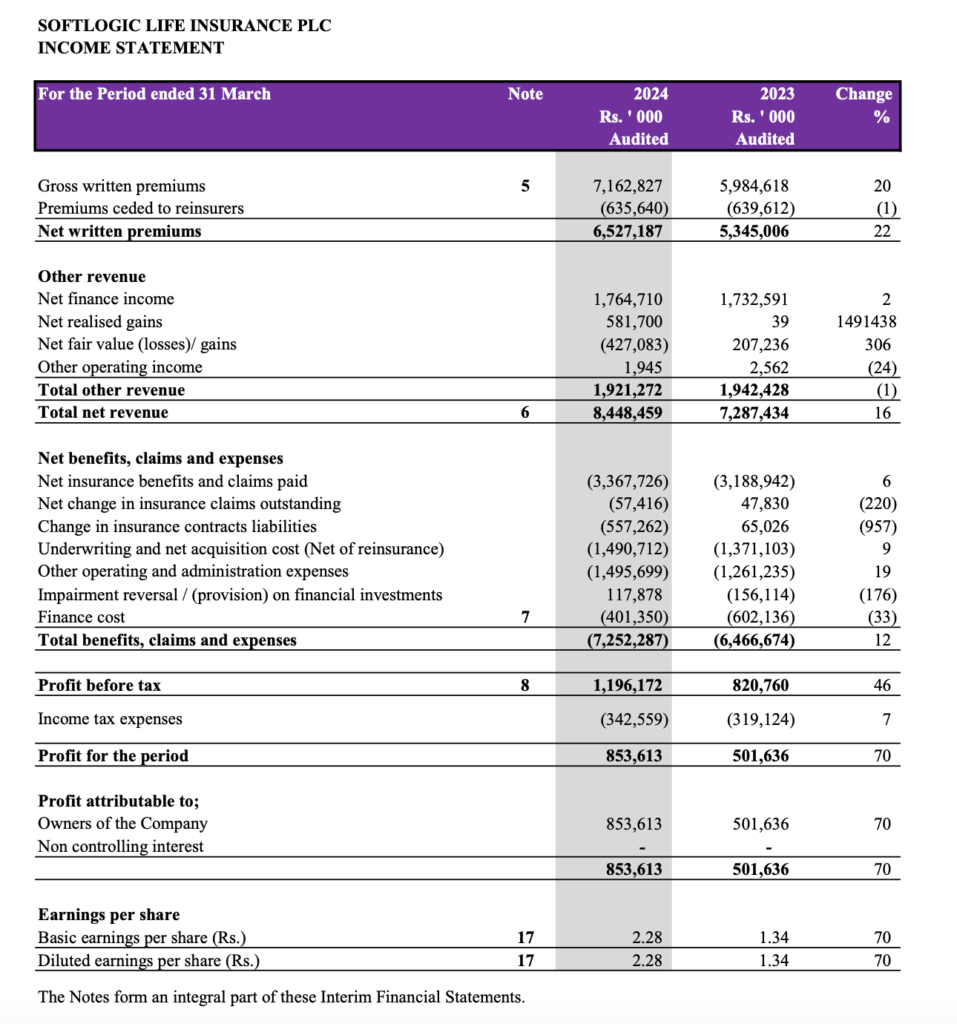

The latest financial performance of Softlogic Life Insurance PLC, as per the provided context, can be summarized as follows:

- Gross Written Premiums: For the Quarter ended 31 March 2024, the company reported gross written premiums of Rs. 7,162,827,000, which is a 20% increase from the previous year’s figure of Rs. 5,984,618,000.

- Premiums Ceded to Reinsurers: There was a slight decrease in premiums ceded to reinsurers, which amounted to Rs. 635,640,000 in Q12024 compared to Rs. 639,612,000 in Q12023, representing a 1% decrease.

- Net Written Premiums: The net written premiums for the Quarter ended 31 March 2024 were Rs. 6,527,187,000, showing a 22% increase from Rs. 5,345,006,000 in the previous year.

- Net Finance Income: The company’s net finance income increased by 2%, from Rs. 1,732,591,000 in Q12023 to Rs. 1,764,710,000 in Q12024.

- Net Realised Gains: There was a significant increase in net realised gains, from Rs. 39,149,438 in Q!2023 to Rs. 581,700,000 in Q12024.

- Profit for the Period: The profit for the period ended 31 March 2024 was Rs. 853,613,000, which is a substantial 70% increase from Rs. 501,636,000 in the previous year.

- Earnings Per Share: Both basic and diluted earnings per share (EPS) for the period were Rs. 2.28 in Q12024, up 70% from Rs. 1.34 in Q12023.

- Other Comprehensive Income: The company experienced a decrease in other comprehensive income, with a loss of Rs. 14,029,000 in Q12024 compared to a gain of Rs. 209,182,000 in Q12023.

- Total Comprehensive Income: The total comprehensive income for the period was Rs. 839,584,000 in Q12024, an 18% increase from Rs. 710,818,000 in Q12023.

