statements for the quarter ended 31st March 2024, Cargills Bank PLC reported a profit before tax of Rs. 109 million. The bank managed its investment portfolio effectively, recording a net fair value gain of Rs. 171 million on financial assets measured at fair value through other comprehensive income, and realized a gain of Rs. 92 million from the realization of some of these assets.

The bank continued to prioritize prudent management of credit exposures, especially in light of ongoing amendments to debt recovery laws. Impairment provisioning was carefully scrutinized in the context of the current operating environment, reflecting the bank’s cautious approach to credit risk.

Despite stiff competition, there was moderate growth in the bank’s deposit and loan portfolios. The bank also maintained support for its customers to help them navigate challenges.

However, the bank faced pressure on its bottom line due to continuous downward revisions of lending rates and lagged repricing of deposits, which eroded net interest margins. This was cited as the main cause for the comparatively lower results in Q1 2024.

The profit after income tax for the quarter was Rs. 46 million. The bank’s capital adequacy remained strong, with a Total Capital Ratio (CAR) at 22.18%. Total assets grew by Rs. 1.6 billion during the quarter.

In comparison to the previous year’s performance, where the bank posted a profit after tax of Rs. 440 million for the year ended 31st December 2023, the first quarter of 2024 shows a lower profitability. This could be attributed to the challenging interest rate environment and the strategic decisions made by the bank in managing its assets and liabilities.

It is important for stakeholders to consider these factors when evaluating the bank’s performance and future prospects. The bank’s focus on business expansion and technological innovation, as mentioned in the reports, may also play a significant role in its long-term growth trajectory.