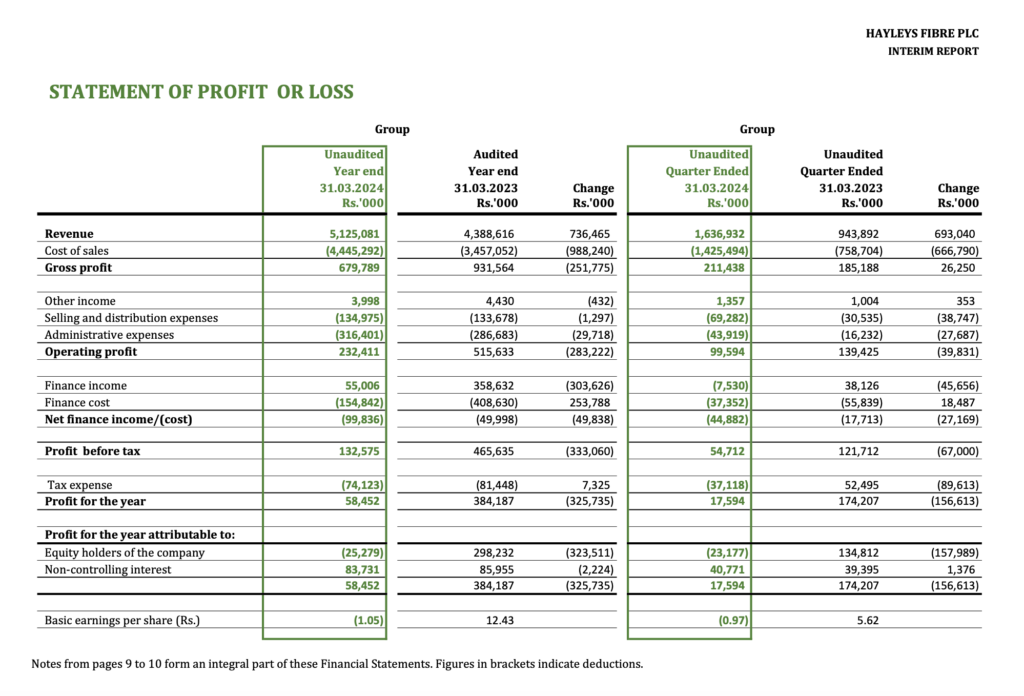

Based on the provided context, the latest financial performance of Hayleys Fibre PLC can be summarized from the interim financial statements for the year ended 31st March 2024. Here are the key figures:

- Basic earnings per share (EPS) for the year ended 31st March 2024 (unaudited) was Rs. (1.05), which is a decrease from the EPS of Rs. 12.43 for the year ended 31st March 2023. Loss for the Quarter ended 31 March 2024 was Rs (0.97) which is a decrease from the EPS of Rs 5.62 from the same quarter of previous year.

- Revenue for the year ended 31st March 2024 was Rs. 5,125,081,000, which is an increase of Rs. 736,465,000 from the previous year ended 31st March 2023, where the revenue was Rs. 4,388,616,000.

- The cost of sales for the year ended 31st March 2024 was Rs. 4,445,292,000 (the full figure is not provided in the context, but it indicates an increase from the previous year).

- Dividend per share for the year ended 31st March 2023 was Rs. 3.80, but there is no dividend reported for the quarter ended 31st March 2024.

It is important to note that the figures for the year ended 31st March 2024 are unaudited, and the earnings per share have significantly decreased, indicating a potential loss for that period. No dividend has been declared for the latest reported quarter, which could be a concern for investors.

When evaluating the financial performance of Hayleys Fibre PLC, it is crucial to consider not only the revenue and profit figures but also other financial metrics and the overall context of the company’s operations, including market conditions, competitive landscape, and any strategic initiatives the company may be undertaking.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net

Future Outlook

Based on the information provided in the context, which includes interim financial statements and corporate information for Hayleys Fibre PLC up to the period ended 31st December 2023, the future outlook for the company would need to be assessed considering several factors:

- Historical Performance: The interim reports suggest that Hayleys Fibre PLC has had changes in revenue over the periods reported. For a more accurate future outlook, one would need to analyze the trends in these revenues, as well as profitability, cash flows, and other financial metrics.

- Market Position: The company’s share trading information, such as the highest and lowest share prices, and the last traded price, can give an indication of investor sentiment and market perception of the company’s value.

- Shareholder Information: The details about the largest shareholders and changes in shareholding can provide insights into the stability and potential influence on the company’s governance and strategic direction.

- Industry Trends: The future outlook would also depend on the broader industry trends within Sri Lanka and globally, such as demand for the company’s products, competition, regulatory changes, and economic conditions.

- Management and Strategy: The direction set by the company’s management, as indicated by the directors listed and any strategic plans disclosed, will significantly impact the company’s future performance.

- Regulatory and Economic Environment: Any changes in the regulatory environment, economic policies, or significant economic indicators could affect the company’s operations and financial health.

- Global Events: Events such as the COVID-19 pandemic have shown that global occurrences can have a profound impact on businesses. Any future outlook should consider potential global risks and opportunities.