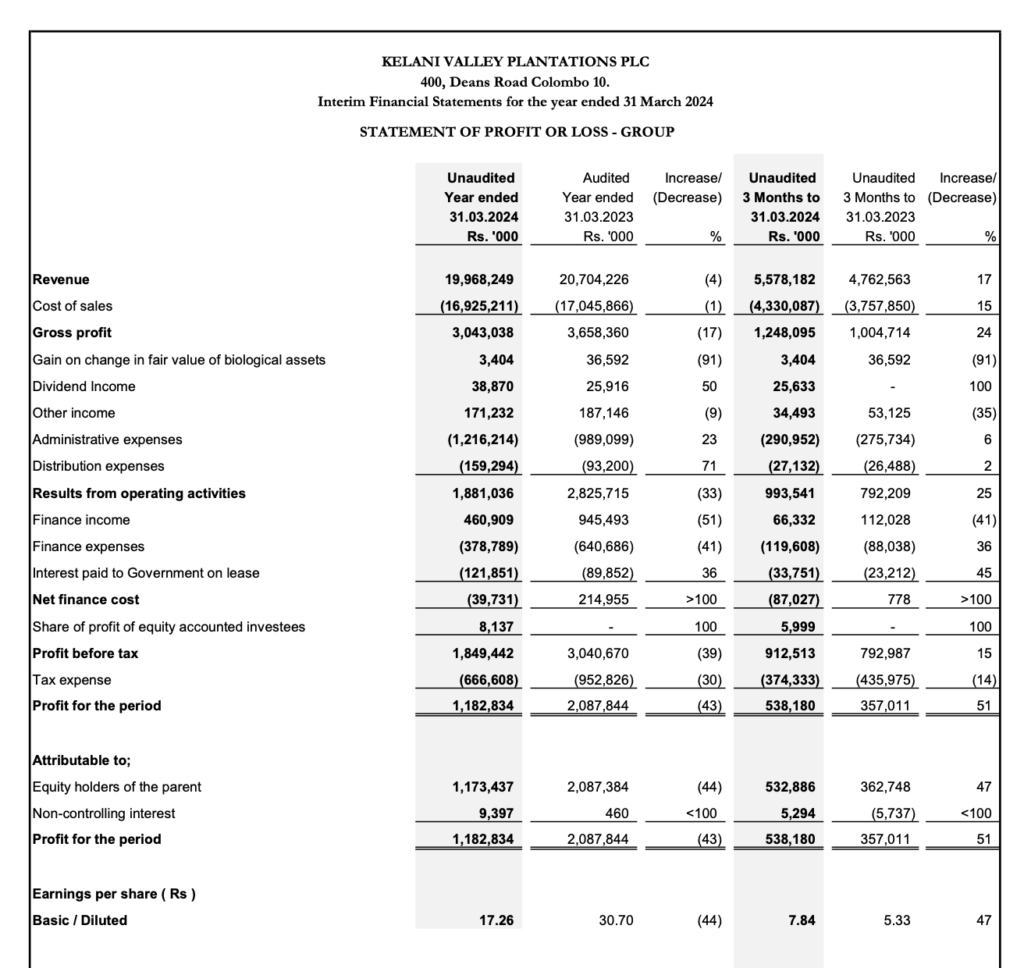

The financial performance of Kelani Valley Plantations PLC as at 31st March 2024 can be analyzed by reviewing the unaudited and audited financial statements provided in the interim reports. Here’s a summary based on the provided documents:

Revenue:

- Year ended 31.03.2024 (Unaudited): Rs. 19,968,249,000

- Year ended 31.03.2023 (Audited): Rs. 20,704,226,000

- There was a decrease in revenue by approximately 4% year-on-year.

Cost of Sales:

- Year ended 31.03.2024 (Unaudited): Rs. 16,925,211,000

- Year ended 31.03.2023 (Audited): Rs. 17,045,866,000

- Cost of sales decreased by 1%, which is less than the decrease in revenue.

Gross Profit:

- Year ended 31.03.2024 (Unaudited): Rs. 3,043,038,000

- Year ended 31.03.2023 (Audited): Rs. 3,658,360,000

- There was a significant decrease in gross profit by 17%.

Other Income:

- Year ended 31.03.2024 (Unaudited): Rs. 171,232,000

- Year ended 31.03.2023 (Audited): Rs. 187,146,000

- Other income decreased by 9%.

Total Equity and Liabilities:

- As at 31.03.2024 (Unaudited): Rs. 15,105,258,000

- As at 31.03.2023 (Audited): Rs. 14,334,909,000

- There was an increase in total equity and liabilities by approximately 5.4%.

Earnings Per Share (EPS)

Earnings Per Share (EPS) for Kelani Valley Plantations PLC as at 31st March 2024 is Rs. 17.26 (Basic/Diluted) declined from Rs 30.70 in 31st March 2023

Future Outlook:

When considering the future outlook for Kelani Valley Plantations PLC, several factors should be taken into account:

- Industry Trends: The performance of the company is closely tied to the agricultural sector, particularly the tea and rubber markets. Global demand, commodity prices, and weather conditions will significantly influence future performance.

- Operational Efficiency: The company’s ability to manage costs effectively, especially in the face of decreasing revenue, will be crucial. The slight decrease in cost of sales suggests some efficiency, but it needs to be improved further to offset the revenue decline.

- Investments and Diversification: The company’s future growth may depend on its ability to diversify its income streams and invest in areas that could provide higher margins or more stable revenue.

- Regulatory Environment: Changes in local and international regulations affecting exports, labor, and environmental standards could impact operations and profitability.

- Global Economic Conditions: Economic conditions, including inflation rates, exchange rates, and economic growth in key markets, will influence the company’s performance.

- Sustainability Practices: As consumers and investors increasingly favor companies with strong sustainability practices, Kelani Valley Plantations PLC’s commitment to sustainable operations could positively impact its brand and long-term profitability.

Investors and stakeholders should monitor these factors and the company’s strategic responses to them when considering the future prospects of Kelani Valley Plantations PLC. It’s also advisable to review the full financial statements, notes to the accounts, and management discussion and analysis for a comprehensive understanding of the company’s performance and future outlook.