- Net Asset Value: The Net Asset Value (NAV) per share of Softlogic Life Insurance PLC, as reported in the interim financial statements for the period ended 31 March 2024 is Rs. 34.04. Net Asset per Share Excluding One-off Surplus is Rs. 31.92

Key Ratios (FY2023)

The annual report of Softlogic Life Insurance PLC for the year 2023 provides several key ratios that can be used to analyze the company’s financial performance and stability. Here’s a breakdown of some of the ratios mentioned in the report:

- Capital Adequacy Ratio:

- 2023: 367%

- This ratio is significantly higher than the minimum requirement of 120%, indicating a strong capital base and financial stability.

- Determination Ratio:

- 2023: 140%

- This ratio exceeds the minimum requirement of 100%, suggesting that the company has a good level of solvency.

- Investment in Government Securities:

- 2023: 41%

- The company has maintained investments in government securities well above the minimum threshold of 30%, reflecting a conservative investment strategy.

- Premium Growth Ratio:

- 2023: 14.1%

- This indicates a healthy growth in premiums compared to the previous year.

- Net Claim Ratio:

- 2023: 53.8%

- This ratio, which measures net claims against net earned premiums, is moderate, suggesting a balanced claims experience.

- Return on Equity (ROE):

- 2023: 23.5%

- Despite a slight decrease from the previous year, the ROE remains strong, indicating the company’s effectiveness in generating profits from shareholders’ equity.

- Operating Expense Ratio:

- 2023: 19.4%

- This ratio has increased slightly, indicating a rise in operating expenses relative to the total premium income.

- Underwriting Profit Margin:

- 2023: 21.0%

- This profitability ratio shows the percentage of profit generated from underwriting activities, which is a positive indicator of operational efficiency.

- Persistency – 1st Year:

- 2023: 83%

- This ratio measures the retention of policyholders after the first year, which is crucial for long-term profitability.

- Expense Ratio:

- 2023: 22.6%

- This ratio indicates the company’s management expenses in relation to its net premiums.

These ratios collectively provide insights into Softlogic Life Insurance PLC’s financial health, underwriting performance, investment strategy, and profitability. The company’s strong capital adequacy and determination ratios reflect a robust financial position, while the growth in premiums and assets indicates positive business momentum. The moderate increase in operating expenses and the slight decrease in ROE suggest areas where the company may focus on improving efficiency and profitability.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net

Share Price performance (FY2023)

The performance of Softlogic Life Insurance PLC’s share price in 2023 showed a decline when compared to the previous year. Here are the key points regarding the share price performance:

- The highest market value of the share in 2023 was Rs. 136.0, which is significantly lower than the previous year’s high of Rs. 249.0.

- The lowest market value recorded in 2023 was Rs. 53.5, which was higher than the 2022 low of Rs. 27.0.

- The year-end closing price of the share was Rs. 53.8, down from Rs. 86.6 at the end of 2022.

- The number of shares traded in 2023 was 80,563,197, a decrease from 155,637,925 shares traded in 2022.

- The value of shares traded in 2023 amounted to Rs. 7,810 million, which is less than half of the Rs. 16,120 million recorded in 2022.

- The number of share transactions in 2023 was 81,431, a decrease from 151,927 transactions in the previous year.

- Softlogic Life Insurance PLC’s market capitalisation as of December 31, 2023, was Rs. 20,175 million, which is a 38% decrease from the previous year’s market capitalisation of Rs. 32,475 million.

Despite the downward trend in share price and market capitalisation, the company demonstrated resilience and adaptability in a challenging economic environment. The company’s gross written premium grew by 14%, and the profit after tax (PAT) increased to Rs. 2.8 billion, with a return on equity (ROE) of 23.5%. The earnings per share (EPS) were reported at Rs. 7.57.

Future Outlook

Here are some key points that reflect the company’s outlook:

- Economic Recovery: The company is optimistic about the future outlook of the economy, anticipating a recovery in GDP growth in Sri Lanka, with the government aiming for a GDP growth of 2.9% in 2024 and 3.2% in 2025.

- Growth Momentum: Despite the challenges faced in 2023, Softlogic Life Insurance PLC experienced a Gross Written Premium (GWP) growth of 14%. The company is confident in maintaining this momentum moving forward.

- Strategic Planning: Softlogic Life has completed a strategic planning cycle for the short- and medium-term, spanning from 2024 to 2026. The strategies have been crafted with market information available during the budget preparation phase.

- Stakeholder Engagement: The company remains committed to incorporating feedback and insights from stakeholders as it navigates the dynamic business landscape.

- Value Creation: Softlogic Life aims to create value for shareholders by targeting a Return on Equity of above 20%, which it has consistently maintained over the past five years.

- Product and Service Focus: The company plans to reassess its products, continually review benefits and coverages, and focus on providing protection to policyholders. It also intends to expand its wealth protection products and services.

- Multi-Distribution Channel Strategy: The company will continue to generate revenue through its multi-distribution channel strategy, aiming for increased market penetration.

- Digitalization and Innovation: Softlogic Life is embracing digitalization, as evidenced by the agency force now exclusively using digital formats for all proposal submissions.

- Community Commitment: The company acknowledges its responsibility to the community, insuring a large number of lives and engaging with various ecosystems to expand products and provide insurance solutions for all segments of society.

- Wealth Management Propositions: Softlogic Life, which previously focused on the protection market, is looking to compete in the investment platform with a suite of wealth product propositions for customers while also addressing their protection needs.

These points suggest that Softlogic Life Insurance PLC is positioning itself to capitalize on emerging opportunities and navigate potential challenges with a strategic and resilient approach.